Published as part of the Financial Stability Review, November 2023.

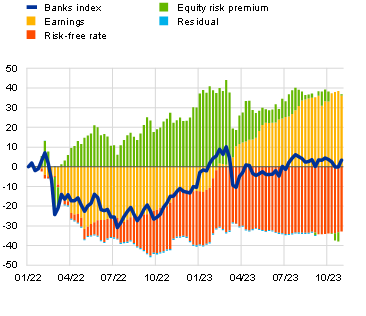

Euro area bank earnings have reached multi-year highs, while bank equity valuations have not substantially exceeded pre-pandemic levels. Between March 2022 and the end of the year, the share prices of euro area banks increased by 18% from the lows they reached after the start of Russia’s unjustified war against Ukraine, as earnings expectations recovered from the initial shock. The negative impact of higher risk-free rates on the net present value of future dividends paid by banks was broadly offset by reduced uncertainty about the prospects of the sector, as measured by the equity risk premium (Chart A, panel a). However, the equity risk premium widened abruptly in March 2023 during the banking tensions in the United States and Switzerland and continued to widen even when the tensions had abated. Taken together with increasing bank profitability, this pattern indicates increased uncertainty about the long-run sustainability of bank earnings. Bank equity risk premia have continued to weigh on valuations since the spring tensions. The aim of this box is to shed light on the cost of equity (COE) and market valuations in the banking sector and to reach a better understanding of the role of bank fundamentals in this context.[1]

Chart A

Bank valuations face headwinds from greater uncertainty, higher risk-free rates and credit risk

a) Estimated contribution of fundamental factors to changes in euro area bank share prices | b) Cumulative change in bank COE since end-2021, by risk factor |

|---|---|

(1 Jan. 2022-3 Nov. 2023, percentage points) | (Q1 2022-Q3 2023, percentage points) |

|  |

Sources: LSEG, Kenneth French’s data library and ECB calculations.

Notes: Panel a: based on a dividend discount model using COE, which includes a risk-free rate and an equity risk premium, as a discount factor. For details, see Fuller and Hsia*. A lower equity risk premium implies a positive contribution to share prices. Panel b: COE is not directly observable. The chart presents a decomposition of its estimates based on two orthogonalised factor models: one based on market factors and the other on Fama-French factors; see Altavilla et al.** The risk-free rate is the one-year overnight index swap rate. The market risk factor is the return on a market equity portfolio. Corporate credit and sovereign risks are captured using returns on indices covering BBB-rated corporate bonds and lower-rated euro area sovereign bonds. The HML factor represents the difference between returns on value stocks and growth stocks. The SMB factor represents the difference between returns on small cap equities and large cap equities. Factor models employ time-varying beta estimates but static risk premia. The contributions of individual factors represent quarterly averages of weekly data. HML stands for high minus low; SMB stands for small minus big.

*) Fuller, R. and Hsia, C., “A simplified common stock valuation model”, Financial Analysts Journal, No 40, 1984, pp. 49-56.

**) Altavilla, C., Bochmann, P., De Ryck, J., Dumitru, A., Grodzicki, M., Kick, H., Melo Fernandes, C., Mosthaf, J., O’Donnell, C. and Palligkinis, S., “Measuring the cost of equity of euro area banks”, Occasional Paper Series, No 254, ECB, 2021.

Banks’ exposure to corporate credit risk and the perception of their stocks as value stocks have contributed to the stagnant valuations of the banking sector in 2023. Factor models of time-varying COE make it easier to understand the drivers of change in banks’ equity risk premia. These models confirm that a large part of the overall increase in the COE can be attributed to the mechanical effects of higher risk-free rates. However, they also reveal concerns about banks’ exposure to credit risk, which have depressed bank valuations since the end of 2022 (Chart A, panel b). Bank valuations have also come under pressure due to their exposure to a factor capturing risks associated with value stocks. While banks are attractive because of the steady dividend income they do not offer any growth opportunities.[2]

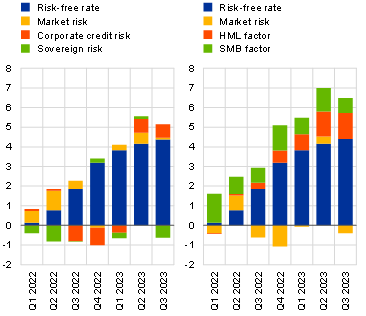

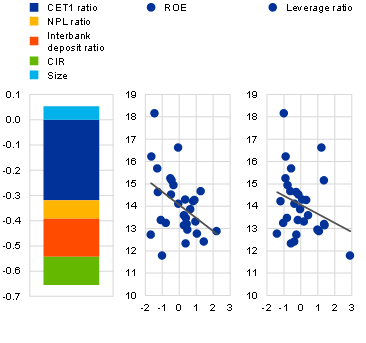

Chart B

Fundamentals, distribution policies and taxation affect the attractiveness of bank stocks to investors

