- RESEARCH BULLETIN NO. 70

- 21 April 2020

Do banks invest in riskier securities in response to negative central bank interest rates?

How do systemic banks in the euro area react to negative central bank interest rates? This article suggests that they do not generally pass negative rates on to their depositors, and that they search for yield by investing in riskier securities. Their investments are directed more towards securities issued by the private sector and denominated in dollars – in addition to euro.

Introduction

In June 2014, for the first time, the Governing Council of the ECB lowered into negative territory the rate on its deposit facility, i.e. the interest rate banks receive for depositing money with the central bank overnight. The rate was reduced four more times in the following years. Money market rates adjusted accordingly and transferred the impact of negative rates to banks’ funding costs through the wholesale market, i.e. where banks receive very short-term loans from other financial institutions. But other sources of funding did not adjust in the same manner: in particular, euro area banks were reluctant to pass on negative rates to their depositors, especially retail depositors – i.e. households. Therefore the effect of negative rates on banks’ funding costs was not homogeneous across banks and depended on their business model, in particular their reliance on bank deposits. As a consequence, it is likely that negative rates have also affected the investment behaviour of banks and their risk-taking choices.

A recent study by Bubeck, Maddaloni and Peydró (2020) suggests that, after the introduction of negative interest rates, systemic banks in the euro area that rely more on customer deposits invested in riskier securities portfolios. These results support the view that banks with a larger deposit base are more affected by negative rates and increase risk-taking in their activities in order to boost profitability.

The transmission of low (negative) central bank interest rates to banks

A reduction in policy rates by the central bank is immediately transmitted to the general level of short-term interest rates prevailing in the market. To understand how this affects the net worth of banks, it is useful to remember that the balance sheet of banks is generally composed of longer-term assets and shorter-term liabilities.[2] A reduction in short-term interest rates affects first and foremost the liabilities: as long as banks can immediately pass on lower rates to their liabilities, for example to the interest rates paid to their depositors, the rate cut enables banks to fund themselves at a lower cost. At the same time, lower interest rates are likely to have a small effect on the asset side of banks’ balance sheets – especially in regard to the existing loan book, since typically the terms of a loan contract do not change in the short-run. Also, the valuation of a bank’s securities portfolio will generally increase because of lower short-term rates. Thus, a reduction in policy rates is likely to raise the net worth of banks, thereby improving their financial position, relaxing their financial constraints and increasing their capacity to lend to borrowers and invest in securities. Ultimately, lower short-term rates should expand banks’ ability to supply credit to the non-financial sectors, in the form of loans or investment in securities.

