The Bulgarian lev and the Croatian kuna in the exchange rate mechanism (ERM II)

Published as part of the ECB Economic Bulletin, Issue 6/2020.

The Bulgarian lev and the Croatian kuna were included in the exchange rate mechanism (ERM II) on 10 July 2020. The decision was taken by mutual agreement of the finance ministers of the euro area countries, the President of the European Central Bank, and the finance ministers and central bank governors of Denmark, Bulgaria and Croatia. This followed a common procedure involving the European Commission and the Economic and Financial Committee. The start of ERM II participation marks the final step of a detailed roadmap. This roadmap set out a process which was characterised by constructive collaboration between the Bulgarian and Croatian authorities and the ERM II parties and based on thorough economic assessments and the principle of equal treatment.

ERM II was introduced in 1999 as one of the ways to assess a country’s convergence with the euro area. The mechanism has two main purposes. The first is to act as an arrangement for managing the exchange rates between the currencies of the participating countries and the euro, and the second is to assist with the assessment of convergence for the adoption of the euro as established by Article 140 of the Treaty on the Functioning of the European Union. Therefore, participation in ERM II is not only legally at the core of the convergence criterion on exchange rate stability, it is also a means of testing the sustainability of convergence before and after adoption of the euro. As participating in ERM II for at least two years without severe tensions is a precondition for the eventual adoption of the euro, all EU Member States are expected to join the mechanism at some stage.

ERM II is a multilateral arrangement of fixed, but adjustable, exchange rates which provides for a central exchange rate between participating currencies and the euro and a fluctuation band with a standard width of ±15% around the central rate. Other main features are central bank interventions at the margins of the agreed fluctuation band and the availability of very short-term financing from participating central banks. When joining ERM II, national central banks can unilaterally commit to a narrower fluctuation band than that provided for by ERM II, without imposing any additional obligations on the ECB or the other participants in the mechanism.[1] During ERM II participation, realignments of the central rate (as has happened in the past with the Slovak koruna) or changes to the width of the fluctuation band may be necessary as a result of significant changes in the equilibrium exchange rate of a given participating country or in the presence of inconsistent economic policies. Interventions at the margins of the fluctuation bands are in principle automatic and unlimited. However, the ECB and the participating national central banks can suspend these interventions at any time if they conflict with the primary objective of maintaining price stability.

Experience shows that ERM II can accommodate different exchange rate regimes, as is now the case with those of Bulgaria and Croatia. The mechanism provides sufficient room for adjustment to shocks and market developments. At the same time, the mechanism may incorporate, as a unilateral commitment, tightly managed or pegged exchange rate regimes, and even currency board arrangements.[2] A currency board arrangement was used by Eesti Pank and Lietuvos bankas before euro adoption and is being used today by Българска народна банка (Bulgarian National Bank). Hrvatska narodna banka maintains the stability of the exchange rate of the kuna against the euro in order to achieve its primary objective of price stability, but does not commit to a fixed exchange rate. In any event, all participating countries are required to stay in the mechanism for at least two years before the convergence reports prepared by the ECB and the European Commission may provide a possible positive assessment with regard to adoption of the euro.[3]

The process leading to ERM II participation has evolved over time, but always relies on the principle of equal treatment. When the last wave of countries joined ERM II, more than 15 years ago, participating in the mechanism required making and publishing a firm, but general, commitment to pursue stability-oriented policies. In the subsequent years, a number of important policy lessons were learned from the global financial crisis. The crisis affected not only the euro area, but also several countries whose currencies were participating in ERM II. Euro area governance was reformed following the crisis, resulting in tighter economic and fiscal surveillance and the establishment of the banking union. During that period it was also better understood that participation in ERM II may have important implications, as it constitutes a regime shift that can alter the economic incentives of international and local investors. In particular, after joining the mechanism, gross capital inflows other than foreign direct investment accelerated sharply in several countries, also in comparison with other countries in the region during the same period. In some cases this proved to be unsustainable, leading to episodes of major capital flow retrenchment in the subsequent years.