a) Relationship between bank fundamentals and COE | b) Sensitivity of bank valuations to changes in profits, taxation and distribution policy |

|---|---|

(left graph: change in COE attributed to bank-specific factors since 2022, contributions in percentage points; middle and right graphs: Q2 2023, x-axis: normalised financial ratios, multiples of standard deviation; y-axis: COE, percentages) | (price-to-book ratio: percentages; effects: percentage points) |

|  |

Sources: ECB (supervisory data) and ECB calculations.

Notes: Panel a: left graph based on Altavilla et al.* using a regression approach to explain changes in COE with bank-specific fundamental factors. This approach is complementary to the factor model analysis presented in Chart A, panel b. CIR stands for cost/income ratio. Interbank deposit ratio is calculated as the ratio of interbank deposits to total assets and is used as a proxy for reliance on unstable funding. Middle and right graphs: bank fundamental variables are standardised to facilitate comparability. Bank-level COE based on Altavilla et al.* Panel b: sensitivities are estimated using a dividend discount model for a representative euro area bank assumed to earn a return on equity of 15% (before tax), pay a 25% tax rate and distribute 50% of net profits after tax and Additional Tier 1 coupons to investors. Assumed changes to these parameters correspond to about one-fifth of the observed input parameters.

*) Altavilla, C. et al., “Measuring the cost of equity of euro area banks”, Occasional Paper Series, No 254, ECB, 2021.

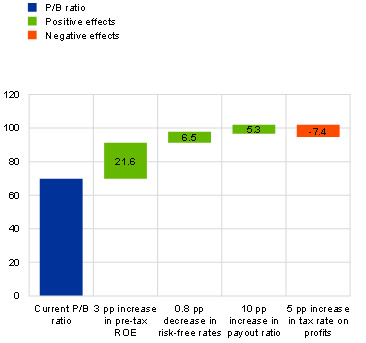

Stagnant bank valuations cannot be fully explained by the fundamentals but may also be due to heightened uncertainty about shareholder access to returns earned by banks. There is empirical evidence that a lower COE is associated with lower leverage, better cost-efficiency and better asset quality.[3] Based on a cross-section of listed euro area banks, these patterns continue to hold. Improving fundamentals are estimated to have reduced the COE by about 0.6 percentage points in 2022 (Chart B, panel a). A sensitivity analysis of the bank price-to-book ratio shows that other factors beyond profitability and capital, such as distribution policies and taxation of profits, can have a large impact on bank valuations. As banks have limited growth opportunities to earn returns commensurate with their COE, distributing a higher share of profits to investors leads to improved valuations. Conversely, the risk of the dividend income stream being taxed affects valuations more strongly relative to growth stocks, which reinvest cash flows internally and are expected to return them to investors in the more distant future (Chart B, panel b).

Weak bank stock valuations and a high COE increase the cost of lending to the real economy and make it harder for banks to raise capital. Uncertainty about the outlook for bank profits and asset quality, coupled with concerns about the sustainability of dividend payouts following announcements of higher bank taxes, is contributing to the stagnant valuations and persistently high equity risk premia observed in the euro area banking sector. In the long run, this may adversely affect financial stability as banks which are valued by investors at a discount will likely find it more challenging to raise new equity when needed. As capital required to support lending is remunerated by lending rates, weak valuations translate directly into stricter terms and conditions for finance to the real economy.

Banks’ market valuations are driven by changes in their return on equity and COE, among other things. If the price-to-book ratio – defined as a bank’s market capitalisation divided by the accounting value of its equity – is higher (lower) than 1, this means that its return on equity is higher (lower) than its COE. All else equal, a higher COE implies a lower valuation.

This can be inferred from the increased positive contribution of the Fama-French HML factor, which represents the excess returns on value stocks compared with growth stocks.

See, for example, Altavilla, C., Bochmann, P., De Ryck, J., Dumitru, A., Grodzicki, M., Kick, H., Melo Fernandes, C., Mosthaf, J., O’Donnell, C. and Palligkinis, S., “Measuring the cost of equity of euro area banks”, Occasional Paper Series, No 254, ECB, 2021; the special feature entitled “Common equity capital, banks’ riskiness and required return on equity”, Financial Stability Review, ECB, December 2011; and Bogdanova, B., Fender, I. and Takáts, E., “The ABCs of bank PBRs”, BIS Quarterly Review, Bank for International Settlements, March 2018.