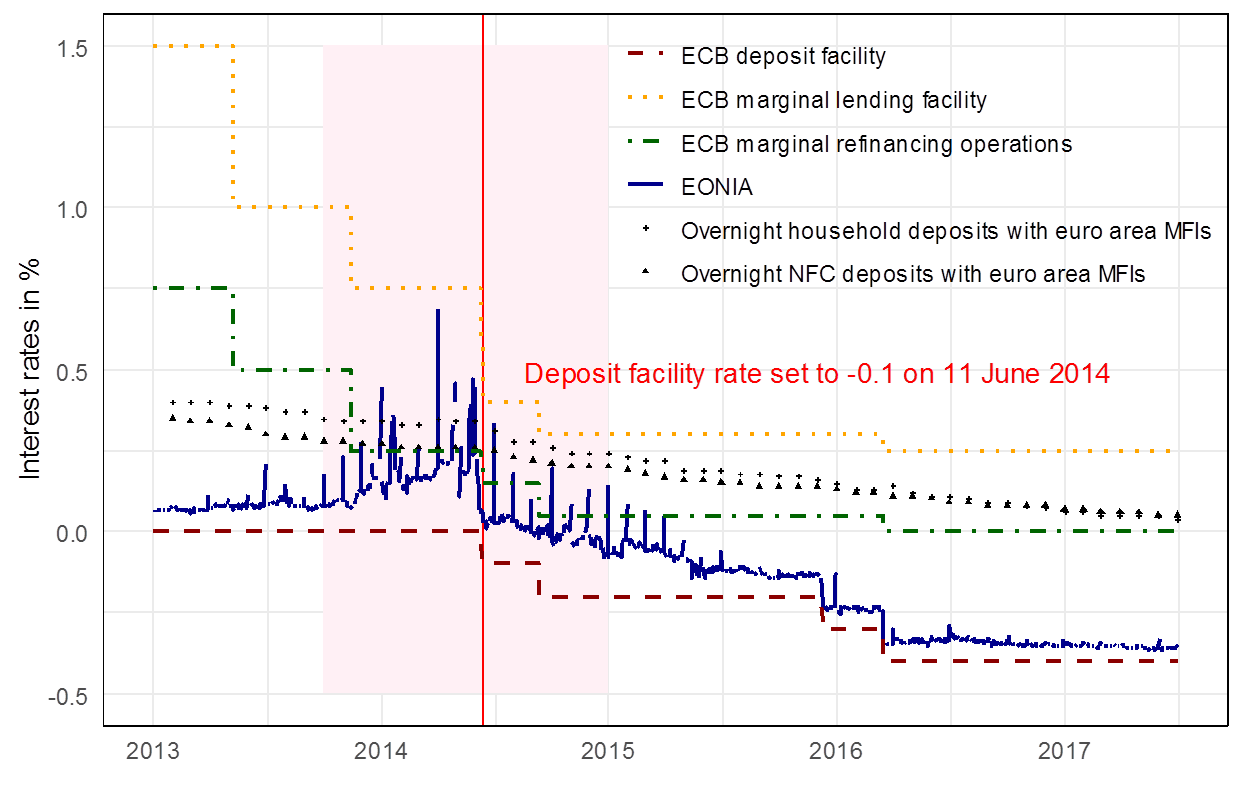

This reasoning relies fundamentally on the ability of banks to pass on the lower rates to their liabilities. Empirical evidence shows, however, that negative interest rates are somewhat special: namely, banks do not generally pass on negative rates, especially to their retail depositors (see Chart 1).[3] This is especially true for banks with more retail deposits, which rely less on wholesale funding. Furthermore, funding structures reflect underlying business models and are difficult to change in the short run. Therefore, negative rates lead to a greater financial burden on banks more reliant on customer deposits than on other banks, reducing their franchise value (see also Ampudia and Van den Heuvel, 2018, and Ampudia, 2019). This may induce these banks to search for yield more actively in order to boost future profitability.

Chart 1

Central bank interest rates and market interest rates in the euro area

Note: The blue line is a daily series of the EONIA interbank interest rate (euro overnight index average) obtained from the ECB’s SDW. The dots and triangles show a monthly time series of the rates applied to overnight household and non-financial corporation (NFC) deposits, obtained from the euro area MFI Interest Rate Statistics via the ECB’s SDW. Euro area monetary financial institutions (MFIs) include banks.

Negative monetary policy rates and banks’ reach for yield

Bubeck, Maddaloni and Peydró (2020) use the reliance on bank deposits as a source of funding as an identification strategy to infer the impact of negative policy rates on the securities portfolios of large euro area banks.[4] For the reasons outlined above, banks with different deposit ratios (deposits to total liabilities) are affected differentially when central bank interest rates reach negative territory. This provides a means to identify the effect of negative policy rates on bank risk-taking in securities investment and isolate it from other forces that shape both monetary policy and the investment behaviour of large euro area banks. In particular, banks with higher deposit ratios might exhibit a stronger increase in risk-taking in response to negative policy rates.

Bubeck et al. (2020) analyse the securities portfolios of banks before and after the implementation of negative rates in June 2014 and compare banks that were more affected by the introduction of negative interest rates (measured through their reliance on deposits) with a control group that was less affected. They use a novel database with detailed information about the securities holdings of the 26 largest banking groups of the euro area. The granularity of this database, with data at the level of individual securities, allows researchers to control for the risk of the securities and all other individual characteristics, and therefore to isolate the effect of the change in interest rates. Bubeck et al. (2020) also restrict the analysis to the period around the first time the ECB implemented negative deposit rates (June 2014). This in particular means that the effect of negative rates can be isolated from other central bank interventions, notably asset purchases, which only started the following year.

