The role of government for the non-financial corporate sector during the COVID-19 crisis

Published as part of the ECB Economic Bulletin, Issue 5/2021.

1 Introduction

The pandemic and the containment adopted entailed economic disruptions worldwide, which induced substantial government interventions to support firms. In anticipation of the negative consequences of the restrictions imposed around the world, governments quickly deployed a set of diverse tools to mitigate the impact of the crisis on the corporate sector.

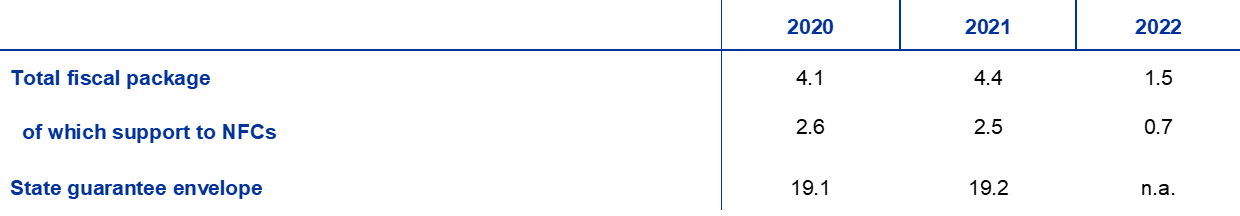

In the euro area, the bulk of government interventions in 2020 and the first half of 2021 focused on mitigating liquidity and solvency risks and supporting employment in the non-financial corporation (NFC) sector. Around two-thirds of fiscal packages have provided firms and employees with direct support, on top of state guarantees for loans. The exact magnitude of the support is difficult to estimate, since the initial measures were extended and new ones have been implemented as the COVID-19 crisis has evolved, varying across countries and fiscal instruments.[1] For the euro area aggregate, as shown in Table 1, the support to NFCs, including furlough measures, amounted to around 2.6% of GDP in 2020 out of a fiscal package of 4.1% of GDP.[2] In 2021 the support to NFCs has continued in the presence of containment measures that have weighed on the euro area economies, especially in the first half of the year, and it is expected to reach a size broadly similar to that in 2020. In addition, the envelope of state guarantees for loans amounted to around 19% of GDP in 2020 and is expected to remain at a similar level in 2021.

Table 1

Fiscal support in the euro area during the COVID-19 crisis (as % of GDP)

Source: June 2021 Eurosystem staff Broad Macroeconomic Projection Exercise (BMPE) projections.

Notes: The total fiscal package is calculated as discretionary changes in government expenditure and revenues, as well as short-time work schemes and temporary tax deferrals and tax credits, but does not include capital injections and automatic fiscal stabilisers (see Section 2 for details). Support to NFCs refers here to direct transfers and subsidies to firms and short-time working schemes.

Government action in the euro area has mitigated the output contraction and employment and income losses, while adding liquidity buffers in the NFC sector. Overall, a much stronger contraction in economic activity has been avoided. Economic growth in the euro area in 2020, while firmly in negative territory, was less affected than expected, registering -6.8% instead of the -7.8% projected by the European Commission in its Autumn 2020 Forecast. The effects of the NFC support measures on household income, for instance through job retention programmes, have also contributed to mitigating the impact of the crisis on output. Policy action coupled with strong precautionary saving behaviour and borrowing has also contributed to minimising liquidity risks and has resulted in an aggregate increase in liquidity buffers.[3] Moreover, the strong government response in support of the NFC sector has also contributed to preventing stress in the banking sector during the COVID-19 crisis.

This article reviews the government interventions in the NFC sector in the euro area from a balance sheet perspective, mainly by focusing on the evidence available for 2020. It is structured as follows. Section 2 reviews the wide array of fiscal policy measures at the disposal of governments for supporting the NFC sector. Section 3 discusses the impact of the government measures taken on the NFC sector balance sheets during 2020. Section 4 describes some possible consequences for government sector balance sheets. Section 5 concludes.

2 Government interventions in the non-financial corporate sector: key concepts, definitions and measures

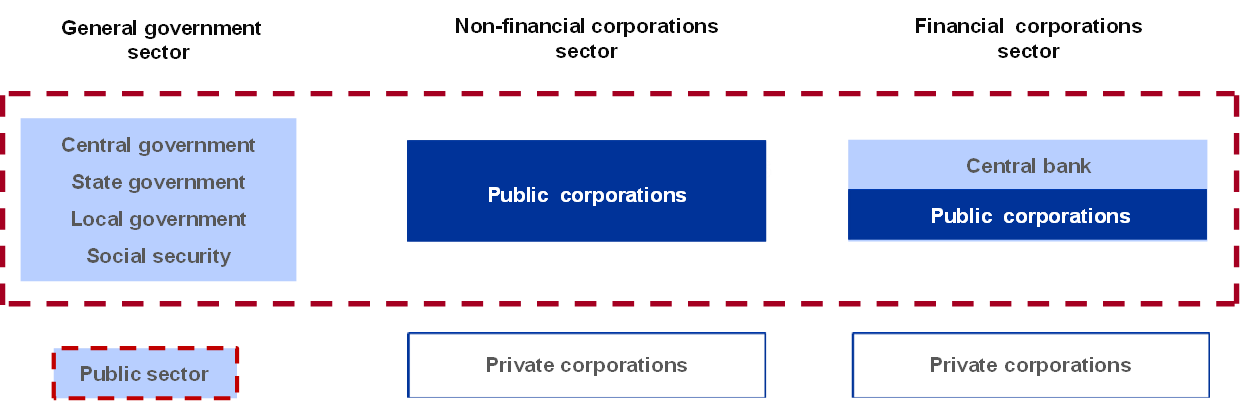

Well-targeted and timely government support for the corporate sector is an important part of the toolkit that governments can deploy during a crisis. In the specific case of a pandemic, government support to firms is more understandable in view of the production and service disruptions caused by the governmental restrictions imposed for public health reasons. The following analysis mainly focuses on the NFC sector, which includes all private and public enterprises that produce goods and/or provide non-financial services (see Figure 1 for the distinction between this and the financial corporations sector).[4]

Figure 1

General government, non-financial and financial corporation sectors

Source: Authors, based on the IMF’s Government Finance Statistics Manual and the ESA2010 Manual.

