Published as part of the Financial Stability Review, November 2023.

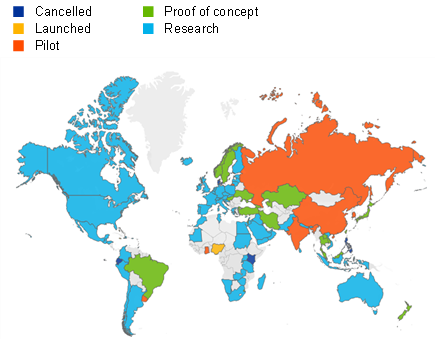

Central banks around the world have stepped up their efforts to explore and develop their own digital currencies (known as CBDCs),[1] an electronic equivalent to cash. New technologies in retail payments (e.g. mobile payments, digital wallets and the potential future deployment of crypto-asset payments) and changes in people’s payment habits have fuelled the interest of central banks in CBDCs. In the euro area, for example, the share of transactions for which cash was used as a means of payment declined from 79% to 59% between 2016 and 2022. At the same time, the coronavirus (COVID-19) pandemic, among other things, has accelerated the shift towards online shopping and digital payments (Chart A, panel a). In response, central banks are investigating the benefits and risks of CBDCs in complementing banknotes and coins, offering an additional means of payment in an increasingly digitalised economy (Chart A, panel b).

Chart A

The role of cash as a means of payment has been declining in the euro area over the last few years, while CBDC-related projects around the world are thriving

a) Share of transactions in the euro area, by means of payment | b) Retail CBDC status |

|---|---|

(percentages) | |

|  |

Sources: Panel a: ECB (SPACE). Panel b: cbdctracker.org.

Notes: Panel a: “Other” includes bank cheques, credit transfers, loyalty points, vouchers and gift cards, and other payment instruments. Percentages may not add up to 100% due to rounding. Panel b: retail CBDC refers to digital central bank money offered to the general public, while wholesale CBDC refers to the settlement of interbank transfers and related wholesale transactions in central bank reserves. The map shows the status of retail CBDC initiatives as of 1 September 2023.

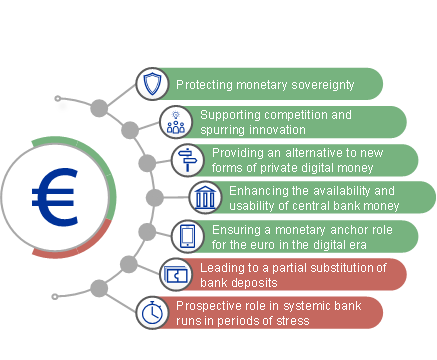

In the euro area, the introduction of a CBDC (“digital euro”) could offer several financial stability benefits by providing an alternative to new forms of private digital money and spurring innovation. Recent years have seen a significant increase in the number of non-European big-techs[2] active in the European payments landscape as well as a proliferation of crypto-assets and stablecoins.[3] A digital euro would help to preserve the role of public money as the anchor for the monetary system in the digital age and protect monetary sovereignty. The introduction of a digital euro could also stimulate innovation,[4] which may benefit banks and non-bank entities, and promote a more competitive, efficient and resilient financial system (Chart B, panel a).

Chart B

A digital euro could offer financial stability benefits but, if not properly designed, could also prompt financial stability risks

a) Digital euro benefits and risks | b) Simulated impact on key liquidity indicators |

|---|---|

(x-axis: deposit outflows, percentages; y-axis: liquidity indicators, percentages) | |

|  |

Sources: Panel b: ECB (supervisory data) and ECB calculations.

Notes: Panel b: simulated impact on key liquidity indicators in a scenario in which banks are willing to draw down their entire voluntary liquidity buffers up to the regulatory minimum (100% for the NSFR and the LCR) to meet the demand for digital euro. The simulation is based on Q1 2023 data. The liquidity indicators represent averages across 111 significant institutions, weighted by total assets. The 0% deposit outflow scenario represents the liquidity metrics in the absence of a digital euro. The other scenarios show how the conversion of household overnight deposits into digital euro, ranging between 5% and 30%, impacts the liquidity metrics: the blue and yellow bars. The green box indicates the range and upper bound of potential levels of household overnight deposit outflows in the event of a €3,000 holding limit per person.