A key contribution of the study is to provide the first comprehensive analysis of the impact of negative rates on the securities portfolios of large banks. The granularity of the dataset also makes it possible to track portfolio reallocations between securities from specific asset classes and currency denominations. These portfolio reshufflings in response to the adoption of negative rates point to the existence of additional channels of monetary policy transmission, which work through the securities portfolios of large banking intermediaries.

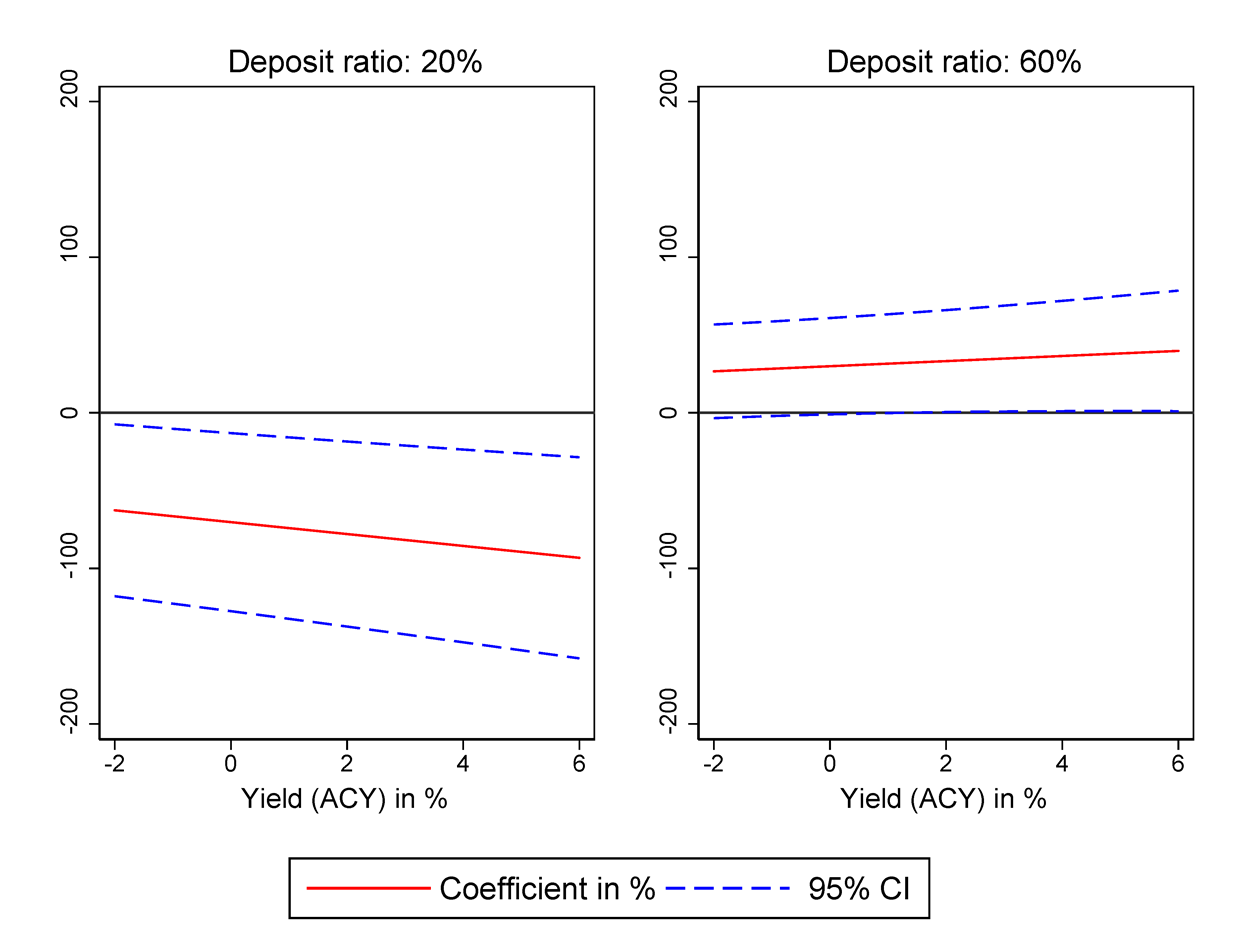

The results of the study suggest that banks with higher deposit ratios invested in riskier securities portfolios after the introduction of negative interest rates. Furthermore, overall, the securities portfolios of banks with a high deposit ratio became riskier relative to those of banks with a low deposit ratio. Chart 2 provides an illustration of this result for banks with different levels of deposit ratios (calculated as fractions of total liabilities). Banks that are more reliant on customer deposits were more affected by negative rates and reached for higher yields. Since the analysis is based on security-level data, controlling for all other securities characteristics, these results point to these banks effectively taking more risk.

The analysis also shows that customer deposits during the same period continued to flow towards banks more reliant on deposits, probably reflecting the fact that these banks have a business model that caters more for retail depositors and are perceived to be safer. At the same time, however, high-deposit banks did not significantly increase the overall amount of loans they offered. Thus, it can be inferred that, during the period of the analysis, high-deposit banks preferred to invest the additional deposit inflows in (liquid) securities that are easier to readjust than (illiquid) loans.[5]