Note: Public corporations are entities where the government has control with ownership of more than 50% of the shares, which can be consolidated with the balance sheet of the general government sector.

The main arguments in support of temporary public interventions are related to the mitigation of corporate vulnerabilities in times of distress, which can contribute to ensuring macroeconomic and financial stability (e.g. by protecting employment and household income).[5] This is particularly important in the case of large companies with systemic relevance, but also in the case of small and medium-sized enterprises (SMEs) given their importance in many European countries. Generally speaking, the arguments against government interventions in the corporate sector could instead be related, among other things, to the possible distortion of competition and efficiency in the provision of goods and services, as well as the burden on public finances and risks to fiscal sustainability.[6] However, these arguments are less relevant in the context of a pandemic with generalised market disruptions caused by restrictions implemented for public health reasons. Moreover, these risks are mitigated thanks to the State aid rules framework in place at the EU level and to the role of the competition authorities. Overall, the success of government interventions depends on several factors, including the speed of the GDP rebound, the cost of financing (i.e. government bond yields), the exit strategy from the support, and the recovery rate – which is also dependent on the type of fiscal instrument used and the quality of the collateral.

Government interventions in the corporate sector can be direct or indirect. On the expenditure side, the most common instrument is subsidies or transfers directly provided to the NFC sector. On the revenue side, there is a wide array of tax reductions and social security measures. The alternative is to facilitate firm financing through government guarantees, direct loans, transfers or equity injections. The policy choice between outright transfers to firms versus equity injections is not always straightforward. Transfers may be preferred for smaller firms as in this case it would be too difficult to handle equity holdings. Targeted fiscal support or equity injections for highly indebted firms may instead be preferable to providing additional loans and guarantees, as it reduces bankruptcy risk and allows, in the case of equity injections, for government influence on corporate decisions.[7] Equity or equity-linked interventions also have a favourable effect on firms’ investment incentives by preventing a possible debt overhang. In order to channel the available resources in an efficient and sustainable way it is important to distinguish viable from non-viable firms, the latter being confronted with negative earnings over the long term and thus being dependent on government assistance for survival.

The initial response in support of the NFC sector during the pandemic has typically been broad-based and aimed at preserving the pre-existing productive structure. Although countries have applied national measures to different degrees and with different timings, the initial fiscal response has been based on containing the impact of the crisis on the economy as a prerequisite for a fast recovery after the pandemic. The interventions in the NFC sector have aimed to minimise crisis-related insolvencies and the exit of viable firms from the market, as well as job losses. In this way, the response has also indirectly protected the financial corporation sector (e.g. banks) and the sovereign-bank-corporate nexus.[8] Later on, attention was also devoted to creating the necessary conditions for a sustained recovery and to promote structural change, namely for the transition to the green economy and digitalisation. The Next Generation EU (NGEU) programme already approved in July 2020 with a cumulated amount up to €750 billion, with the Recovery and Resilience Facility (RRF) at its heart, is expected to play an important role. The main objective of the RRF is to support public and private investment coupled with structural reforms in the Member States during the period 2021-26.[9] This represents a unique opportunity to strengthen potential growth, job creation and economic and social resilience in the Member States.