At the same time, a CBDC, if not properly designed, could prompt financial stability risks and affect the structure and scale of bank intermediation. The introduction of a CBDC could lead to changes in the demand for bank deposits – typically a stable and relatively inexpensive form of bank funding – which would be partially substituted. The extent of bank deposit substitution would depend on the relative attractiveness of the digital euro and could, depending on the magnitude, have adverse consequences for banks’ liquidity, profitability and overall resilience. This, in turn, could affect the provision of a wide range of intermediation and financial services by the banking sector.[5]

In the absence of adequate holding limits, the materialisation of high deposit outflows could heighten liquidity risk for significant institutions. An analysis based on a constrained balance sheet optimisation model[6] suggests that liquidity risk for significant institutions might only become significant if 20% of the stock of overnight deposits were withdrawn from the banking system.[7] For key liquidity metrics such as the net stable funding ratio (NSFR) and the liquidity coverage ratio (LCR), the current level of voluntary buffers that significant institutions hold above the regulatory minimum would progressively decrease as deposit outflows became larger (Chart B, panel b).

However, the envisaged design of a digital euro would address financial stability concerns by applying adequate holding limits.[8] The cap on individual holdings would set an upper bound for the amount of digital euro in circulation and prevent the materialisation of high deposit outflows.[9] Recent studies show that setting a digital euro holding limit of €3,000 per person, as suggested by Bindseil and Panetta[10], would be effective in containing the impact on banks’ liquidity risks and funding structures. With such a limit in place, outflows of household overnight deposits from the euro area banking sector could only occur (up to a maximum of 15%) in the following highly unlikely circumstances: (i) if all euro area citizens adopted the digital euro simultaneously, and (ii) they all shifted bank deposits to the digital euro at the upper bound of the holding limit instantaneously and then held these on a continuous basis. However, the actual level of the individual holding limit would be calibrated closer to the possible introduction of a digital euro to reflect the economic conditions prevailing at that time.

Looking more broadly, recent experience has shown that digitalisation generally has the potential to speed up systemic bank runs in periods of stress in the absence of the necessary safeguards. An important lesson from the March 2023 events in the US banking sector was that bank runs can occur more swiftly in the digital era irrespective of any CBDC. That said, the introduction of a digital euro would not heighten the risk of idiosyncratic bank runs. A flight to safety towards a CBDC[11] or another commercial bank deemed safer would depend on customers’ risk appetites and preferences. To prevent a CBDC increasing the latent risk of systemic bank runs during periods of stress, however, all currently applicable financial stability, central bank and bank risk management limits and tools should remain in place should a digital euro be introduced.

A CBDC is a digital form of central bank money that would be available to the general public as a complement to banknotes and coins. The ECB is currently working with the euro area national central banks to investigate whether to introduce a CBDC in the euro area. For more information, see the digital euro page on the ECB’s website.

See, for example, Beck, T. et al., “Will video kill the radio star? Digitalisation and the future of banking”, Reports of the Advisory Scientific Committee, No 12, ESRB, 2022.

See, for example, the article entitled “Stablecoins’ role in crypto an beyond: functions, risks and policy”, Macroprudential Bulletin, ECB, July 2022, and the box entitled “The expanding uses and functions of stablecoins”, Financial Stability Review, ECB, November 2021.

For example, a CBDC has the potential to streamline payment processes and reduce transaction costs. Moreover, a CBDC could potentially enhance cross-border transactions by simplifying the settlement process.

The theoretical literature on the impact of introducing a CBDC leads to different conclusions, depending on the theoretical framework employed. For a review of the literature, see Ahnert, T. et al., “The economics of central bank digital currency”, Working Paper Series, No 2713, ECB, 2022.

A bank’s reaction to CBDC demand (deposit outflows) is simulated using a constrained balance sheet optimisation model in which a bank is expected to maximise profits, subject to some constraints. A bank sequentially (i) draws down its own reserves (until reserves-depleted or NSFR/LCR-constrained), (ii) obtains market funding (until liquidity or collateral-constrained), and (iii) obtains additional reserves from the central bank. For an overview of the model, see Meller, B. and Soons, O., “Know your (holding) limits: CBDC, financial stability and central bank reliance”, Occasional Paper Series, No 326, ECB, 2023.

The results presented hinge on the level of reserves available in the system. All things being equal, a lower level of reserves would imply that banks would have to rely more on the interbank market or central bank funding to accommodate the same level of deposit outflows.

See “A stocktake on the digital euro: Summary report on the investigation phase and outlook on the next phase”, ECB, 2023.

Business users would have a zero holding limit, meaning that they would not be able to accumulate holdings of digital euro, but they would be able to make specific types of payments. Similarly, governments and public authorities would be able to conduct transactions in digital euro without holding any digital euros in their wallets.

See Bindseil, U. and Panetta, F., “Central bank digital currency remuneration in a world with low or negative nominal interest rates”, VoxEU, Centre for Economic Policy Research, 5 October 2020.

This is not expected to occur thanks to the lines of defence currently in place, including effective banking regulation and supervision, deposit insurance and the central bank’s role as lender of last resort.