But in which securities did banks invest after the introduction of negative rates? Bubeck et al. (2020) use the granular database at their disposal to answer this question. First, the analysis performed for asset classes shows that the increase in risk-taking was seen for all classes of debt securities, albeit at different levels of statistical and economic significance. High-deposit banks invested more in riskier debt issued by private financial and non-financial companies. These banks also invested more in riskier securities with longer maturities, adding an additional dimension of risk-taking.

It is also interesting to look at the investment in securities issued in various currencies other than in euro. This represents an additional channel through which euro area monetary policy spills over to other economic areas and currencies. Indeed, the findings of the study point to high-deposit banks directing their investment more towards higher-yielding securities denominated in US dollars, an effect almost twice the size of the estimated effect for securities denominated in euro.

Bank risk-taking in response to lower interest rates is also related to bank risk-bearing capacity.[6] Indeed, the analysis in Bubeck et al. (2020) shows that, after the introduction of negative rates, banks with higher levels of capital appeared to reach for yield more. However, among the most affected banks (i.e. high-deposit banks), it was the banks with less capital that displayed a stronger increase in the risk of their securities portfolios.

While liquid assets such as securities are easier to rebalance in response to changes in policy rates, the largest fraction of banks’ assets is represented by loans. While studies based on banks’ portfolios of syndicated loans point to an increase in risk-taking by banks most affected by negative rates (see Heider et al., 2019), analyses based on loan portfolios of banks in specific countries have somewhat mixed results. Bubeck et al. (2020) provide a complementary analysis based on syndicated loans data for their sample of large banks. The impact of negative rates on the volume of loans is somewhat ambiguous, making it difficult to draw strong conclusions. At the same time, banks that are more dependent on retail deposits increased their exposure by lending to riskier borrowers more than other banks.[7] Overall, this is again evidence that high-deposit banks take greater risks after the introduction of negative rates.