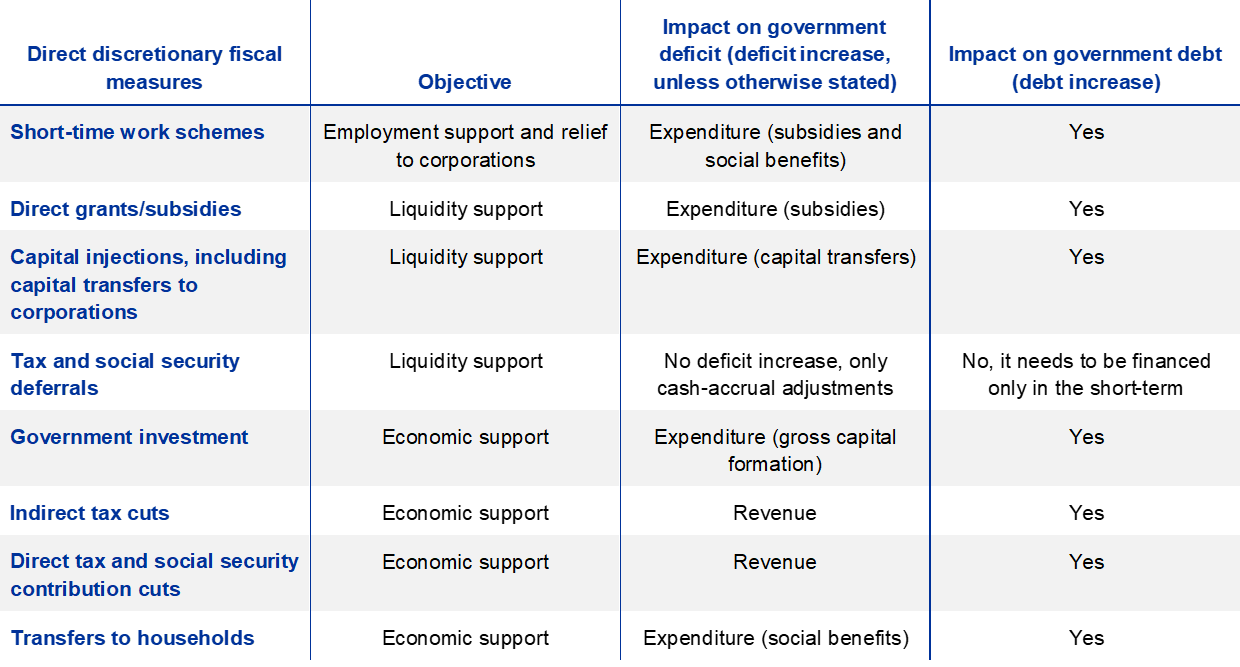

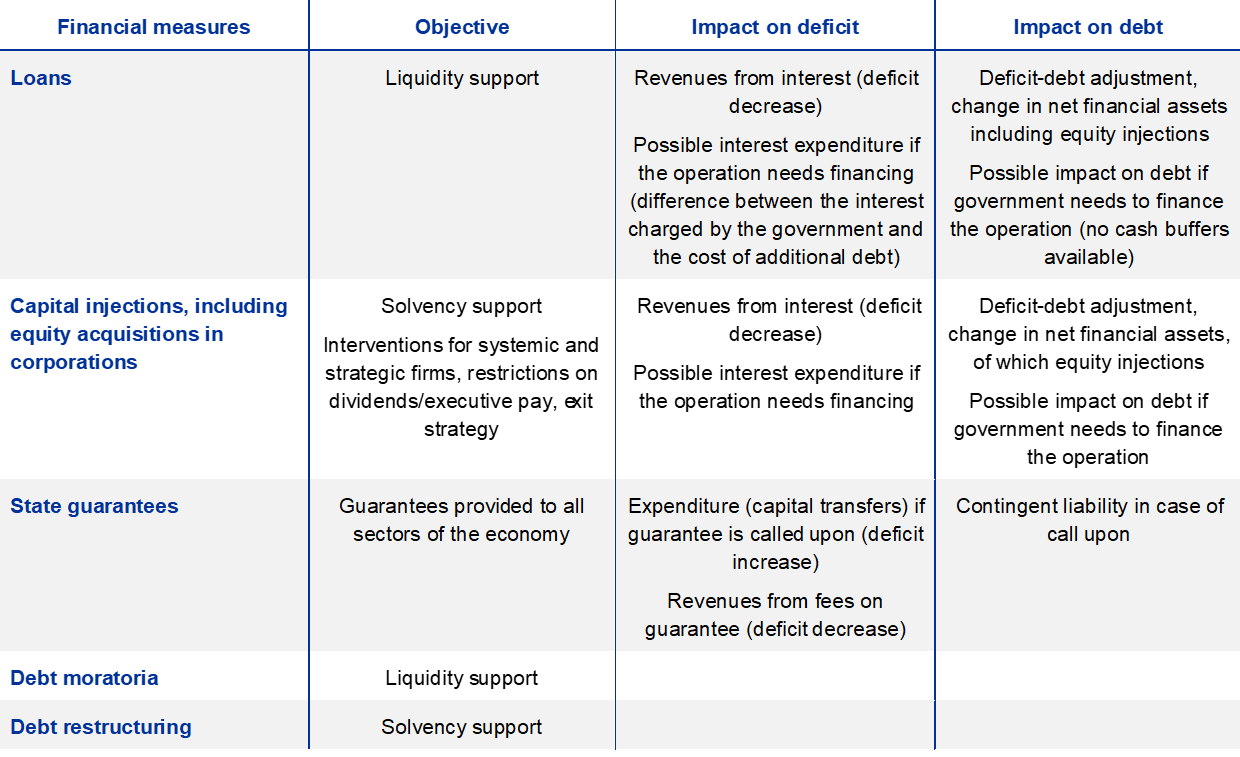

Table 2 summarises the different government interventions introduced at the start of the broad lockdowns in March/April 2020 to support NFCs directly or indirectly, with subsequent extensions during the rest of 2020 and 2021. Some tools have a short-term impact and fall under the remit of national discretionary fiscal policies (e.g. tax deferrals, one-off grants or subsidies, labour income support), while others are more financial in nature and with a medium to long-term horizon, as in the case of the provision of contingent liabilities and recapitalisations. Likewise, debt moratoria and restructurings are financial tools available in some euro area countries. We have also introduced a set of measures aimed at providing stimulus to the economy and hence indirectly impacting NFCs, such as cuts in direct and indirect taxes and growth in government investment (Table 2).

Table 2

A taxonomy of government interventions in the NFC sector implemented in the euro area during the COVID-19 crisis, and their impact on government accounts

Source: Authors.

Overall, the response to the COVID-19 crisis in support of the NFC sector has seen the use of a wider range of policy tools compared with previous crises. First, there have been more tools at the national level, such as extending deadlines for tax filing, the deferral of tax payments, the provision of faster tax refunds, and more generous loss offset provisions or tax exemptions, including from social security contributions. Second, general and sizeable schemes for protecting workers’ wages have been deployed − in some cases through subsidies to NFCs − which go beyond the existing automatic mechanisms. Around two-thirds of firms in the euro area used at least one of the government policy support measures introduced during the pandemic.[10]

The substantial national fiscal response has been enabled by applying the flexibility provided for in the legal framework. At the European level, this includes (i) the activation of the general escape clause under the Stability and Growth Pact and (ii) the relaxation of State aid rules, which has allowed countries to support the corporate sector with measures additional to the fiscal measures already envisaged under these rules.[11] At the national level, other legal measures have been implemented, such as the temporary suspension of the obligation to file for insolvency and debt moratoria.[12] These government interventions have in turn been supported by an accommodative monetary policy, whereby fiscal and monetary temporary measures have complemented each other during the pandemic.

Finally, the European Union has also substantially supported corporates in response to the COVID-19 crisis. First, the SURE loan facility (Support to mitigate Unemployment Risks in an Emergency) has made available €100 billion in emergency funding for national short-time work schemes since October 2020. Out of this envelope, Member States had used €94.3 billion by the cut-off date for this article. Second, the European Investment Bank’s European Guarantee Fund provides €25 billion of guarantees backing €200 billion of additional financing for firms, with a focus on SMEs, including through national promotional banks. Third, the Recovery and Resilience Facility (RRF) which entered into force on 19 February 2021 is also expected to provide support to corporates, albeit more indirectly. The expected fiscal stimulus of the RRF-financed spending is at least 0.5% of GDP per annum at the euro area level (June 2021 Eurosystem BMPE projections).[13]

3 The impact of government interventions on non-financial corporation balance sheets during the COVID-19 crisis

The crisis has had a swift effect on balance sheets in the NFC sector. The ratio of debt to gross value added rose strongly in the euro area, reflecting both the drop in economic activity and a sharp increase in the preference for liquid assets given rising uncertainty. While this balance sheet development has much in common with other episodes during the last 20 years, the role of government support measures on this occasion has some distinctive features.

We use a sectoral accounts decomposition of changes in corporate debt, defined as consolidated loans and debt securities, by uses and resources counterparts (Chart 1) as the main analytical tool in this section. Debt dynamics are explained as the result of combined leverage forces stemming from:

- the need to cover the shortage of own funds (equity and retained earnings) to finance investments in non-liquid assets, here called “long-term financing gap”; the gap is positive when the investment in non-liquid assets exceeds own funds raised and widens owing to, for instance, increases in gross investment or decreases in retained earnings, this widening leading, all other things being equal, to increased debt requirements;[14]

- the accumulation of liquid assets, which, everything else being constant (including alternative sources of financing, such as equity), leads to increased debt requirements;

- the net accumulation of inventories driven by the business cycle, also posing leverage pressures, as in the case for liquid asset accumulation;

- the “differential interest/growth”, corresponding to a measure of the excess of the interest burden over value added growth; this differential captures the changes in the debt-to-value-added ratio due to mechanical elements not directly linked to current corporate decisions on indebtedness: the interest payments depend on debt accumulated in the past and the growth in value added affects the ratio via a denominator effect.

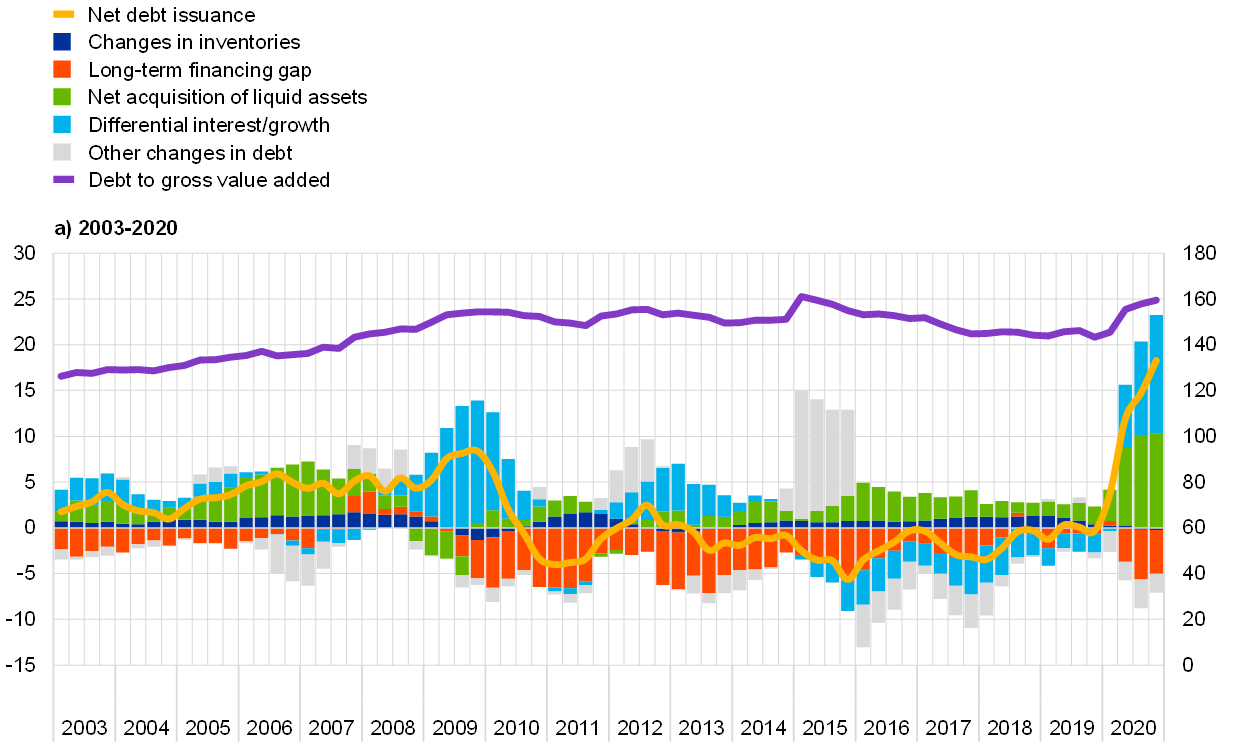

Chart 1

Contributions to changes in non-financial corporation debt in the euro area

(four-quarter sums, % of corporate value added)

Source: ECB and Eurostat.

Note: The time series shown in bars are rolling four-quarter accumulated flows of sector accounts non-financial corporations’ uses and resources, excluding debt issuance and including changes in assets and liabilities not due to transactions, expressed as a percentage of the gross value over the four quarters. Flows are grouped in analytical categories as explained in the main text and footnote 18. The statistical discrepancy between financial and non-financial flows is included in “long-term financing gap”. A notional negative flow is included in the time series “differential interests/ growth” corresponding to the result of applying the growth rate in gross value added during the four quarters to the stock of debt liabilities at the beginning of the four quarters; this makes the bars add up to the total change in the debt-to-gross value ratio during the four quarters.

The line shows the sum of bars corresponding to transactions, which is arithmetically equal to the net issuance of debt as a percentage of gross value added over the four quarters.

Chart 1 shows the changes in the corporate debt to gross value-added ratio attributable to the four dynamics above, which sum up to total net debt issuance represented by the yellow line (gross issuance minus redemptions). The chart also shows the changes in debt attributable to other factors (i.e. revaluations and reclassifications and other statistical treatments) and the level of the ratio itself (on the right-hand scale).

The COVID-19 crisis has resulted in an unfavourable interest-growth differential (blue bars in Chart 1), which − though likely to be temporary − has been a major driver of the leverage increase. This development was due to the collapse in economic activity, while supportive monetary policy has kept interest rate spreads contained. This contrasts with the evidence over 2008-09, when the increase in the interest rate-growth differential occurred due to a combination of negative growth and high spreads, and with the recession in 2012-13, with developments dominated by high spreads amid the sovereign debt crisis.

Liquid assets (light green bars in Chart 1) are playing a distinctively different role in the current crisis compared with the start of the global financial crisis (GFC). Liquid assets were this time the main factor behind the increase in the debt to value added ratio in 2020 following record-high borrowing in the first half of the year and subdued capital investment triggered by the COVID-19 shock.[15] This also translated into a contained development of net corporate debt. Similarly, as in previous crises, inventory cuts (dark blue bars) related to low activity are contributing negatively to corporate debt accumulation.

The COVID-19 crisis has also brought about a change in the long-term financing gap (red bars). This gap had been a sustained and robust deleveraging force after the GFC, reflecting subdued investment and preferential recourse to equity and internal financing. This force was showing signs of exhaustion in 2018 and 2019 on the back of increasing capital formation.[16] The COVID-19 crisis abruptly broke this trend, and the gap has again started to provide a significant contribution to deleveraging, similar to the one that materialised after the GFC from 2008 to 2013.

The government interventions can be seen in the increase in the contribution of subsidies and capital injections to overall resources in 2020. In Chart 2, the resources from government support are broken down into two categories, “subsidies”, which include current transfers and salary support measures,[17] and “capital injections”, including both capital transfers and equity acquisitions by government.[18] The relative weight of subsidies and capital injections has been high since end-2017, mainly due to a general decline in private own funds financing (particularly due to a lower raising of equity compared with previous periods, also reflecting a preference for bond issuance). The year 2020 saw an acceleration in this trend, with subsidies and capital injections on the rise, while private own funds financing continued to be subdued. The latter mainly reflected a decline in operating surpluses before subsidies (down by 1.4 percentage points on value added from end-2019, four-quarter sums).

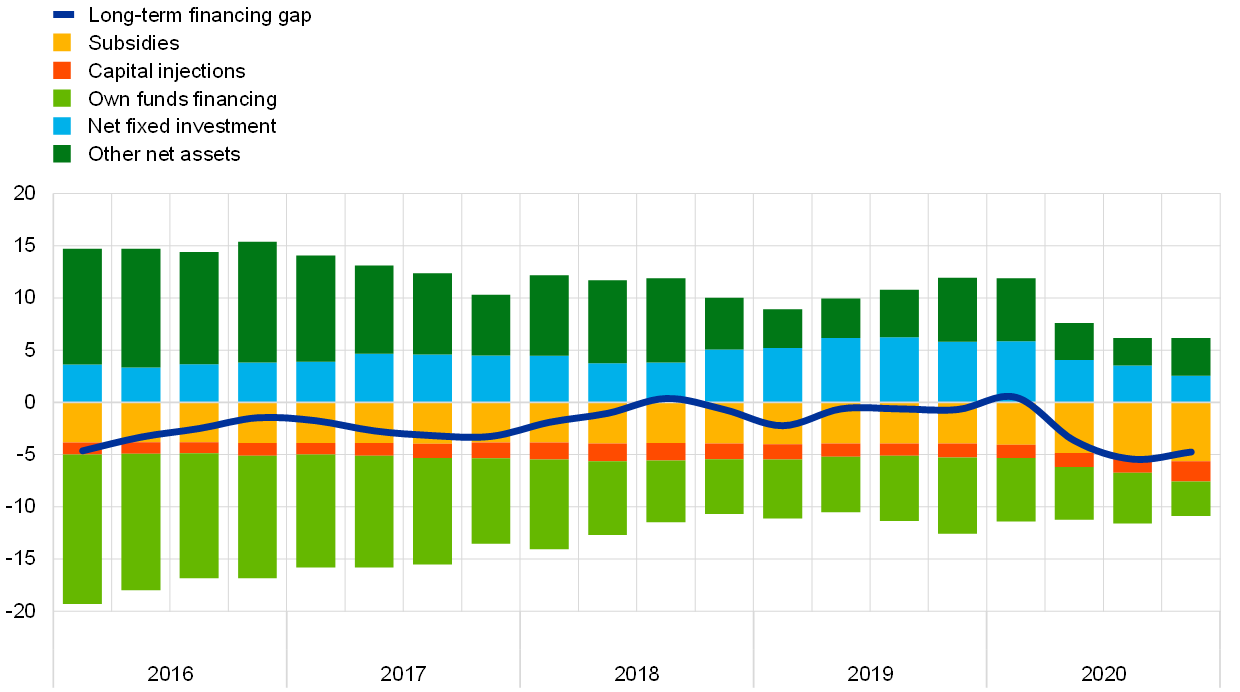

Chart 2

Financing gap of the NFC sector in the euro area

(four-quarter sums; % of corporate value added)

Source: ECB and Eurostat

Note: Rolling four-quarter sector accounts resources are shown below the line (i.e. constituting negative contributions to the financing gap and therefore to debt needs) and uses above the line (positive contributions to the gap and debt needs), expressed as a percentage over the gross value added in the four quarters. Uses and resources are grouped in analytical categories as explained in the text and footnote 14. The statistical discrepancy between uses and resources is included in “other net assets”.

Overall, the resources provided by governments in the last quarter of 2020 represented 70% of the total own funds raised by the NFC sector, compared with an average share of less than 40% prior to 2020. The substantial increase in subsidies and capital injections and the sharp decline by end-2020 in capital formation and long-term financial investment caused subsidies and capital injections to exceed capital formation and long-term financial investment during 2020 for the first time ever.

4 Government interventions and risks to public balance sheets

Government interventions in the NFC sector result in explicit and implicit costs on the government’s balance sheet. First, the discretionary fiscal packages designed to tackle the COVID-19 crisis throughout 2020, which were then extended during 2021, mainly consist of direct fiscal measures with an immediate and substantial effect on the budget balance. Second, the governments have lost a share of tax revenues owing to the restrictions imposed on the economy.[19] Third, the crisis has also impacted on government debt through financial public support in the form of equity injections and loans. Fourth, additional contingent liabilities, mainly state guaranteed loans, may have an impact on public debt in the future depending on the risks related to the actual take-up. Moreover, there is the risk that private non-financial corporations may be forced to fall under public remit.

The COVID-19 crisis is strongly affecting public finances, which is reflected in growing deficits and debt-to-GDP ratios in the short term. The euro area budget deficit increased from 0.6% of GDP in 2019 to 7.2% of GDP in 2020, i.e. by around €700 billion. The main driver, apart from the decline in economic growth, was the implementation of discretionary measures on the expenditure side, whereas total revenue only slightly decreased vis-à-vis 2019.

The euro area debt-to-GDP ratio rose from 83.9% of GDP in 2019 to 98.0% of GDP in 2020.[20] Euro area governments increased their stock of debt by €1,100 billion in 2020 vis-à-vis 2019. However, the government debt ratio is projected to peak in 2021, at around 100% of GDP, and to decline slightly thereafter, mainly on account of favourable interest-growth differentials and improving deficits. The large surge in the stock of debt in 2020 not only originates from the large deficits incurred, but also reflects the loans and equity injections provided to corporations and other financial asset acquisitions, which do not appear in the deficit figures but in the deficit-debt adjustment, which reached €400 billion in the euro area (2.4% of GDP). The net acquisition of financial assets was historically high in 2020 due to: (i) significant accumulated amounts of currency and deposits (2.0% of GDP), reflecting that countries borrowed funds by issuing debt in anticipation of liquidity needs; (ii) loans granted and equity injections (0.5% of GDP), reflecting policy measures aimed at providing public financing to corporations; and (iii) “other accounts receivable” (-0.1% of GDP, reflecting tax accruals and deferral schemes). The strong bond issuance during 2020 consisted mostly of long-term debt (i.e. above one year maturity), which represented 61% of the euro area total borrowing requirement, whereas short-term debt accounted for 33%.

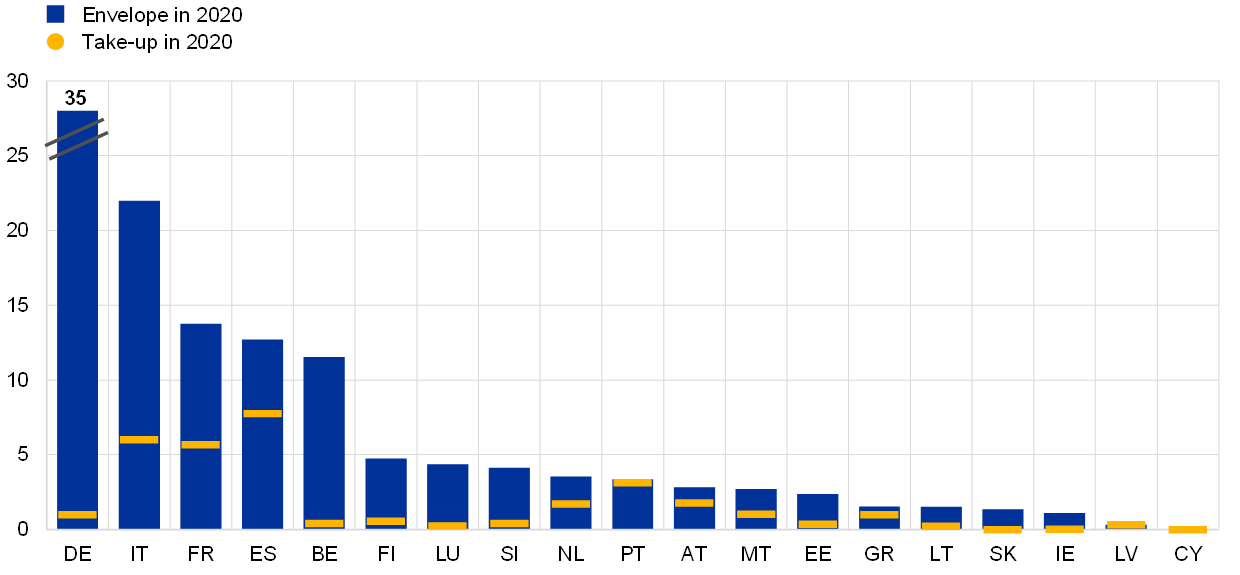

The provision of contingent liabilities has supporting effects for the whole economy. In order to prevent liquidity shortages from turning into solvency risks, particularly in SMEs, many governments have taken on new contingent liabilities since March-April 2020, mainly in the form of direct state guaranteed loans, which are not reflected in the official debt statistics. The different legal frameworks at country level render a comparison of the public guarantees granted to firms difficult, with some guarantee schemes being new, and others already having been in place before the onset of the crisis. The current size of the off-balance-sheet position was around €2,000 billion (19% of GDP) on average in 2020, compared with 9% of GDP at the end of 2019. However, the extent of possible losses for sovereigns, while considerable, appears so far to be contained overall, as the take-up of guarantees amounted to no more than around 4% of GDP by end-2020 at the aggregate level, albeit with considerable cross-country differences. [21] While a harmonised quantification of the state guarantees supporting the NFC sector across countries and over time is complex, Chart 3 provides an estimation for the euro area countries in 2020.[22]

Chart 3

State guarantee envelopes and guarantee take-up in 2020 across euro area countries

(state guarantee envelopes (incl. take-up), in percentage of GDP)

Source: Estimates provided by the Working Group on Public Finance in the context of the June 2021 Eurosystem staff BMPE and the ESRB report “Financial stability implications of support measures to protect the real economy from the COVID-19 pandemic”, February 2021.

The performance of public corporations also poses an additional upside risk to government debt, even in the absence of explicit government guarantees. If losses materialise, public corporations add additional risks to government balance sheets.[23] Data from Eurostat show that the stock liabilities from the public NFC sector were limited before the pandemic[24] . However, this situation could change over time, as happened during the GFC. Experience suggests that the most successful privatisations and divestments need to be well prepared, implying that possible pressures to re-privatise hurriedly may need to be resisted. The OECD guidelines suggest the transactions’ impact on the specific firm, market and the wider economy should be carefully considered, which might lead to government stakes remaining in government portfolios for some time.[25]

5 Conclusion

The support provided by euro area governments to NFCs during the COVID-19 crisis, coupled with some use of the flexibility available within the European and national legal framework, has so far prevented major disruptions, such as a wave of filed insolvencies. Euro area countries introduced a variety of support measures during 2020, which, among other things, have contributed to an unprecedented increase in liquid assets held on corporate balance sheets as private investment has been inhibited by the economic uncertainty. Public resources have contributed to sustainable corporate debt developments, allowing NFCs to increase their liquidity buffers to cushion future shocks. However, there are significant differences across firms and countries. Moreover, the take-up of loan guarantees has been relatively low, which, although partially reflecting a certain tightening of credit conditions, also suggests that demand in most countries has been low. However, the low uptake of loan guarantees might change in the near future. In addition to state guaranteed loans, governments can provide equity injections and direct loans. Depending on the depth and duration of the COVID-19 crisis, risks from further capital injections may materialise. Overall, there are potential risks stemming from a tightening sovereign-bank-corporate nexus.

The forms and magnitude of government support to the corporate sector will further evolve in 2021 and beyond, depending on the evolution of the pandemic and containment measures and the pace of the economic recovery. Following the substantial fiscal support provided during 2020-21 at national level, the EU will become an increasingly important contributor to investment and the economic recovery. The funds under the Recovery and Resilience Facility are also aimed at facilitating the digital and green transition of the European economies. According to the June 2021 Eurosystem BMPE projections, the euro area is projected to recover strongly, with growth of 4.6% in 2021 and 4.7% in 2022. As the recovery gains momentum, it will be important to shift from broad-based support to increasingly targeted support to sectors and firms to relieve government exposures, as well as to reduce corporate dependence on official support. At the same time, it will be desirable to avoid possible spillovers stemming from specific sectoral imbalances which may be affecting banks (through loans, NPLs) and which reinforce possible negative sovereign-financial loops.[26]

- See “The initial fiscal policy responses of euro area countries to the COVID-19 crisis”, Economic Bulletin, Issue 1, ECB, 2021.

- The employment measures can be a result of discretionary policies or of automatic mechanisms from welfare systems already in place. However, our calculations include only ad hoc discretionary measures implemented in the context of the COVID-19 crisis, mainly in the form of subsidies and transfers to firms, including short-time working schemes.

- According to ECB calculations, around 20-25% of firms in Spain, Germany and France were at risk of becoming illiquid in 2020 under a no-policy-change scenario, while the European Commission estimated around 35% of firms across the EU-27 would be under liquidity stress in an intermediate scenario (see “The impact of COVID-19 on potential output in the euro area”, Economic Bulletin, Issue 7, ECB, 2020).

- Public corporations are independent legal entities that are market producers and are subject to control by government units, which are often referred to as state-owned enterprises (SOEs). In practice, these typically include utilities and transportation companies or public-private partnerships for the implementation of large investment projects. Public corporations that are financial in nature (S.12 in national accounts) include the central bank and all public corporations that are engaged in financial intermediation and auxiliary financial activities, as well as insurance corporations and pension funds. This category typically includes nationalised banks and/or development banks, where the government has control with ownership of more than 50% of the shares. A wider definition of "public sector" entails a consolidated view of the balance sheet of the general government sector together with the financial and non-financial public corporations.

- Furthermore, other fiscal stimuli to the economy can also be regarded as a complementary policy tool at the disposal of governments to foster the recovery of demand/activity and therefore corporate income. On the expenditure side, this is typically the case with investment. On the revenue side, this is typically done through indirect tax cuts. However, the analysis of all fiscal stimuli to the economy falls outside the scope of this article.

- See Lojsch Hartwig, D., Rodríguez-Vives, M. and Slavik, M., “The size and composition of government debt in the euro area”, Occasional Paper Series, No 132, European Central Bank, October 2011.

- See Mojon, B., Rees, D. and Schmieder, C., “How much stress could Covid put on corporate credit? Evidence using sectoral data”, BIS Quarterly Review, March 2021, pp.55-70.

- See Financial Stability Review, ECB, November 2020 and May 2021. However, risks related to the sovereign-corporate-bank nexus continue to be relevant and might affect the recovery in the euro area.

- The implementation of the RRF funds is expected to be up to €672.5 billion (of which up to €312.5 billion in grants and up to €360 billion in loans in 2018 constant prices). At this stage it is still too early to assess the actual degree of absorption of these funds and how much corporates will benefit from them.

- According to an ECB survey, around 55% of large euro area firms and 48% of euro area SMEs used government support to ease their wage bills. About 28% of large firms and 25% of SMEs benefited from tax cuts and tax moratoria, and about 24% of large firms and 32% of SMEs used other government support schemes. Econometric analysis indicates that more vulnerable firms and firms recording a decline in bank loans were more likely to receive such fiscal backing. (see “The impact of fiscal support measures on firms’ liquidity needs during the pandemic”, Economic Bulletin, Issue 4, ECB, 2021).

- On 23 March 2020 the EU Council approved the activation of the general escape clause in the Stability and Growth Pact. This allows Member States to temporarily undertake budgetary measures in response to the COVID-19 crisis while still remaining within the rules-based framework of the Stability and Growth Pact. See here.

- Deutsche Bundesbank Financial Stability Review, 2020.

- This figure can be compared with the 0.5% of GDP fiscal stimulus projected by the European Commission’s 2021 Spring Forecasts.

- In detail, transactions in the “long-term financing gap” item are calculated as: (i) capital formation, plus (ii) net acquisitions of financial assets other than currency, deposits, debt securities and financial derivatives (i.e. less liquid assets; the component mainly covers acquisitions of equity and net trade credits receivable), minus (iii) retained earnings (measured as corporate savings) plus interest paid (which are accounted for in the “differential interest/growth” item), minus (iv) equity raised.

- While during 2008-09 the NFC sector reacted to the shortage of short-term financing by exhausting the liquid assets accumulated in previous years, this time the different nature of the shock has led to an unprecedented accumulation of liquidity, exacerbating a positive trend that already existed since 2014.

- In the period between 2010 and 2015 the gap values were usually in a range between -3% and -7%, in sharp contrast with the period prior to the financial crisis, with values typically above -2% and even in positive territory (i.e. with own funds financing being insufficient to cover long-term investment) from end-2007 to mid-2009. Chart 2 shows the gap developments as of 2016, when this dynamic post-crisis phase was starting to fade away.

- In some euro area countries not all salary support measures are reflected in sector accounts as affecting the NFC sector, but instead as directly supporting households’ income. It could then be argued that the analysis here underestimates actual support to NFC resources.

- The remaining financing gap components comprise “private own funds financing” (equity issuance and retained earnings adjusted for government support measures and interest payments), real investment adjusted for the depreciation of the capital stock (net fixed investment) and other investments, in particular in long-term financial assets (“other net assets”).

The decomposition in Chart 2 corresponds to the items described in footnote 14, except that retained earnings and equity raised are further split into contributions from government support actions and other subcomponents, which are jointly called “private own funds financing”. - While tax deferrals are often reported by Member States as part of the total costs of fiscal packages, these typically do not affect the budget balance.

- See euroindicators 22 April 2021.

- This figure reflects the maximum amount of public funds involved in the entire envelope of available guarantees (and not the total amounts mobilised, including leveraged private funding).

- Note that this does not distinguish between the recipients of the support, i.e. whether it is addressed to large companies, SMEs or entrepreneurs, nor between the different risk profiles in each category.

- The public sector concept (see Figure 1) can be a useful additional tool to monitor government balance sheet risks in this context (see IMF Fiscal Monitor, October 2018).

- “Products Eurostat News”, 29 January 2021, following Council Directive 2011/85 (known as the “Six-Pack”). However, the financial public sector has been relatively sizeable since the GFC owing to public equity injections and asset management companies. Some of these companies (called special purpose vehicles, or SPVs) are recorded under the remit of the public sector (European Commission, 2015).

- The OECD Guidelines on Corporate Governance of SOEs indicate, among other things, that a clear rationale for reprivatisation should be communicated to the public to avoid the appearance of improper motives. Sound competition should be in place prior to embarking on the transaction. The role of privatisation advisors and their independence is crucial. An appropriate company valuation and sales price is an important condition for success and is commonly based on the principle of fair market value. Should a government sell at below market value the reasons should be clearly identified, justified and transparent at the outset to ensure the integrity of the process.

- Financial Stability Review, ECB, May 2021.