A key lesson learned from the global financial crisis was that, in the run-up to euro adoption, a high level of institutional quality and good governance help to reduce the risk of a build-up of excessive imbalances. Greater structural resilience creates the preconditions for allocating capital to productive firms instead of rent-seekers, thus supporting the catching-up process rather than the formation of bubbles. Moreover, good governance implies that policymakers are able to resist pressure from vested interests against the implementation of necessary reforms and the building-up of buffers in normal and good times, including countercyclical macroprudential and fiscal measures. In the past few years these lessons and developments have been reflected in the roadmap to ERM II designed by the national authorities of Bulgaria and Croatia in cooperation with the ERM II parties.

The inclusion of a currency in ERM II follows the procedure outlined in the Resolution of the European Council of 16 June 1997.[4] Decisions on ERM II participation are taken by mutual agreement of the ERM II parties, which means achieving a consensus about the pursuit of sustainable policies by the Member State requesting the inclusion of its currency in ERM II. At the same time, it has more recently been clarified that reaching this consensus depends on three fundamental factors: (i) reflecting the lessons learned from past crises; (ii) taking into consideration the introduction of the banking union; and (iii) recognising the need to take due account of any country-specific vulnerabilities that need to be addressed to ensure smooth participation in the exchange rate mechanism.

Based on this approach, the Bulgarian and Croatian authorities identified a number of prior policy commitments, which were formally adopted in the summer of 2018 by Bulgaria and in the summer of 2019 by Croatia. They were designed in collaboration with the ERM II parties and had to be voluntarily fulfilled before starting ERM II participation. These commitments reflect the current reality in a way that is reasonable, proportional and motivated. In particular, the commitments have to be specific, realistic and verifiable in nature and they have to be implemented, monitored and verified within a relatively short space of time. Their fulfilment has been monitored and assessed by the ECB and the European Commission, each in their respective field of competence, namely banking supervision and macroprudential policy for the ECB and structural policies for the European Commission (fiscal policies fall under the provisions of the Stability and Growth Pact).

With a view to ensuring a sustainable convergence path to the euro area, Bulgaria and Croatia made additional policy commitments when they joined ERM II on 10 July 2020.[5] In line with past practices, Bulgaria and Croatia made voluntary policy commitments, the so-called post-entry commitments, when they began their participation in ERM II. The agreement on participation of the Bulgarian lev and the Croatian kuna in ERM II has also been accompanied by a firm commitment by the respective national authorities to pursue sound economic policies with the aim of preserving economic and financial stability and achieving a high degree of sustainable economic convergence. The authorities, together with the responsible European Union bodies, will closely monitor macroeconomic policy developments and the implementation of these policy measures, in the appropriate frameworks. All in all, the process leading to ERM II entry has acted as a catalyst for reforms that will mitigate risks under ERM II with a view to subsequent euro adoption. Although these reforms do no eliminate risks, their importance in preparing for sustainable participation in the monetary union should not be underestimated.

The Bulgarian lev and the Croatian kuna were included in ERM II with their current exchange rate levels. The Bulgarian lev has been included in ERM II with a central exchange rate of 1.95583 levs per euro, which corresponds to the fixed exchange rate under Bulgaria’s currency board arrangement. The Croatian kuna has been included in ERM II with a central exchange rate of 7.53450 kuna per euro, which corresponds to the prevailing market rate at the time of its inclusion on 10 July 2020.

The inclusion of both currencies at their current exchange rate reflects the fact that Bulgaria and Croatia have a remarkable track record of exchange rate stability, under which both economies have undergone significant external adjustment. For more than two decades Българска народна банка (Bulgarian National Bank) has operated a currency board arrangement under which it commits to exchange levs against the euro at a fixed exchange rate. Hrvatska narodna banka has maintained a managed floating exchange rate regime under which the kuna fluctuates within a relatively narrow range around its average exchange rate against the euro. While fundamentally different in their functioning, both regimes have served their economies well. In particular, they proved resilient in periods of severe financial market stress, including during the ongoing coronavirus (COVID-19) pandemic. Moreover, both countries underwent significant external adjustment after the onset of the global financial crisis. This involved the correction of large current account deficits, which have since turned into surpluses. As a result, there has been a sizeable reduction of net external liabilities, with both central banks accumulating comfortable buffers in terms of foreign exchange reserves.

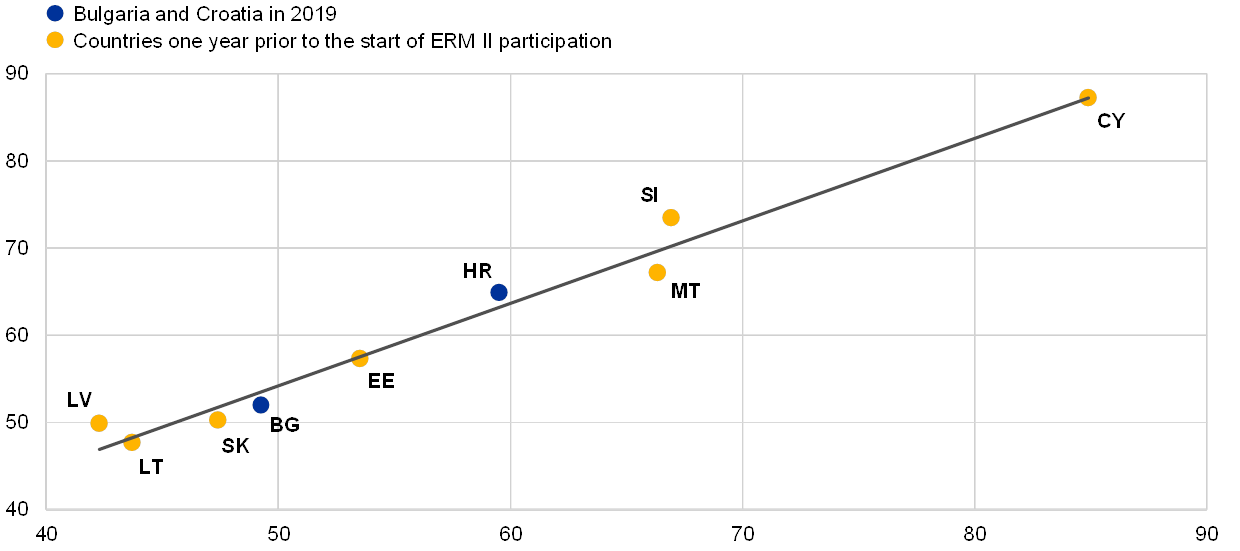

External rebalancing has been coupled with nominal adjustment in both countries, with price levels clearly reflecting the state of convergence of the two economies. Both countries recorded substantial increases in prices and costs before the global financial crisis. These were partly a by-product of the real convergence process, i.e. the fact that both countries were catching up in terms of income levels relative to the rest of the European Union. Conversely, the global financial crisis brought about some correction of price and cost levels in both Bulgaria and Croatia. As a result, their price levels relative to the euro area are now well in line with their income levels relative to the euro area. While such levels remain significantly below that of the euro area, this does not in itself constitute an impediment to participation in ERM II. Past experience has in fact shown that countries that join ERM II at comparable or even less advanced stages of convergence can subsequently introduce the euro in a successful way. In this regard, a more important prerequisite for successful participation in ERM II is that price levels are commensurate with income levels (as shown in Chart A) and, more generally, with the economic fundamentals of the country.

Chart A

GDP per capita and price levels relative to the euro area

(percentages; x-axis: GDP per capita relative to the euro area; y-axis: price level relative to the euro area)

Source: ECB.

- Multilaterally agreed bands that are narrower than the standard band should only be considered at a very advanced stage of convergence. This is the case with the Danish krone, for which a multilaterally agreed fluctuation band of ±2.25% vis-à-vis the euro is in place.

- See “Policy position of the Governing Council of the European Central Bank on exchange rate issues relating to acceding countries”, ECB, Frankfurt am Main, 18 December 2003.

- Euro adoption is decided on by the Council of the European Union in line with the relevant Treaty provisions. After consulting the European Parliament and after discussion in the European Council, the Council, on a proposal from the Commission, decides which eligible Member States outside the euro area fulfil the necessary conditions to adopt the euro. This decision is taken on the basis of a number of criteria listed in Article 140 of the Treaty on Functioning of the European Union. The reports on the fulfilment of such criteria, called convergence reports, are prepared by the ECB and the European Commission. The Council acts on the basis of a recommendation of a qualified majority of its Member States whose currency is the euro.

- Resolution of the European Council on the establishment of an exchange-rate mechanism in the third stage of economic and monetary union (OJ C 236, 2.8.1997, p. 5).

- See the ECB’s website for the ERM II communiqués, the countries’ application letters and the list of post-entry commitments of Bulgaria and Croatia.