Chart 2

Change in securities holdings after the introduction of negative rates

Note: The chart shows the change in securities holdings of large euro area banks as a function of the yield of the security, for two different values of the deposit ratio. Deposit ratios are calculated as the ratio of customer deposits over total liabilities. ACY is the adjusted current yield of a security.[8]

Conclusions and policy implications

The introduction of negative policy rates in several countries in the last few years was a significant and novel development. It is therefore crucial to gain a better understanding of how negative rates affect financial intermediaries’ incentives to take risks. The analysis reported on in this article provides new evidence on the impact of negative rates on the securities investment of the largest euro area banks and complements the results obtained by other researchers focusing on the lending portfolios of banks. High-deposit banks increase securities holdings after the introduction of a negative policy rate more than low-deposit banks and this increase is most pronounced for assets with higher yields. This search-for-yield behaviour is mostly visible for less capitalised banks, for assets denominated in US dollars, is confined to private sector debt securities and is geared towards long-term debt – which is typical for search-for-yield behaviour. The analysis complements the evidence in Heider et al. (2019) which shows that the banks most affected by negative rates increased risk-taking through their syndicated loan portfolios. Other studies based on granular data on national loan portfolios produce somewhat mixed results (see for example Bottero et al., 2019 and Arce et al., 2019).

Overall, these findings suggest that negative interest rates have heterogeneous effects across financial intermediaries, leading some to take more risks than others depending on their funding structure. Whether negative interest rates lead to more risk-taking across the entire banking system, especially considering the effects of a prolonged period of negative rates, is an important open question that remains to be addressed.

References

Altavilla, C., Burlon, L., Giannetti, M. and Holton, S. (2019), “Is there a zero lower bound? The effects of negative policy rates on banks and firms”, ECB Working Paper Series, No 2289.

Ampudia, M. (2019), “Do low interest rates hurt banks’ equity values?”, ECB Research Bulletin, No 60.

Ampudia, M. and Van den Heuvel, S. (2018), “Monetary policy and bank equity values in a time of low interest rates”, ECB Working Paper Series, No 2199.

Arce, O., Garcia-Posada, M. and Mayordomo, S. (2019), “Adapting lending policies against a background of negative interest rates”, Banco de España Article 5/19.

Bottero, M., Minoiu, C., Peydró, J.-L., Polo, A., Presbitero, A. F., Sette E. (2019), “Negative Monetary Policy Rates and Portfolio Rebalancing: Evidence from Credit Register Data”, IMF Working Papers, No 19/44.

Bubeck, J., Maddaloni, A. and Peydró, J.-L. (2020), “Negative monetary policy rates and systemic banks’ risk-taking: Evidence from the euro area securities register”, ECB Working Paper Series, No 2398, and Journal of Money, Credit and Banking (forthcoming).

Heider, F., Saidi, F. and Schepens, G. (2019), “Life below zero: bank lending under negative policy rates”, Review of Financial Studies (forthcoming).

Peydró, J.-L., Polo, A. and Sette, E. (2017), “Monetary policy at work: Security and credit application registers evidence”, CEPR Discussion Papers, No 12011.

- The article was written by Johannes Bubeck (Economist, Monetary Policy and Analysis Division, Deutsche Bundesbank), Angela Maddaloni (Deputy Head of Division, Financial Research Division, Directorate General Research, European Central Bank) and José-Luis Peydró (Imperial College, ICREA-Universitat Pompeu Fabra, CREI, Barcelona GSE and CEPR). The authors gratefully acknowledge the comments of Philipp Hartmann, Alberto Martin and Louise Sagar. The views expressed here are those of the authors and do not necessarily represent the views of the Deutsche Bundesbank, the European Central Bank or the Eurosystem.

- For a simple illustration of a bank balance sheet see the ECB’s banking supervision website.

- For more recent evidence on negative rates applied to deposits of non-financial corporations see for example Altavilla et al. (2019).

- Heider et al. (2019) employed the same identification strategy to analyse the impact of the introduction of negative rates on the lending behaviour of banks.

- See Bubeck et al. (2020). This evidence should be interpreted keeping in mind that the analysis focuses on the first implementation of negative rates in the euro area. The composition of banks’ assets in reaction to negative rates and deposit inflows may have changed over a longer period of time.

- Peydró et al. (2017) provide evidence of this during a crisis period by analysing granular data on loans and securities holdings of Italian banks.

- The risk of the borrower is measured by the ratings of the borrower institutions.

- The adjusted current yield (ACY) of a security is computed as: