- SUBMISSION TO THE ECB BLOG

The euro area needs better structural policies to support income, employment and fairness

11 October 2023

The euro area economy has recovered swiftly from the pandemic, supply bottlenecks and the energy price shock. But there is no room for complacency. Structural weaknesses are still a brake on income and productivity growth. Governments need to implement reforms to make European economies stronger and promote social fairness.

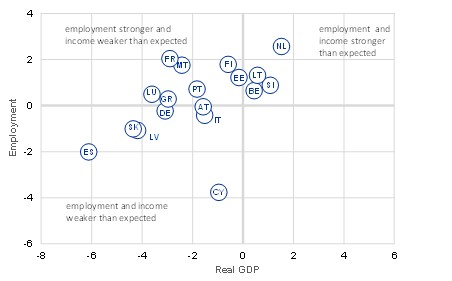

The euro area economy has proven remarkably resilient over the past few years. In 2022, output and employment in many countries in the currency union exceeded pre-pandemic expectations, despite the major shocks in recent years (Chart 1). This robustness is in large part the result of decisive fiscal and monetary policies. Over the course of the pandemic, job retention schemes and sizeable national fiscal support helped to prevent a collapse of economic activity and employment. Other instruments at the European level, such as Next Generation EU[1], complemented these efforts.[2]

Close alignment between monetary and fiscal policies in response to the pandemic yielded an unexpectedly strong recovery. This in turn contributed to the rise in inflation. In the second half of 2021, inflation started to overshoot the ECB’s 2% target, reaching a peak of 10.6% in October 2022.

To fight inflation, the ECB first discontinued its net asset purchases during the first half of 2022, and has since then swiftly increased its main policy rates. Monetary policy shifted from easing to tightening and therefore no longer has a supportive effect on short-term growth.

Expansionary fiscal policies are coming to an end, too. Reducing deficits and bringing debt levels down are important, not only to improve debt sustainability and fiscal space in countries with high public debt, but also to lower medium-term inflationary pressures. Against this background, governments need to get their economies into better shape and enhance longer-term growth prospects.

Chart 1

Real GDP and employment rate in 2022 relative to pre-pandemic projections

(percentage point deviation from Eurosystem projection in December 2019)

Sources: Eurostat and Eurosystem.

Note: The chart shows the cumulative growth in real GDP (x-axis) and the change in the employment rate (y-axis) between 2019 and 2022 relative to the (pre-pandemic) Eurosystem projections in December 2019. As an example, in the case of Spain and over the three years from 2019 to 2022 output growth was some 6 percentage points and the change in the employment rate some 2 percentage points below the Eurosystem projections from December 2019. Ireland is excluded from the chart for readability.

Structural weaknesses reduce resilience

The strong economic recovery and the solid job markets in the wake of recent crises could lead policymakers to overestimate the resilience and growth potential of their economies. But there is no room for complacency. There are still many structural weaknesses in our economies: e.g. too much regulation that hinders the entry of new firms and job creation, not enough competition and insufficient incentives to innovate and invest. In several euro area countries productivity growth has been weak for decades.[3] Average annual labour productivity growth, measured as GDP per hour worked, has been only 0.8% in the euro area since 2001. That compares to an average of 1.3% in the United States and 1.1% across all OECD countries.[4] The risks to sustained growth have increased in many countries in the wake of the major supply shocks in recent years. And in the longer term, our economies face big structural challenges related to ageing, climate change, digitalisation and new geopolitical risks.

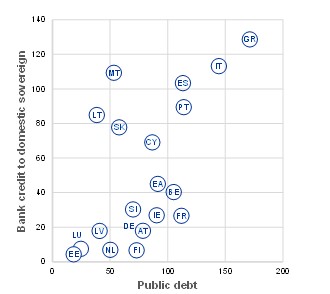

Public deficits went up significantly as governments spent substantial amounts to help people and businesses through the recent crises. Debt-to-GDP ratios remain above 2019 levels in many countries. This will burden citizens in the future – either via higher taxes or lower government spending – and limit the room for manoeuvre for fiscal policy, in particular if long-term growth remains weak. High public debt can also increase the exposure of banks to their sovereign. As banks tend to hold much more government debt of their own countries than of others, there is the risk of adverse feedback loops (Chart 2). If distrust about the creditworthiness of a sovereign emerges, risk premia tend to increase. This in turn might get banks into trouble – a phenomenon described as the “doom loop” during the euro sovereign debt crisis in 2010-13. In parallel to fiscal risks, macro-financial vulnerabilities have increased in other parts of the economy, most notably real estate markets.[5]

Chart 2

Bank credit to domestic sovereign

(x-axis: percent of GDP, y-axis: percent of bank CET1 capital)

Sources: Eurostat and ECB supervisory data (COREP and FINREP).

Note: CET1 refers to Common Equity Tier 1 capital. Consolidated data referring to Q4 2022.

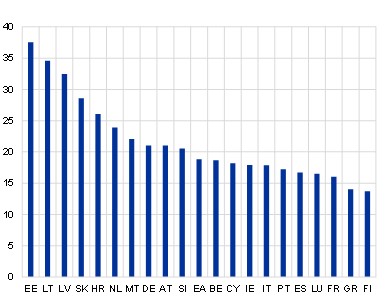

Another consequence of the recent crises is large differences in inflation rates across euro area countries. In part, these reflect the extent to which countries are dependent on imported energy. For instance, cumulated inflation rate since January 2020 is 38% in Estonia, compared to 14% in Finland (Chart 3). Some inflation differentials are normal in a currency union. They can, for example, reflect temporary adjustments or different exposures to shocks. They can also be associated with a normal convergence of overall price levels across countries, as less-developed economies catch up to more-productive countries. But large cumulated inflation differentials may also reflect unsustainable relative cost and price developments. Experiences since the introduction of the euro show that large and persistent divergences of inflation and unit labour cost can lead to costly macroeconomic imbalances. In this case, national economic policies need to be adjusted. That’s why governments need to keep a close eye on losses in price competitiveness, which have been observed in several euro area countries over recent years.[6]

Chart 3

Cumulated increase in harmonised consumer prices between January 2020 and August 2023

(percent)

Source: Eurostat.

Improving framework conditions and the quality of institutions

Structural reforms should be a key priority, together with sound fiscal and macroprudential policies.[7] National governments have significant room to make their economies function better, and in particular to improve the institutions, rules and regulations that govern economic activities. One way to identify areas where improvements are needed the most is the World Bank’s Worldwide Governance Indicators (WGI) dataset. It summarises how companies, citizens and experts view the quality of governance. About half of euro area countries have seen a deterioration in their composite rank in the WGI over the last decade (Chart 4). No euro area country has seen any significant improvement since 2012, with the exception of the Baltics and Greece.

That is worrying, because better structural policies can help economies to grow faster and fairer.[8] Poorer people often suffer the most from inefficient public services, weak institutional quality (including corruption, a lack of transparency or rent-seeking in product markets) and rigid economic structures that keep unemployment high and real wages low. Policies that address such inefficiencies can put euro area economies on the path to greater prosperity and promote social fairness. For instance, reforms that strengthen the quality of education and incentivise firms to invest in employees’ qualifications lead to higher-quality jobs that pay more and reduce youth unemployment. Reforms that address structural rigidities and improve regulatory and administrative efficiency, e.g. via the use of modern digital technologies, would improve the quality of public services and could thus disproportionally benefit the more vulnerable part of the population. The Recovery and Resilience Plans prepared by euro area countries under Next Generation EU contain many detailed investments and useful reforms. But government commitments in the areas of labour and product markets or pension systems, for example, are often not ambitious enough.

Chart 4

Institutional quality in EU Member States

(score ranging from -250 to 250)

Source: World Bank Worldwide Governance Indicators.

Note. Scores reflect the average of the four measurable governance indicators: rule of law, regulatory quality, government effectiveness and control of corruption. Higher values indicate better governance. A score of 250 would reflect that a country is the global best performer in all four subcategories. Euro Area average in unchanged composition.

National efforts to enhance structural policies can be supported by European policies. Progress in deepening the Single Market, especially in the services sector, could give a boost to productivity. According to a European Parliament study, removing the remaining barriers to a fully functioning single market could bring total benefits of €713 billion by the end of 2029.[9] Moreover, a simplified EU regulatory framework would increase the attractiveness of the euro area for investors and innovative activities. The same is true for Banking Union and Capital Markets Union, which would strengthen the capacity of financial markets to bear, diversify and reduce risk.

Overall, enhanced structural policies and better institutional quality would have many interconnected benefits. They would increase the potential for growth, make debt more sustainable, help weaker euro area economies to catch up, reduce the risk of fragmentation and make the future shocks economically and socially less costly. Last but not least, this would support the smooth transmission of monetary policy to the whole euro area economy – and thereby help preserve price stability in the euro area.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

See Bańkowski, K., Bouabdallah, O., Domingues Semeano, J., Dorrucci, J., Freier, M., Jacquinot, P., Modery, W., Rodríguez-Vives, M., Valenta, V. and N. Zorell (2022), “The economic impact of Next Generation EU: a euro area perspective”, Occasional Paper Series, No 291, ECB.

There was also an element of luck as most of those euro area economies hit hardest by the pandemic had less trouble with the later shock of high energy prices – and vice versa. While the pandemic hit countries with large contact-intensive services sectors (including tourism) particularly hard, Russia’s war against Ukraine and the energy crisis were of particular concern for countries with large manufacturing sectors, a low share of domestically produced energy and higher dependence on supplies from Russia.

Work Stream on productivity, innovation and technological progress (2021), “Key factors behind productivity trends in EU countries”, Occasional Paper Series, No 268, ECB.

For details, see the ECB’s May 2023 Financial Stability Review and the European Commission’s 2023 European Semester: Spring Package Communication.

See Filip, D., Momferatou, D. and Setzer, R. (2023), “Inflation and competitiveness divergences in the euro area countries”, Economic Bulletin, Issue 4, ECB.

See Lane, P. (2021), “The resilience of the euro”, Journal of Economic Perspectives, Vol. 35(2), Isabel Schnabel’s keynote speech entitled “Finding the right mix: monetary-fiscal interaction at times of high inflation”, given at the Bank of England Watchers’ Conference on 24 November, 2022, and the ECB’s May 2023 Financial Stability Review.

For a detailed overview of a broad set of structural policies, see Anderton, R., Benalal, N., Masuch, K. and Setzer, R. (eds.) (2018), “Structural policies in the euro area”, Occasional Paper Series, No 210, ECB. See also a recent European Commission study that finds that ambitious structural reforms could raise EU GDP by around 8% after 20 years, with substantially larger effects in countries with weaker fundamentals. See Pfeiffer, P., Varga, J. and in’t Veld, J. (2023), “Unleashing potential: model-based reform benchmarking for EU Member States”, Discussion Paper 192, European Commission.

See the European Parliamentary Research Service’s “Europe’s two trillion euro dividend: Mapping the Cost of Non-Europe, 2019-24” study from 2019.