Foreword

This spring saw considerable financial turbulence, with the spotlight increasingly turning on systemic risk concerns following a series of bank failures outside the euro area. While the fallout experienced by euro area banks was limited, these events have served as a powerful reminder of the importance of ensuring that banking system fundamentals are sound, in an environment where financial conditions are being tightened to tackle elevated inflation around the world.

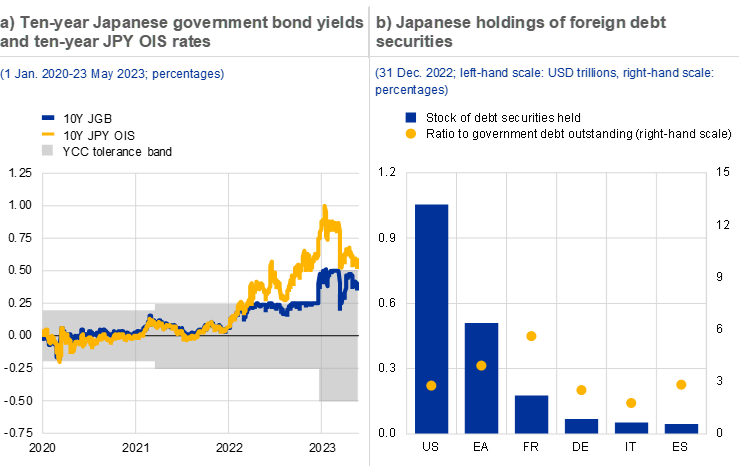

Price stability remains as crucial as ever for durably preserving financial stability. Tighter financing conditions to forcefully address high inflation have contributed to a reappraisal of the economic outlook and to a reversal of overly-compressed asset price risk premia. As financial conditions normalise, this may expose fragilities and fault lines in the financial system. Non-bank financial intermediaries remain heavily exposed to a turning financial cycle, despite ongoing de-risking. Such turning is becoming increasingly evident in the real estate sector – in both commercial property markets, where a clear downturn is visible, and their residential counterparts, which are showing signs of correction after several years of expansion. In all of these challenges, the resilience of euro area banks has been noteworthy, but should not give way to complacency.

Recent stresses in the US and Swiss banking sectors have served as a timely reminder of just how much the preservation of financial stability depends on the shock-absorption capacity of the financial system. This is especially true for banks, which operate at the core of the system. The resilience of euro area banks is largely attributable to the strength of their capital and liquidity buffers, under stringent regulatory and supervisory oversight. Strengthening the banking union – and notably making progress on a common European deposit insurance scheme – will reinforce the ability of the euro area financial system to withstand risks going forward.

Beyond the overview of key financial stability vulnerabilities in the euro area, this issue of the Financial Stability Review (FSR) includes three special features. The first examines how interactions in market and funding liquidity can amplify stress in the financial system. The second investigates the channels through which stress in non-bank financial institutions could propagate to euro area banks. The third furthers work on identifying potential threats from climate change, with a primer on associated risks for sovereigns.

This issue of the FSR has been prepared with the involvement of the ESCB Financial Stability Committee, which assists the decision-making bodies of the ECB in the fulfilment of their tasks. The FSR promotes awareness of systemic risks among policymakers, the financial industry and the public at large, with the ultimate goal of promoting financial stability.

Luis de Guindos

Vice-President of the European Central Bank

Overview

Euro area financial stability outlook remains fragile

Euro area financial stability vulnerabilities remain elevated in the context of unexpected stress in the banking sectors of some mature economies. The recent failures of a number of US regional banks and the takeover of a Swiss bank have invited closer scrutiny of bank exposure to long-term fixed income securities, the stability of wholesale uninsured deposit funding and latent business model challenges. While the immediate cause of bank stress was related to idiosyncratic bank fragility in non-euro area economies, the episode prompted more general concerns about bank resilience in an environment of higher interest rates. This led to tensions in the bank equity and funding markets in the euro area. These tensions were short-lived, as euro area bank fundamentals remain solid and prompt regulatory intervention has contained spillovers from other economies. Nevertheless, it is possible that these events could lead to a reassessment of the profitability and liquidity outlooks for euro area banks.

Chart 1

The financial stability outlook remains fragile, with weak macroeconomic growth and a flare-up of systemic stress

Sources: Consensus Economics, Bloomberg Finance L.P., ECB and ECB calculations.

Notes: Panel a: HICP stands for Harmonised Index of Consumer Prices; CPI stands for consumer price index. Panel b: “Probability of default of two or more LCBGs” refers to the probability of simultaneous defaults in the sample of 15 large and complex banking groups (LCBGs) over a one-year horizon. The composite indicators of systemic stress in financial markets and sovereign bond markets are contemporaneous indicators. To find out more about the composite indicator of systemic stress in financial markets, see Holló et al.* For details on the composite indicator of systemic stress in euro area sovereign bond markets, see Garcia-de-Andoain and Kremer.**

*) Holló, D., Kremer, M. and Lo Duca, M., “CISS – a composite indicator of systemic stress in the financial system”, Working Paper Series, No 1426, ECB, March 2012.

**) Garcia-de-Andoain, C. and Kremer, M., “Beyond spreads: measuring sovereign market stress in the euro area”, Working Paper Series, No 2185, ECB, October 2018.

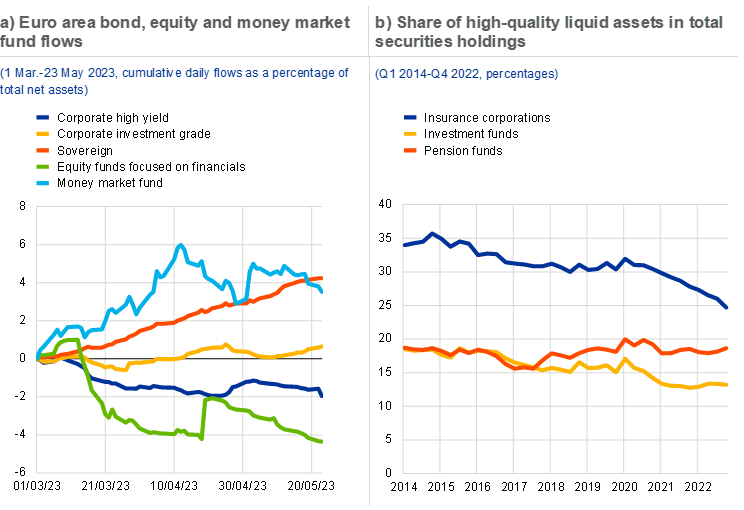

Despite some improvement seen at the turn of the year, weak macro-financial prospects continue to pose a challenge to financial and non-financial sectors alike. Macro-financial conditions have improved slightly since the publication of the previous Financial Stability Review (Chart 1, panel a), thanks to a robust post-pandemic recovery, fading global supply chain disruptions and lower energy prices. That said, the outlook remains highly uncertain, given the presence of downside risks to growth accompanied by persistent inflationary pressures. Also, near-term financial stress indicators have picked up again (Chart 1, panel b) in the context of stress in the banking sectors of some mature economies, although they remain below pandemic and war-related levels. At the same time, there are still structural vulnerabilities in the non-bank financial intermediation (NBFI) sector in the form of liquidity mismatch and leverage. High volatility and signs of lower market liquidity are rendering financial markets and the NBFI sector prone to adverse dynamics such as forced asset sales and are increasing the likelihood of credit events materialising. Such amplification effects could tighten broader credit conditions more strongly than expected with regard to both the cost and the availability of credit, and could dampen confidence, potentially weakening the resilience of the non-financial sectors.

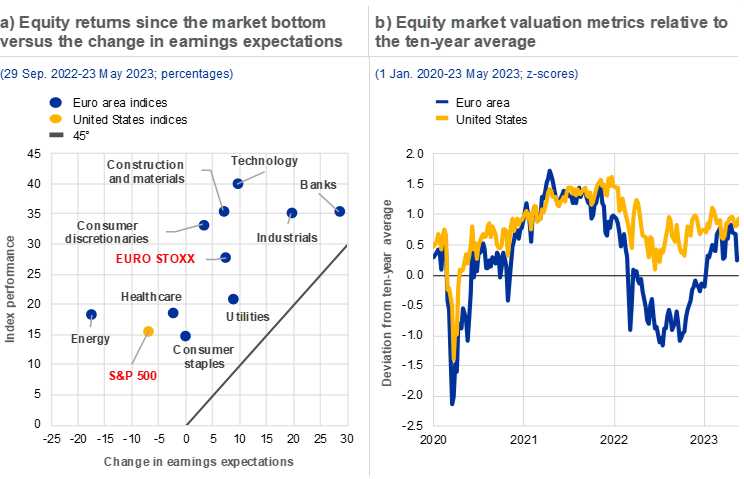

Financial markets and non-bank financial intermediaries remain vulnerable to disorderly adjustments

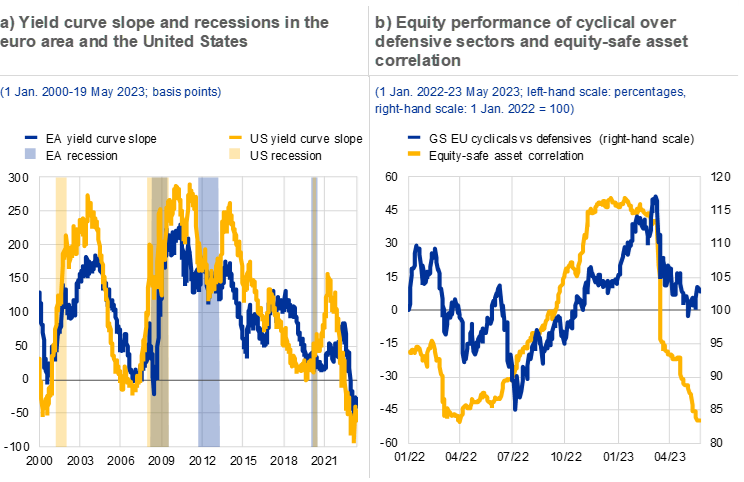

Following the rally in financial markets seen at the turn of the year, stresses in some mature economy banking sectors triggered price adjustments. Global financial markets saw an unusually robust start to 2023, driven by optimistic macroeconomic expectations predicated on the resilience of the euro area economy at the turn of the year, the faster than expected reopening of the Chinese economy and a sharp drop in energy prices. Solid corporate financial results, alongside lower volatility in interest rate markets, pushed euro area equity valuations back above historical averages (Chapter 2). The positive risk sentiment started to fade in February, following the more hawkish tone adopted by central banks globally. It reversed more abruptly in March, as unexpected stress in the US and Swiss banking sectors sent shockwaves through global financial markets.

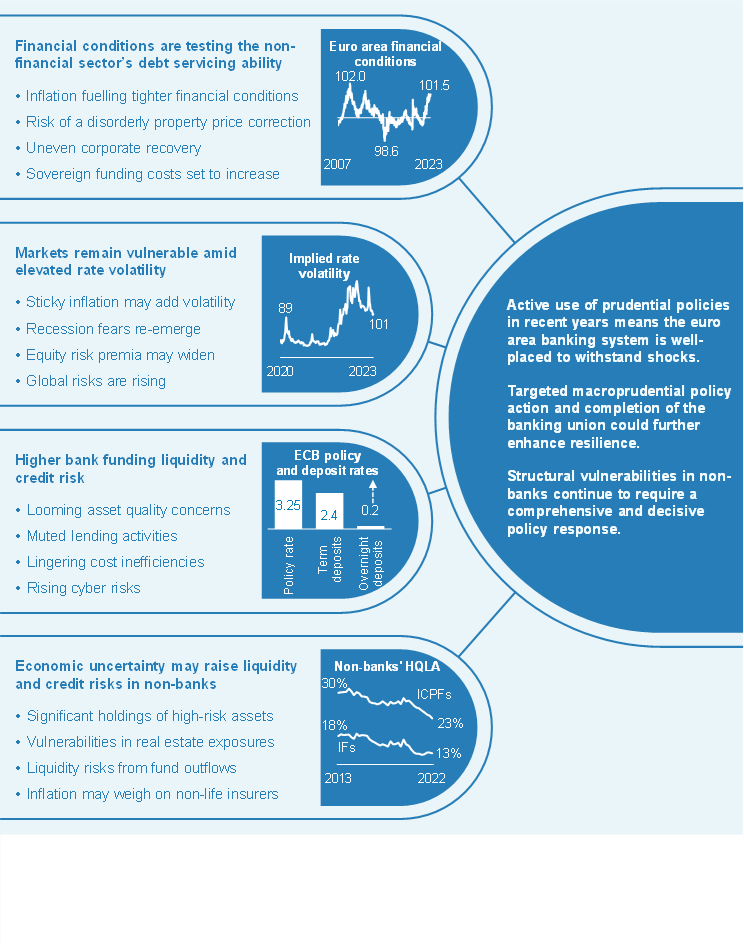

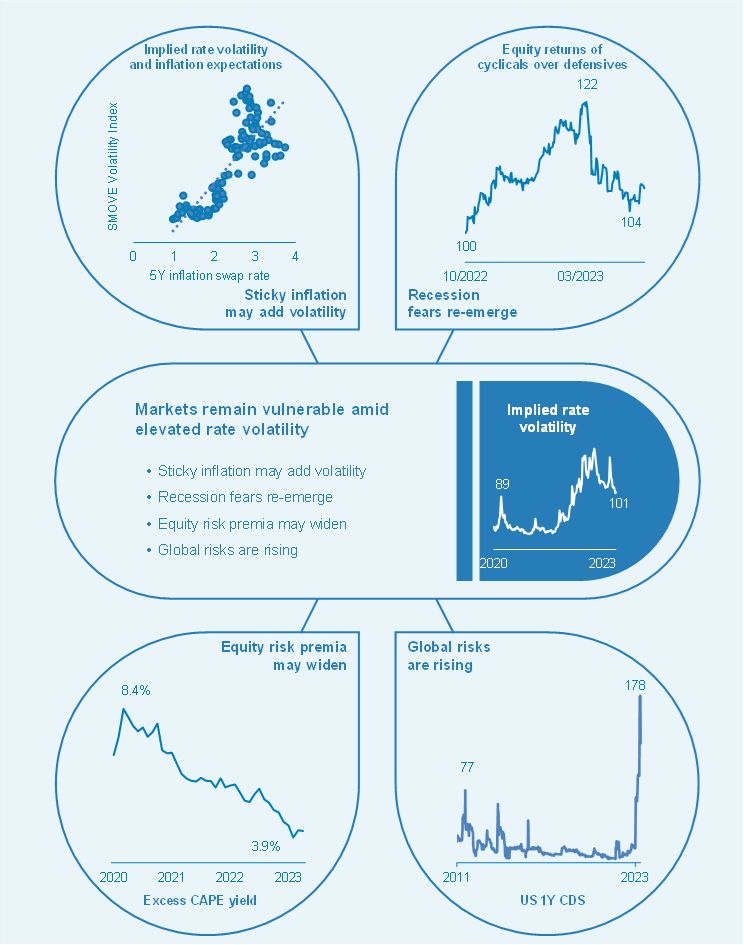

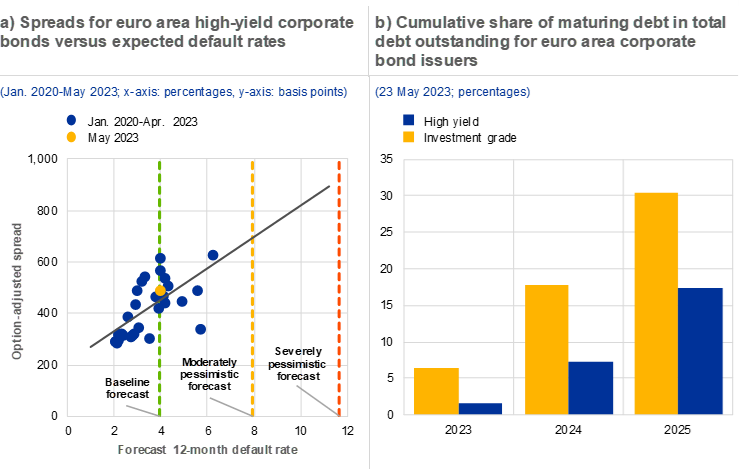

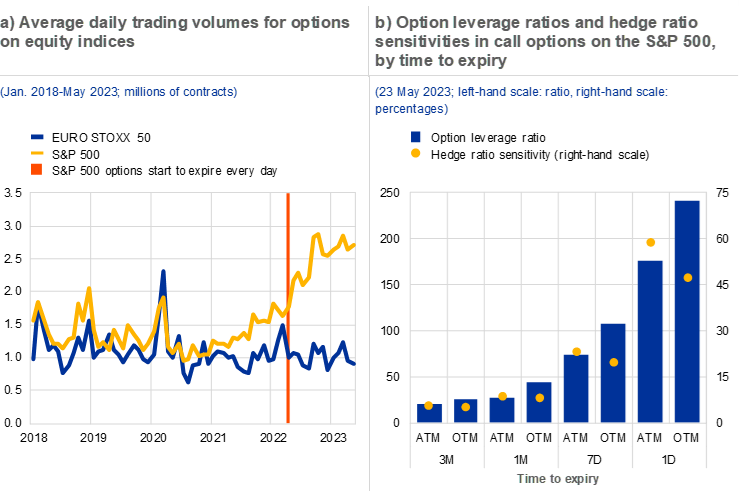

The potential for disorderly adjustments in financial markets has risen in the context of tighter financial conditions and lower market liquidity. Renewed recession concerns in the aftermath of the banking sector stress in the United States and Switzerland have significantly lowered market-based policy rate expectations. Financial conditions have tightened as the market turmoil has led to a widening of credit risk premia in the euro area. By contrast, the fact that equity risk premia remain compressed in absolute and relative terms, especially in the United States (Chart 2, panel a), raises concerns over potential overvaluation. Equities may thus be more vulnerable to a disorderly price correction in the event of a further deterioration in the economic outlook (Chapter 2). As such, risk sentiment remains fragile and is highly sensitive to surprises as regards the outlook for inflation, growth and monetary policy in mature economies. More persistent inflationary pressures might require more significant monetary policy responses from major central banks than market participants currently expect. Among other things, a renewed surge in energy prices could also pose upside risks to inflation and could add to already-elevated volatility in interest rate markets (Chart 2, panel b). The combination of a tighter monetary policy environment and recession fears could put pressure on the valuations of riskier assets. At the same time, elevated volatility in interest rate markets has contributed to a substantial decline in market liquidity in both corporate and sovereign bond markets, leaving them more vulnerable to adverse dynamics (Chart 2, panel c and Special Feature A).

Chart 2

The risk of disorderly adjustments in financial markets remains high in an environment of high volatility and low market liquidity

Sources: Bloomberg Finance L.P. and ECB calculations.

Notes: Panel a: equity risk premia are calculated as the five-year CAPE yield for the EURO STOXX (euro area) and S&P 500 (United States) less the five-year real (inflation swap-adjusted) government bond yield (German for the euro area); credit risk premia are calculated as the option-adjusted spread for BBB-rated corporate bonds with a residual maturity of 5-7 years. “Current” refers to the date 23 May 2023. Panel b: SMOVE is the Merrill Lynch 1M EUR Swaption Volatility Estimate Index; MOVE is the Merrill Lynch 1M UST Option Volatility Estimate Index. Panel c: for methodological details please, see Special Feature A in this issue of the Financial Stability Review

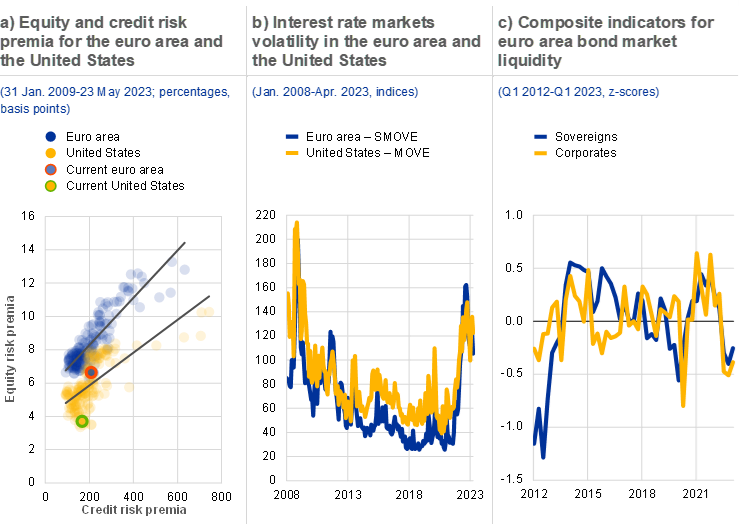

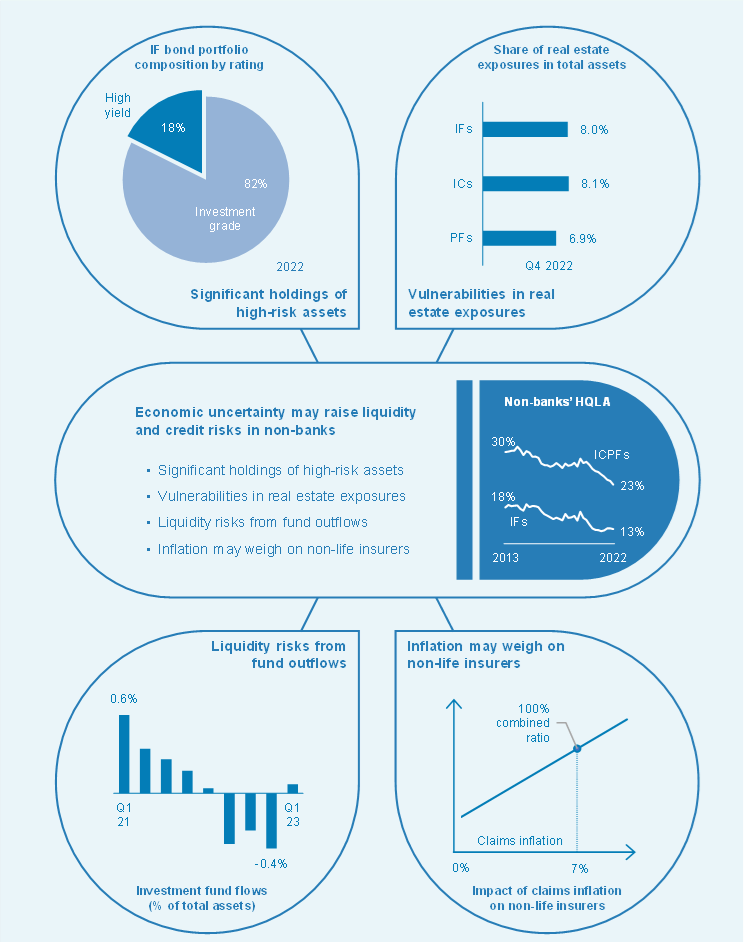

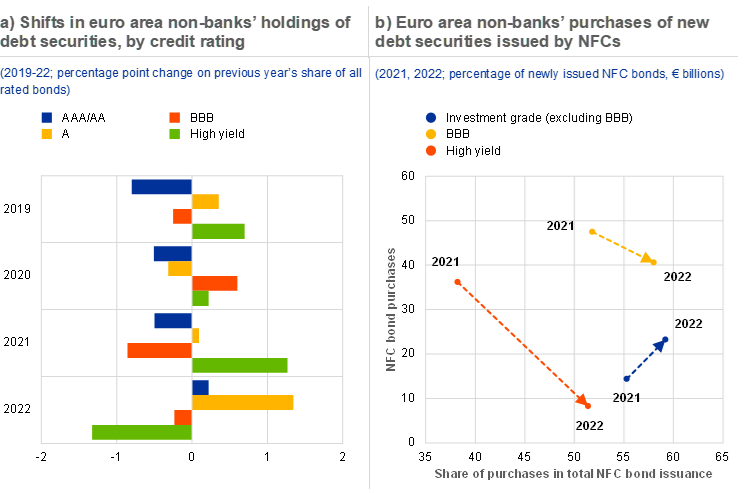

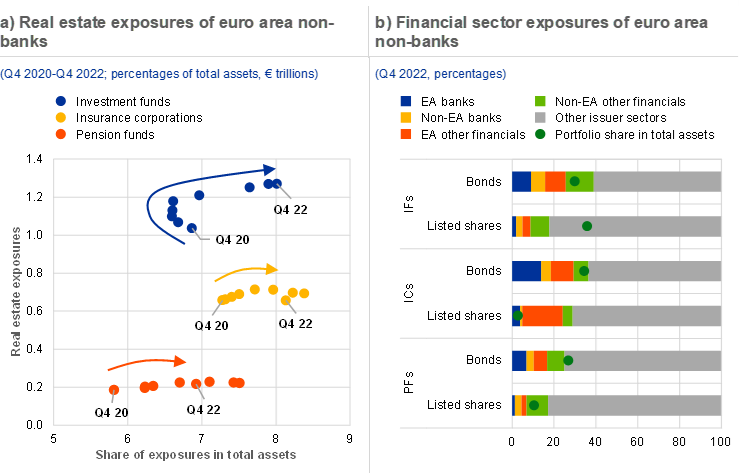

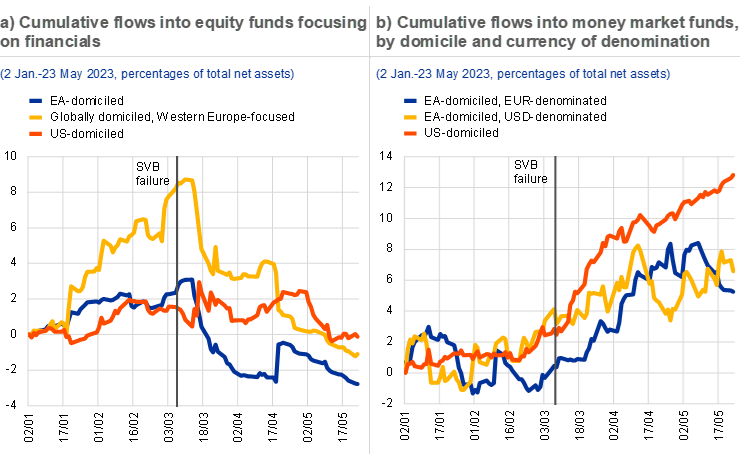

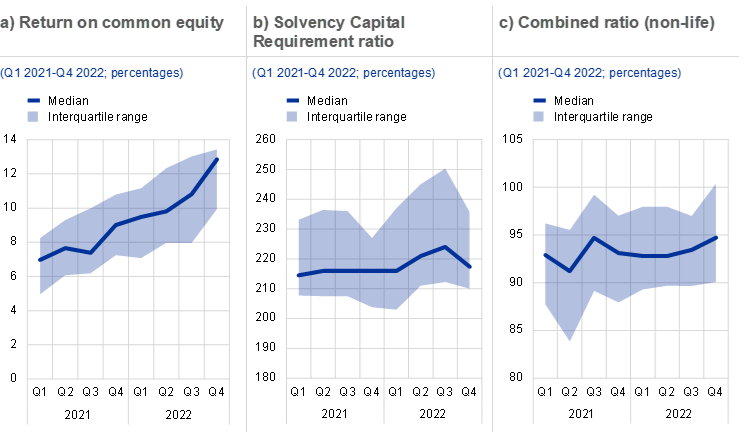

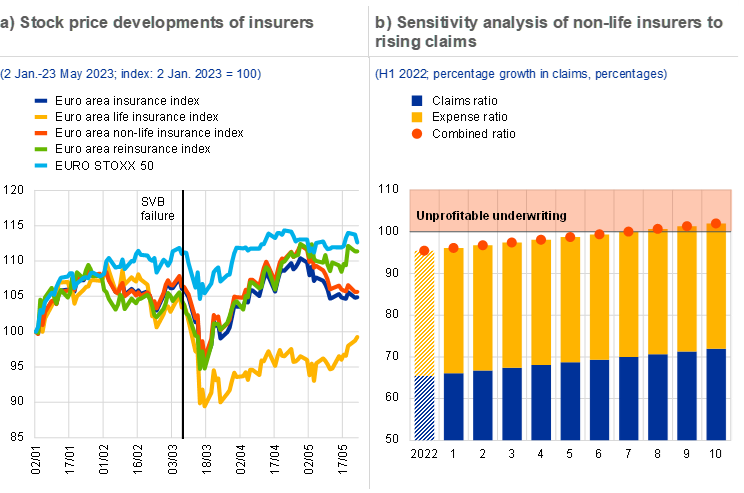

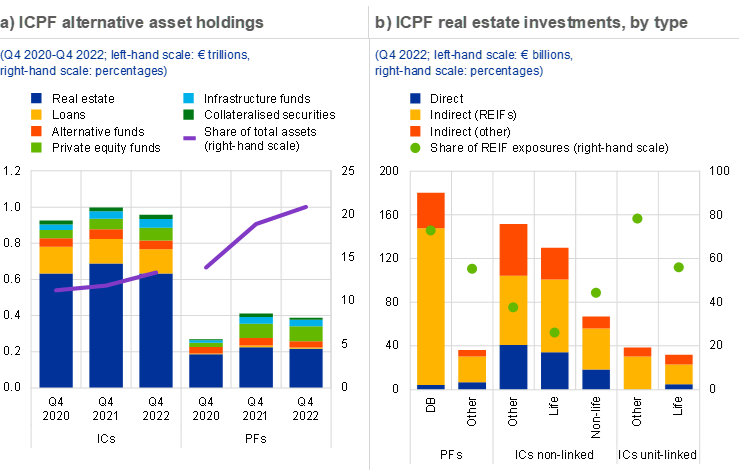

The non-bank financial sector has remained resilient during the recent banking sector stresses and market volatility, but liquidity and credit risks remain high. The highly volatile market conditions which followed the flare-up of banking sector stress in the United States and Switzerland resulted in funds which invest in European and US financials, as well as those exposed to riskier assets such as high-yield corporates, facing significant investor outflows after early March. At the same time, inflows into sovereign bond funds and money market funds accelerated (Chart 3, panel a), reflecting safe haven flows in an environment of elevated macro-financial uncertainty as well as higher rates offered compared with bank deposits. Shifts by investors towards safer fund types served to reduce aggregate credit risk in the sector (Section 4.2). Portfolio de-risking has also been evident on the balance sheets of insurance corporations and pension funds, as higher interest rates have reduced the incentives for the non-bank financial sector to search for yield. That said, overall exposures to credit risk remain high, exposing the non-bank financial sector to the risk of material losses should corporate sector fundamentals deteriorate substantially. In addition, non-banks’ exposure to property markets has increased markedly in recent years, rendering institutions vulnerable to ongoing property price corrections (Section 4.1 and Box 2). Strong links with banks, as an important source of funding for instance, could also give rise to additional vulnerabilities in the banking sector via liquidity and credit risk spillovers (Special Feature B).

Low liquid asset holdings and potential margin calls could pose the risk of possible forced asset sales, calling for enhanced liquidity preparedness. While increasing slightly in 2022, the share of high-quality liquid assets in investment funds’ securities holdings remains relatively low (Chart 3, panel b). As such, the risk remains high that, if they were to experience any sudden liquidity needs, funds could amplify adverse market dynamics via procyclical selling behaviour and forced asset sales, thereby introducing risks to wider financial stability. It is therefore necessary to strengthen existing regulatory frameworks and address issues related to structural liquidity mismatches in funds. Past stress events, such as the turmoil in March 2020 and the UK gilt market stress in the autumn of 2022, also vividly illustrate how non-banks can amplify margin call dynamics in the wider financial system, especially when coupled with excessive leverage. This highlights the importance of enhancing liquidity preparedness in the non-bank financial sector (Box 7).

Chart 3

Despite ongoing portfolio de-risking, liquidity and credit risks in the non-bank financial sector remain high in a volatile market environment

Sources: ECB, EPFR Global and ECB calculations.

Note: Panel b: high-quality liquid assets include debt securities, listed shares and investment fund shares that correspond to Level 1, Level 2A or Level 2B securities according to Commission Delegated Regulation (EU) 2015/61*, which defines liquidity requirements for banks. Shares are calculated based on market values relative to all debt securities, listed shares and investment fund shares held in the respective non-bank financial sector.

*) Commission Delegated Regulation (EU) 2015/61 of 10 October 2014 to supplement Regulation (EU) No 575/2013 of the European Parliament and the Council with regard to liquidity coverage requirement for Credit Institutions Text with EEA relevance (OJ L 11, 17.1.2015, p. 1).

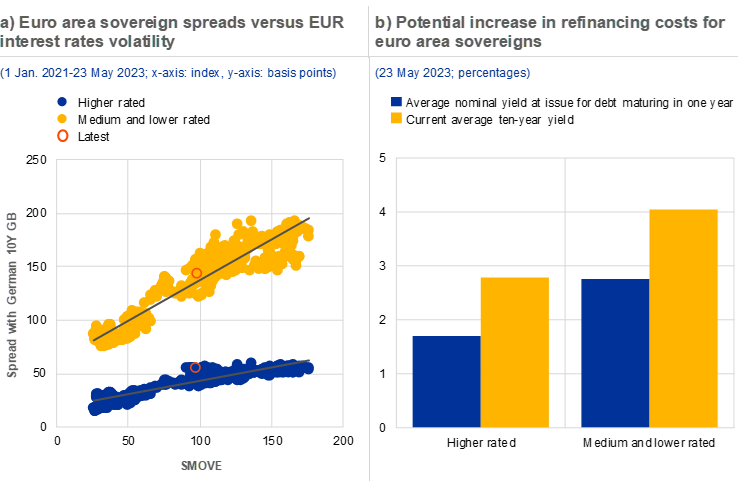

Tighter financial conditions are testing corporate, household and sovereign resilience

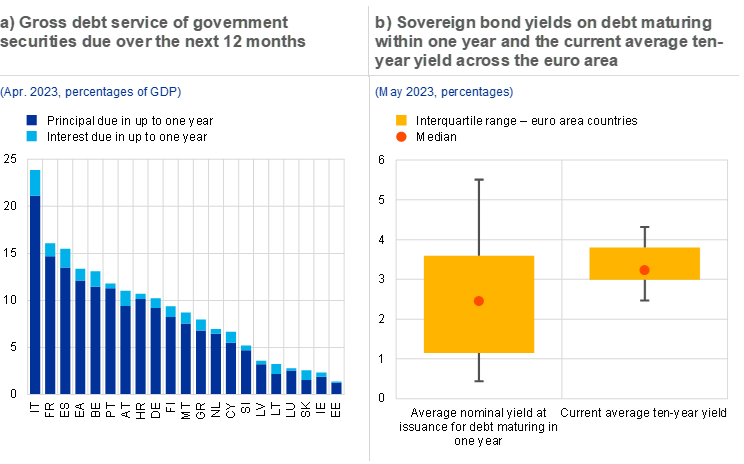

Sovereign vulnerabilities have remained elevated in a context of tightening financial conditions and weak macro-financial prospects. The pressures on public finances have eased in recent months, as the big drop in energy prices has reduced the need for additional energy-related fiscal support to be provided to corporates and households. But fiscal fundamentals remain fragile in some countries given their high debt levels, rising funding costs and high short-term refinancing needs (Chart 4, panel a). Vulnerabilities associated with potential abrupt shifts in market sentiment remain contained for now, as in recent years many sovereigns have locked in cheap financing at longer maturities. In addition, the ECB’s Transmission Protection Instrument is able to counter any unwarranted and disorderly sovereign debt market dynamics that may pose a serious threat to the transmission of monetary policy across the euro area. Foreign investors can also play a stabilising role when spreads between sovereigns become elevated, as they increase their exposures towards euro area government bond markets (Box 3). That said, interest payments are expected to increase gradually going forward, as maturing public debt is rolled over at higher interest rates (Chart 4, panel b).

Chart 4

Interest payments are set to rise gradually as maturing public debt is rolled over at higher interest rates, in particular in countries with high short-term refinancing needs

Sources: Bloomberg Finance L.P., ECB and ECB calculations.

Notes: Panel a: sovereign debt service covers all securities instruments at all original maturities with residual maturity of less than one year. Data only reflect existing maturing securities (principal and interest). Panel b: yields are averaged for the notional amount of the maturing debt.

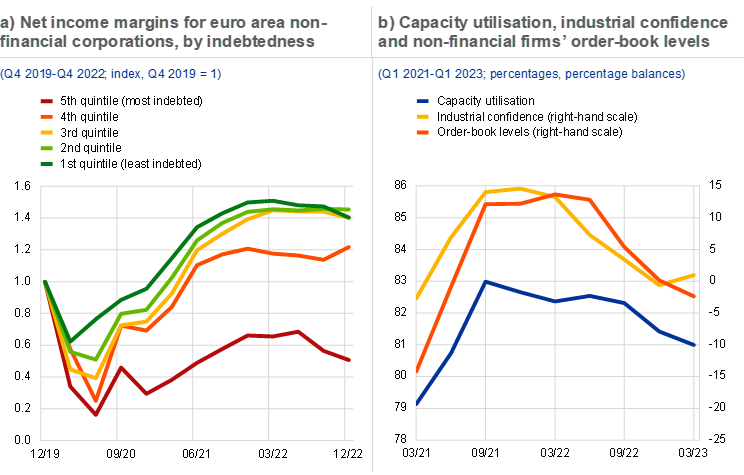

Euro area firms have benefited from high profits in the context of a sharp post-pandemic recovery and lower energy prices, but rising costs are weighing on prospects. Higher revenues and profit margins have both contributed significantly to upbeat corporate financial results. In fact, many firms have been able to raise their profit margins in sectors facing constrained supply and resurgent demand, contributing to higher wage demands and, by extension, upside risks to inflation. That said, not all firms have benefited equally from the recovery. Highly indebted, energy-intensive and/or pandemic-sensitive sectors have often been unable to increase profit margins (Chart 5, panel a), with some heterogeneity across countries. At the same time, euro area firms are facing challenges from higher refinancing costs (Box 1). There are also signs of corporates switching from market-based financing to bank loans (Box 6), given the faster pass-through of policy rate increases to investment grade corporate bond yields. Looking ahead, a combination of higher financing costs and highly uncertain business prospects will weigh on the corporate sector outlook (Chart 5, panel b). In particular, a sharper economic slowdown than currently anticipated, together with a disorderly tightening of financing conditions, could prove particularly challenging for those firms that exited the pandemic with higher debt levels, subdued earnings and low interest coverage ratios. Small and medium-sized enterprises may be particularly vulnerable to a slowdown in economic activity and higher borrowing costs, as they have benefited less from the economic recovery (Section 1.3).

Chart 5

Euro area corporates are benefiting from high profit margins, but tighter financial conditions and uncertain business prospects could prove a challenge going forward

Sources: S&P Global Market Intelligence, Bloomberg Finance L.P., European Commission, ECB and ECB calculations.

Notes: Panel a: a fixed sample of 1,099 euro area non-financial corporations with total assets in excess of €50 million as at Q4 2022. Indebtedness is based on pre-pandemic debt levels (Q4 2019).

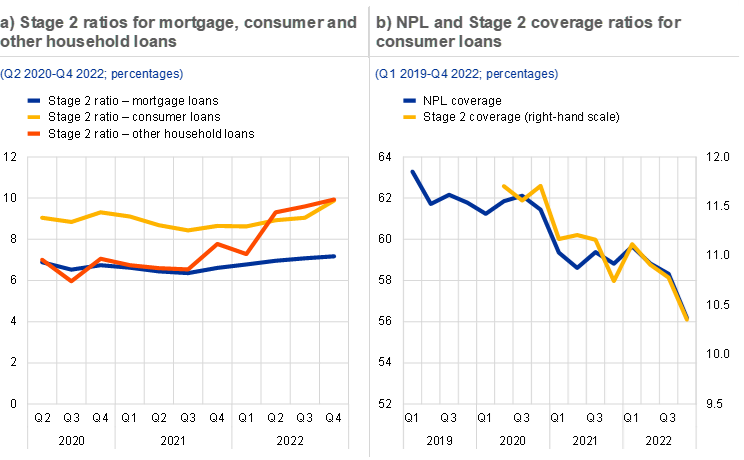

In recent months, euro area households have benefited from lower energy prices and a resilient labour market, but higher interest rates are increasingly weighing on credit dynamics. Household confidence has recovered to some extent in recent months, in line with the marked drop in energy prices and the associated lower headline inflation outturns (Section 1.4). But households’ real incomes and consumption remain under pressure from persistently high inflation, especially for lower income buckets. The real income squeeze, coupled with higher interest rates, is increasingly compromising households’ debt servicing capacity, particularly in the consumer loan segment. On a positive note, resilient labour markets have so far supported incomes, and the shift towards more fixed-rate mortgage lending in recent years has shielded many households from the immediate impact of higher interest rates. The use of borrower-based macroprudential measures in most euro area countries in recent years has also helped to limit the build-up of risks. That said, vulnerabilities could resurface, should labour market conditions deteriorate or energy prices rise again.

The euro area property market cycle is turning, as higher interest rates weigh on affordability

The euro area residential real estate cycle has shifted into correction mode, compounding the vulnerabilities of euro area households. Euro area residential real estate markets cooled markedly in the second half of 2022. The easing of residential property price inflation is apparent in most euro area countries, in particular those (notably Germany) which were less affected during previous crises (Chart 6, panel a). Orderly price corrections might be warranted, as overvaluation measures have been signalling the potential for corrections in recent years. That said, looking ahead, a fall in prices could become disorderly as rising interest rates on new mortgage lending increasingly compromise affordability and increase the interest burden on existing mortgages, especially in countries where variable-rate mortgages predominate. This is also indicated by the record high number of banks– even more than during the global financial crisis – reporting a decline in the demand for mortgages in the first quarter of 2023. At the same time, euro area banks have tightened credit standards for mortgage loans considerably, against a backdrop of rising interest rates and deteriorating housing market prospects. The pace of prices falling could be further amplified in countries and regions where the presence of institutional investors is strong (Box 2).

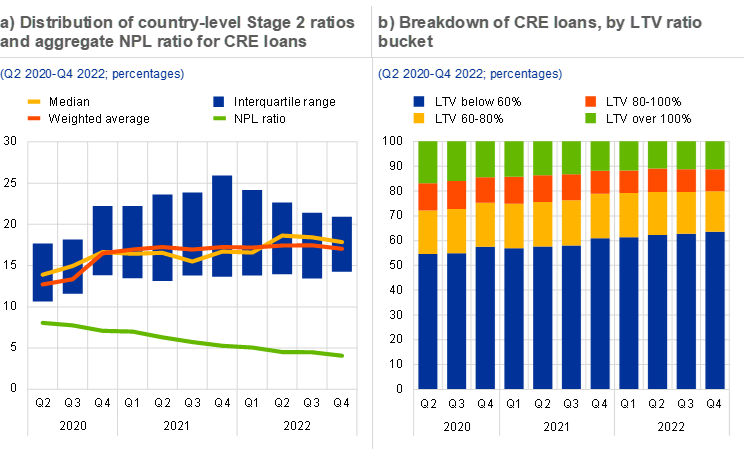

Euro area commercial real estate (CRE) markets remain in a clear downturn. In an environment of tighter financing conditions and elevated macro-financial uncertainty, CRE valuations have continued to decline sharply. Demand has dropped significantly across both the office and the retail segments, with overall transaction volumes declining at a pace similar to that observed during the global financial crisis (Chart 6, panel b). The challenges associated with the current uncertain market environment are amplified by pandemic-induced structural changes, particularly in markets for lower quality assets where tenant demand has weakened since the pandemic (Section 1.5). While bankruptcies among CRE-exposed non-financial firms remain low, an even more pronounced adjustment in CRE markets could expose structural vulnerabilities in some open-ended property funds, increase credit risk for lenders and lower collateral values.

Chart 6

Higher interest rates and lower affordability have brought about a synchronous correction in residential and commercial property markets

Sources: ECB and ECB calculations.

Notes: Panel a: the countries most affected by previous crises (i.e. the global financial crisis and the euro area sovereign debt crisis) are Ireland, Greece, Spain, Italy, Cyprus, Portugal and Slovenia. Panel b: transaction volumes are based on the four-quarter moving average of the underlying total number of transactions.

Euro area banks have proven resilient to bouts of bank stress in some advanced economies

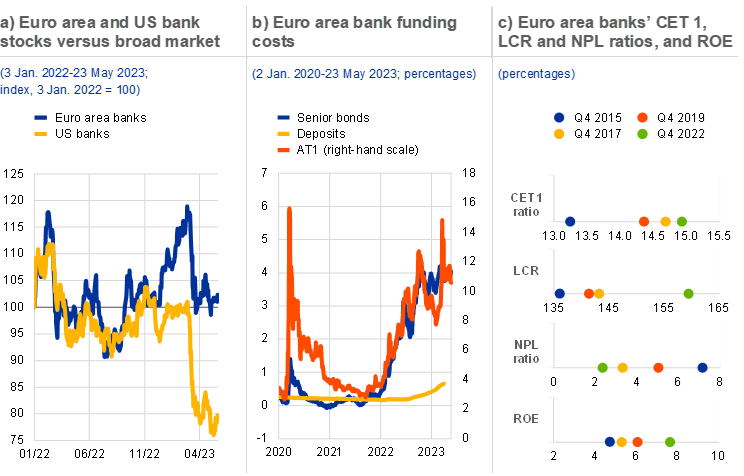

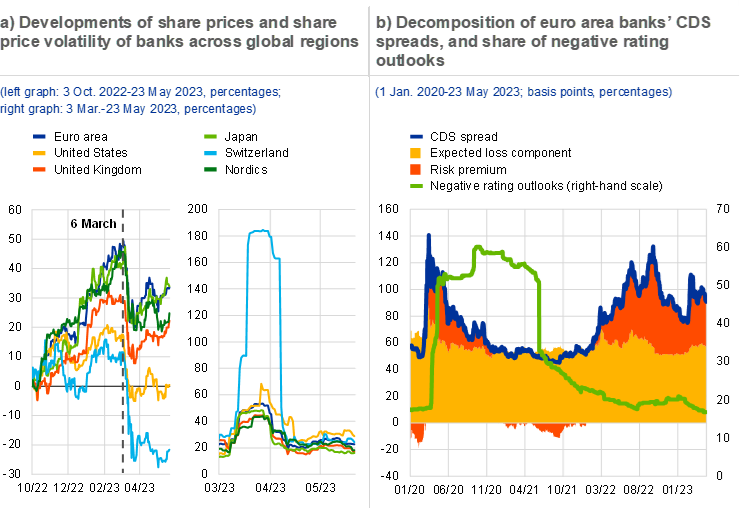

Stress in the US and Swiss banking sectors has triggered concerns over the health of parts of the banking industry, although the impact has been limited in the euro area amid solid bank fundamentals. The bullish market sentiment towards euro area banks that prevailed after the publication of the previous Financial Stability Review reversed abruptly in the first half of March (Chart 7, panel a). The failure of three medium-sized banks in the United States – Silicon Valley Bank, Signature Bank and later First Republic – as well as the takeover of Credit Suisse in Switzerland, led to broader market concerns over banks’ exposure to long-term fixed income securities, the cost and stability of deposit funding amid the growing digitalisation of banking services, business model viability and banks’ risk management practices. Euro area bank share prices fell sharply, while signs of tension became apparent in riskier bank bond markets, notably the Additional Tier 1 (AT1) segment (Chart 7, panel b), following the decision by the Swiss authorities to write down Credit Suisse Group’s AT1 instruments before its equity capital had been used up. However, given the idiosyncratic nature of the sources of US and Swiss bank stress, tensions have remained contained, and the broader implications for euro area banks have been limited. The resilience of the euro area banking sector has, in aggregate, been underpinned by strong capital and liquidity positions, and by greatly improved asset quality and profitability in recent years (Chart 7, panel c).

Chart 7

Tensions in euro area bank equity and bond markets were apparent following the US and Swiss bank stress, but euro area banks remain resilient

Sources: Bloomberg Finance L.P., S&P Dow Jones Indices LLC and/or its affiliates, Refinitiv, ECB and ECB calculations.

Notes: Panel a: euro area bank stocks are reflected by the Dow Jones EURO STOXX Banks Index and US banks stocks by the Dow Jones U.S. Banks Index; the broad market refers to the Dow Jones EURO STOXX 50 Price Index for the euro area and the Dow Jones U.S. Total Stock Market Index for the United States. Index relative to the broad market, i.e. values above (below) 100 indicate bank stocks outperforming (underperforming) the market. Panel b: deposit rates comprise rates paid to households and non-financial corporations on outstanding deposits and are weighted by their respective volume share. Yields of senior bonds comprise covered bonds, senior unsecured bonds and senior non-preferred securities, and are weighted by nominal values. AT1 stands for Additional Tier 1 capital. Panel c: CET1 stands for Common Equity Tier 1; LCR stands for liquidity coverage ratio; NPL stands for non-performing loans; ROE stands for return on equity.

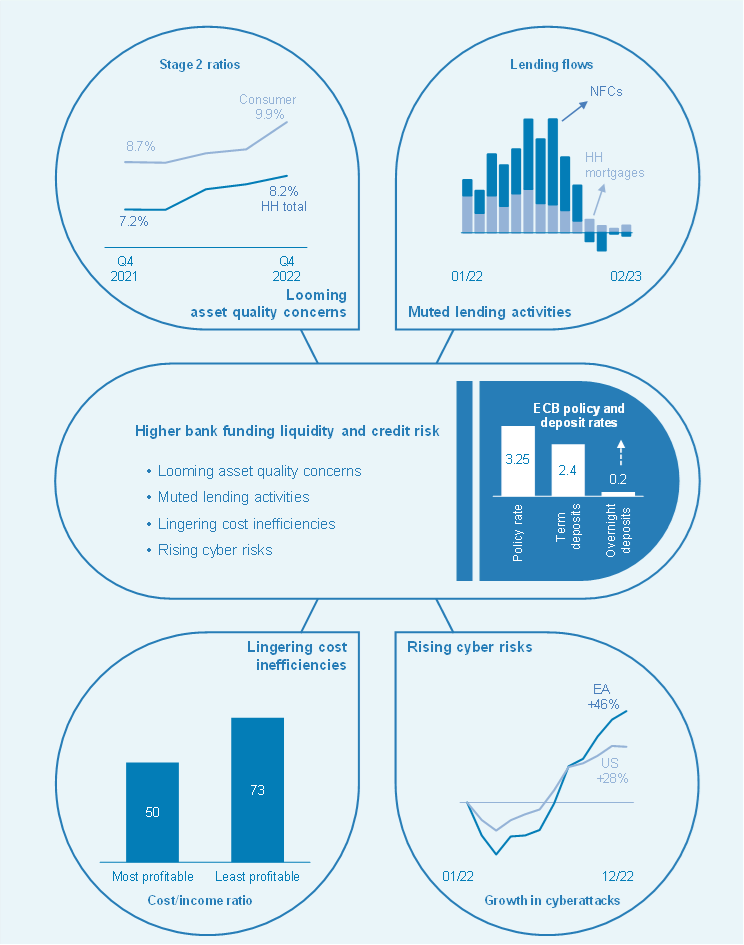

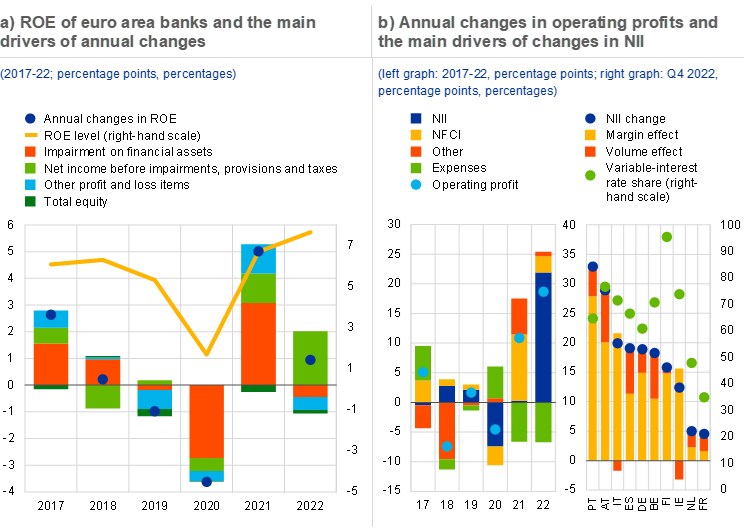

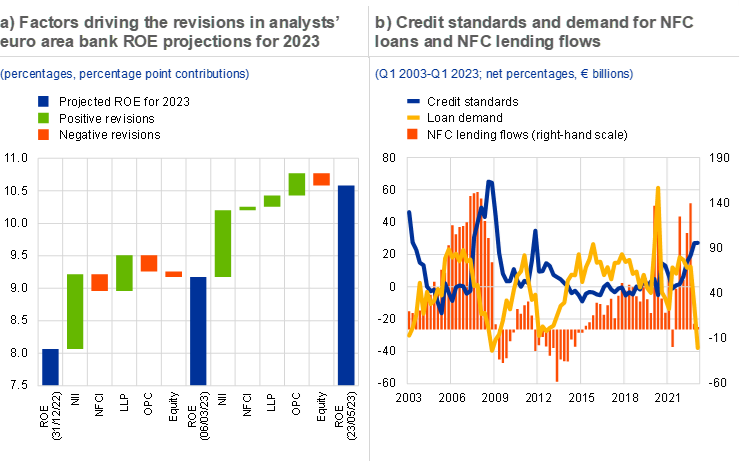

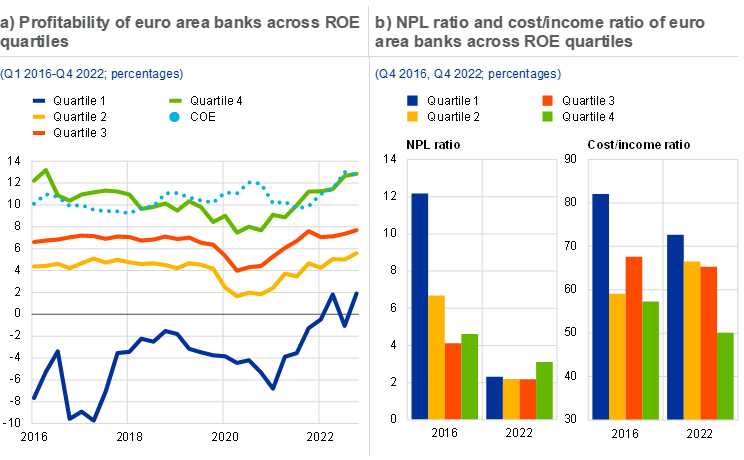

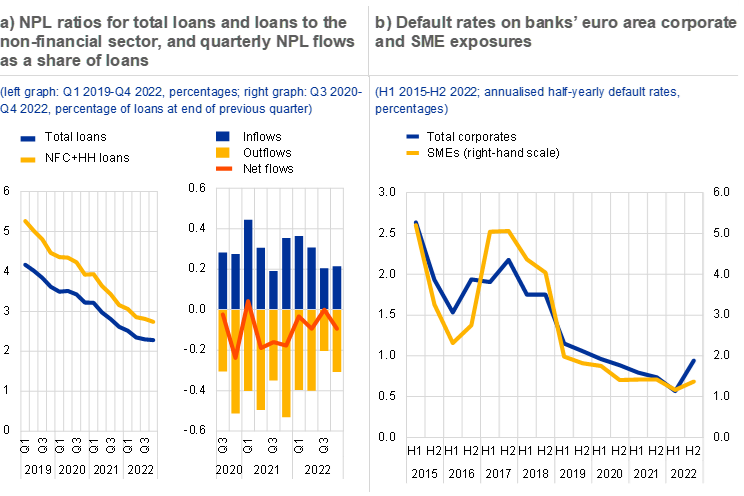

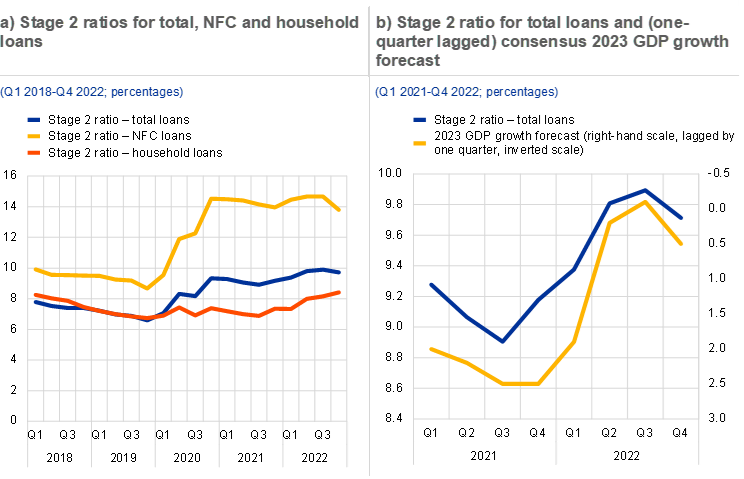

Bank operating profitability improved further in 2022, but the outlook has become more uncertain amid vulnerabilities in non-financial sectors. Supported by higher interest rates and low loan loss provisions, euro area banks showed robust earnings momentum throughout 2022. This is particularly true for banks in countries where variable-rate lending predominates. While the profitability of most euro area banks has benefited from rising interest margins, uncertainties have increased around the profitability outlook. In fact, the net interest income benefits from higher interest rates could turn out to be smaller than expected, given lower interest rate expectations more recently and a catch-up in deposit rates. Also, an environment of more muted economic growth prospects, coupled with considerably tighter credit standards and a slump in credit demand, may weigh on volume growth going forward. Furthermore, some signs of increasing credit risk are already becoming evident in loan portfolios that are more sensitive to cyclical downturns, such as those with exposures to commercial real estate, SMEs and consumer loans (Section 3.4). As a result, banks may face the risk of higher provisioning costs (which tend to increase markedly around credit events), with better-capitalised banks tending to provision significantly more than banks with less capital headroom (Box 5).

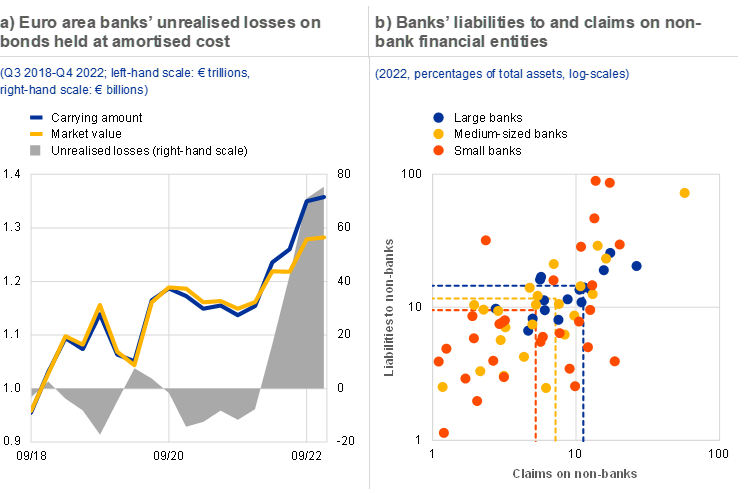

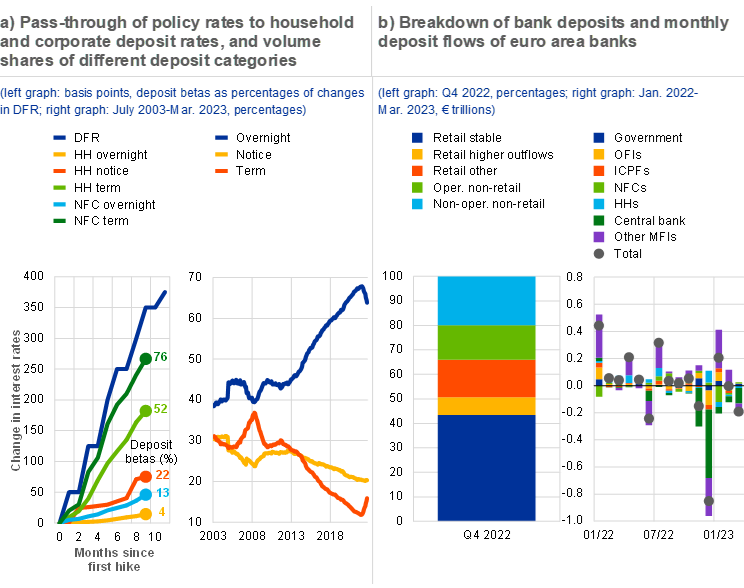

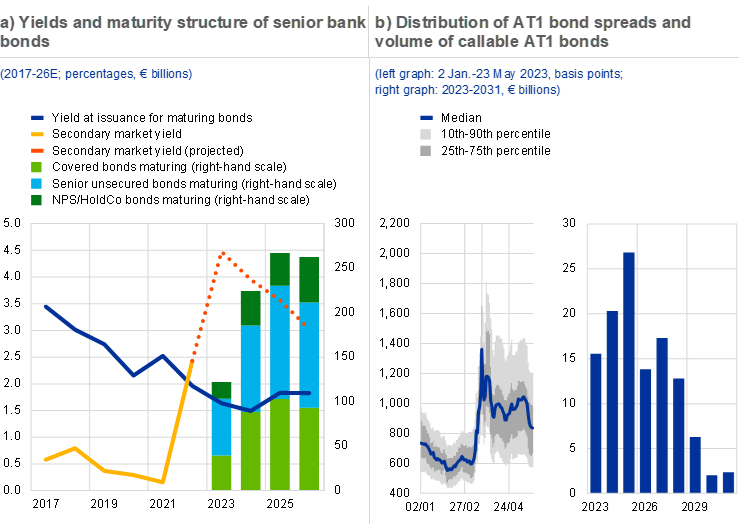

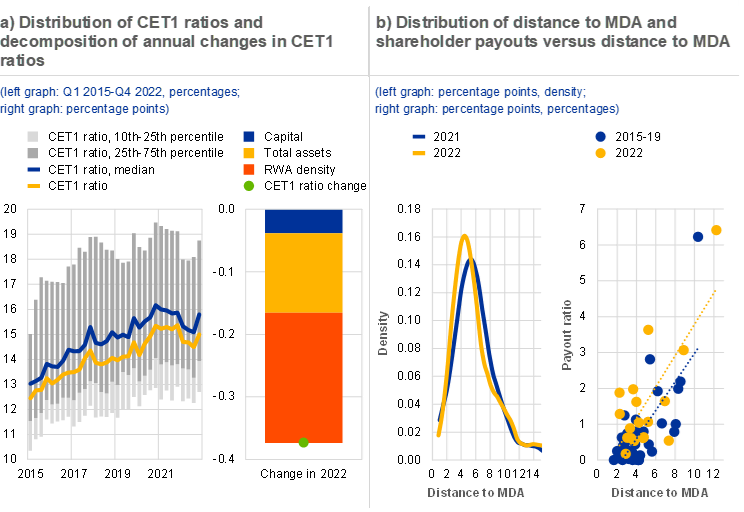

The prospects of higher bank funding costs are increasing downside risks to euro area bank earnings, while a stable deposit base is limiting funding risks. Bank bond funding costs have risen markedly since the start of 2022 on account of higher interest rates and, more recently, heightened market concerns regarding banks. As such, rolling over maturing bonds will increase banks’ market funding costs going forward. Banks could also face upward pressure on their funding costs if competition for deposits were to rise and translate into faster deposit repricing (Box 4). In particular, in countries where fixed-rate loans predominate, higher funding costs make it more challenging for banks to fund low-yielding assets until maturity. That said, standard regulatory metrics suggest strong liquidity resilience overall, despite a recent decline in the funding liquidity of banks (Special Feature A). Unrealised mark-to-market losses on bond holdings are limited (Chart 8, panel a), given the relatively low share of bond holdings in total assets, and are fully reflected in regulatory liquidity ratios. Securities held at amortised cost can be used to obtain secured funding, including through ECB operations, without crystallising the valuation losses. Banks’ vulnerability to liquidity shocks is further mitigated by composition of high-quality liquid assets, which consist largely of reserves held with the ECB. In aggregate, euro area banks do not share the funding vulnerabilities which have contributed to recent US and Swiss bank failures. They are funded mainly by deposits, with retail customers providing the majority of all deposits. In addition, a relatively high share of deposits is covered by deposit guarantee schemes (Chapter 3.1).

Chart 8

While unrealised losses on bond holdings are relatively limited, interlinkages with the NBFI sector could challenge euro area banks

Sources: ECB and ECB calculations.

Notes: Panel a: calculated on debt securities held at amortised cost only. Where a carrying amount is not reported, nominal value is used. Unrealised losses are calculated as the carrying amount minus market values. Intra-group holdings are not accounted for. Panel b: small banks refer to banks with total assets of up to €100 billion, medium-sized banks from €100 billion to €500 billion, and large banks over €500 billion. The dashed lines represent intra-group weighted averages.

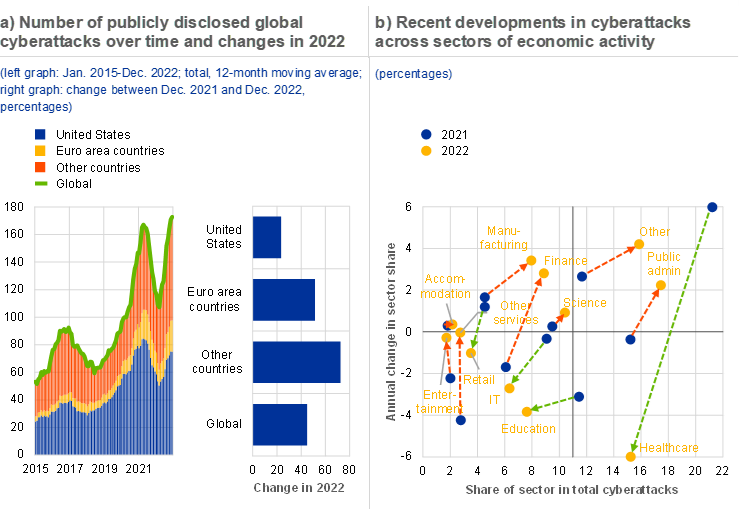

A greater need to respond to cyber and climate risks, and strong interlinkages with the NBFI sector, may also challenge euro area banks. Next to the cyclical headwinds associated with the challenging macro-financial conditions, euro area banks need to press ahead with digital transformation, not least so they can respond to the growing threat of cyber risks (Section 3.3). They also need to manage the implications of the transition to a greener economy. The results of the second ECB top-down economy-wide climate stress test suggest that, while the overall impact of the green transition is limited relative to portfolio size, it increases banks’ expected losses and provision needs in the short term (Box A in Special Feature C). In addition, elevated vulnerabilities in the NBFI sector may produce spillover risks for euro area banks, given the strong interconnections, exposing such banks to liquidity, asset price and credit risks (Special Feature B). These links appear on both sides of banks’ balance sheets and are stronger for larger banks (Chart 8, panel b).

Completion of the banking union would further enhance the resilience of the financial system

All in all, the financial stability outlook remains fragile, with stresses in the United States and Switzerland bringing banking sector vulnerabilities back into focus in an uncertain macro-financial environment. Pre-existing vulnerabilities could become more prominent and risks could spread across different sectors, should further pockets of vulnerability be revealed in the US or other banking sectors and/or macro-financial conditions worsen. The materialisation of downside risks to economic growth, more persistent inflation or a disorderly tightening of financial conditions could expose existing vulnerabilities, notably those associated with high levels of debt across the economy as well as the potential for disorderly adjustments in both financial and tangible asset markets. At the same time, shocks such as the failure to reach a political agreement on the US government debt ceiling or a further escalation of geopolitical tensions could cause these vulnerabilities to materialise, possibly simultaneously.

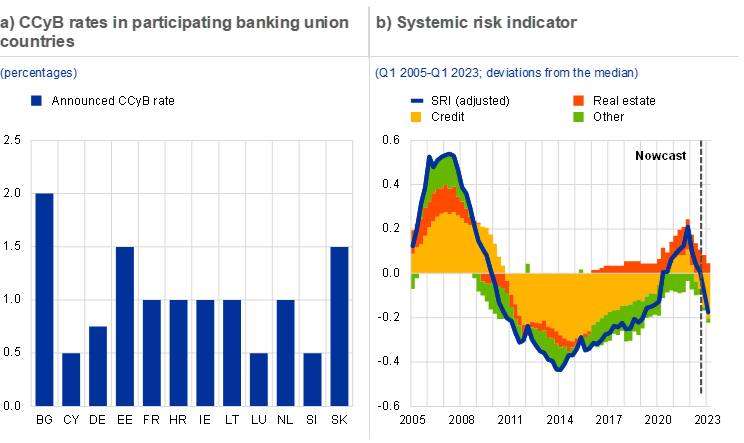

Preserving financial sector resilience remains key as the financial cycle turns. In the light of elevated uncertainty, involving accumulated vulnerabilities and signs of a turning financial cycle, macroprudential policy should continue to focus on ensuring that the financial system remains able to withstand adverse shocks. Existing macroprudential capital buffers should therefore be maintained to preserve the resilience of the banking sector, as the conditions for their release have not yet been met. Targeted increases in capital buffer requirements may still be considered in some countries. For example, in countries with a framework that features a positive neutral rate for the countercyclical capital buffer, the build-up of the buffer towards the neutral rate is welcome, provided that procyclical effects are avoided. Banks should, in the context of increased downside risks to economic growth and recent banking sector stresses, refrain from increasing payout ratios further, but should instead focus on preserving their existing substantial resilience. Finally, borrower-based measures under the remit of national authorities should continue to ensure sound lending standards and the sustainability of household debt, in a framework where capital-based and borrower-based measures complement each other.

The sources of US and Swiss banking sector stress have highlighted the need to complete the banking union and to further strengthen the EU bank regulatory framework. The recent banking sector stress has highlighted the need for sound corporate governance and effective risk control by banks. At the same time, it has also been a powerful reminder of the need to complete the banking union (Section 5.1), in particular the crisis management framework and a common European deposit insurance scheme. In addition, full implementation of the final Basel III elements by the agreed deadline of January 2025 is essential to ensure that banks remain well-capitalised, in order to foster trust in the EU banking system and to provide additional levers for supervisory scrutiny. ECB Banking Supervision, the Single Resolution Board and the European Banking Authority have recently reiterated the need for the consistent application of the EU’s detailed order according to which shareholders and creditors of a troubled bank should bear losses applied in past cases. This will also guide the actions of the Single Resolution Board and ECB Banking Supervision in any possible crisis interventions going forward.

Structural vulnerabilities in different parts of the non-bank financial sector require a comprehensive policy response across entities and activities. In the light of persisting vulnerabilities in the NBFI sector and the risk of renewed stress, it is critical that policy initiatives continue to be pursued as a matter of priority. The focus should be on policies that reduce liquidity mismatch in investment funds, tackle risks arising from financial and synthetic leverage across the NBFI sector and enhance liquidity preparedness across a broad range of institutions, especially in relation to margin calls. As it will take time for regulatory reforms to be agreed internationally and then implemented, the authorities regulating and supervising NBFI entities should pay close attention to vulnerabilities in the sector and should play an active role in strengthening resilience, in accordance with their mandates and existing policy frameworks (Section 5.2).

1 Macro-financial and credit environment

1.1 An improved but still fragile economic outlook

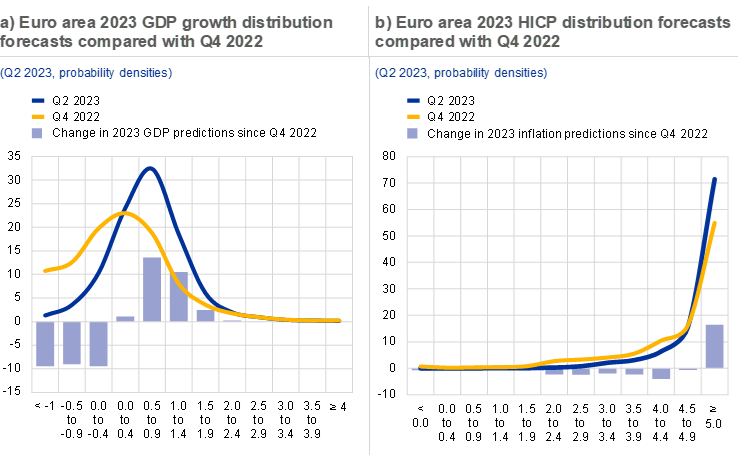

Amid high uncertainty, private sector forecasters have upgraded their baseline growth expectations for the euro area in the light of moderating energy prices. The global economic outlook seems fragile, after a period of high macro volatility, as geopolitical tensions remain high and financial conditions are tightening. At the same time, forecasters have revised euro area growth expectations for 2023 up to 0.6%, in contrast to expectations of a shallow recession of -0.1% as recently as November last year, in response to falling energy prices, China’s reopening helping to ease strains on global supply chains and labour markets remaining tight. In parallel, consensus inflation expectations for 2023 remain high (5.6% as against 5.8% in November 2022). Despite the improvement in growth prospects, risks to the outlook for economic growth remain elevated, as the distribution of expected GDP outcomes for the euro area economy in 2023 remains tilted to the downside (Chart 1.1, panel a) and inflation expectations remain high (Chart 1.1, panel b). Against the background of the stress events in the banking sector, risks to the outlook are driven predominantly by the potential for a disorderly tightening of financial conditions combined with heightened geopolitical risks.

Chart 1.1

Euro area growth expectations improve but tail risks remain elevated

Source: ECB Survey of Professional Forecasters.

Notes: Panel a: x-axis labels reflect the year-on-year GDP growth for the euro area economy. Panel b: x-axis labels reflect the year-on-year HICP level for the euro area economy.

Easing energy prices have helped headline inflation to moderate, but risks to energy prices and inflation remain tilted to the upside. Despite a normalisation of energy prices, underlying global price inflation remains elevated and upside risks to commodity prices remain high. Tight and resilient labour markets have contributed to persistent core inflationary pressures. Moreover, measures of core inflation have continued to surprise to the upside, as the pass-through of higher costs to the services, food and industrial goods sectors is still ongoing and is likely incomplete. High geopolitical uncertainty, coupled with efforts to secure natural gas supply for the next winter season (Chapter 2) and a stronger than expected economic rebound in China, could push energy prices higher again.[1]

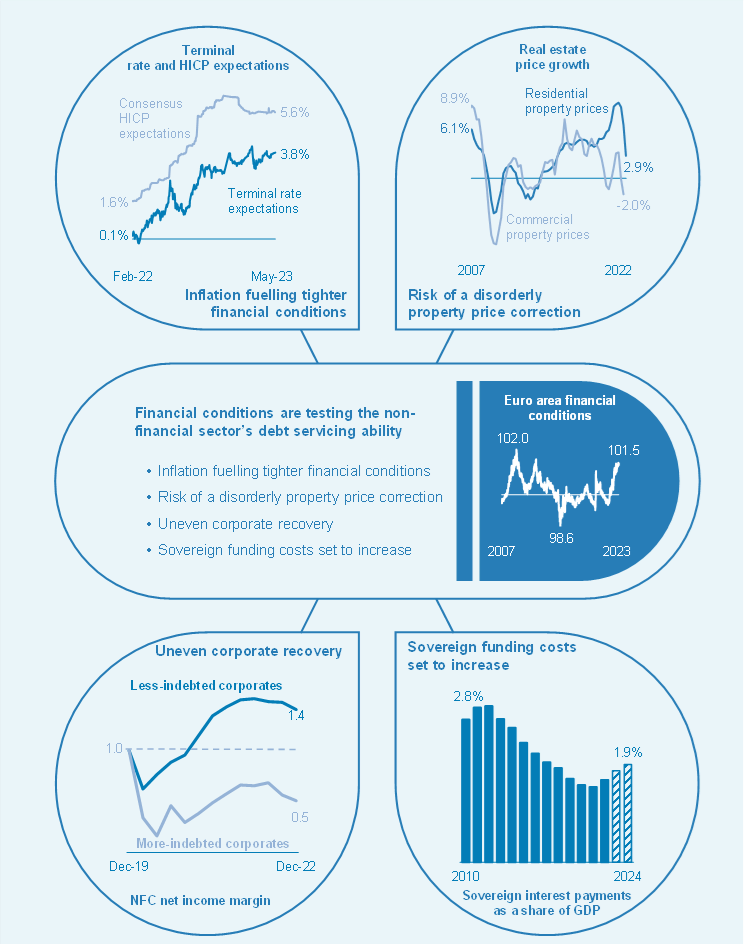

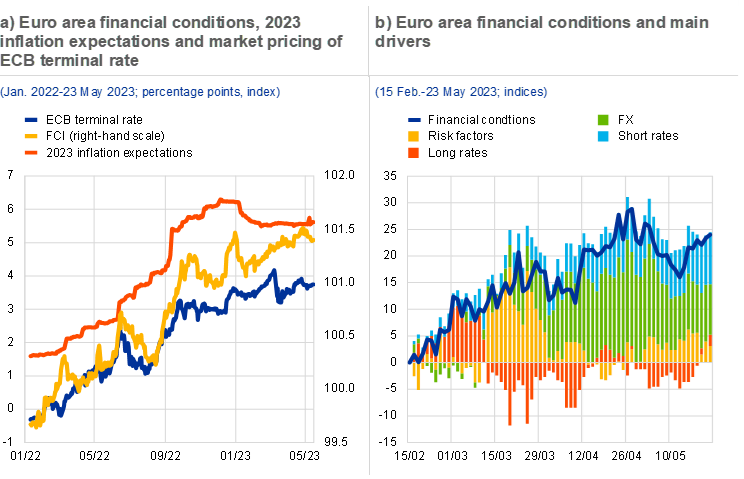

The global growth outlook could be derailed if there is a disorderly tightening of financial conditions while inflation remains at high levels. To ensure the timely return of inflation to their medium-term targets, central banks around the world have continued to raise their policy rates, thereby contributing to a global tightening of financial conditions. Consequently, the market pricing of the terminal rate globally, and in the euro area, has increased (Chart 1.2, panel a). Adding to tighter conditions, the recent failures of a number of US regional banks and the takeover of a Swiss bank have pushed up risk premia, including in the euro area (Chart 1.2, panel b). Moreover, changes in monetary policy expectations have resulted in the euro appreciating against a bucket of major currencies, further contributing to tighter financial conditions. Persistently elevated financial market tensions could tighten credit conditions more strongly than expected, with feedback to the broader economy, as they might impact credit availability and increase debt service costs further.

Chart 1.2

Financial conditions tighten as inflation remains high and risk perceptions increase

Sources: Bloomberg Finance L.P., Goldman Sachs, Consensus Economics and ECB calculations.

Notes: Panel a: terminal rate defined as the maximum of the OIS (€STR) forward curve. FCI stands for financial conditions index. Panel b: risk factors represent the sum of the category’s sovereign spreads and equities.

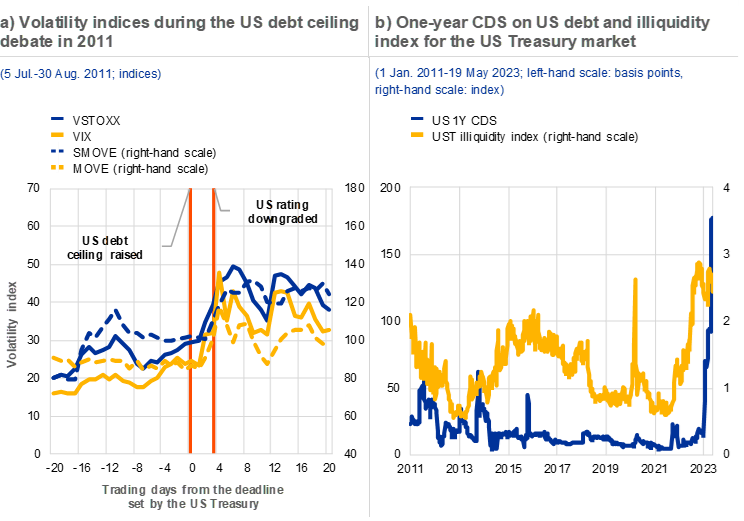

Globally, the failure to raise the US debt ceiling, possible side effects of China’s reopening and vulnerabilities in emerging markets are adding to downside risk and heightened uncertainty. Against the background of high political uncertainty, the inability to raise the US debt ceiling debate could spark financial market volatility and hit US growth prospects. A disorderly process could add to the risks of US sovereign debt being downgraded (Chapter 2).[2] Moreover, the reopening of the Chinese economy after pandemic lockdowns is having an ambiguous impact on global inflation levels and is adding further to uncertainty. On the one hand, it could exert upward pressure on commodity prices and global inflation levels as pent-up demand boosts consumer expenditure. On the other hand, the reopening is helping to ease supply bottlenecks.[3] Moreover, risks in China’s property market remain high, even though some improvement in conditions has been observed since the start of the year. Finally, a prudent policy stance in emerging markets is currently helping to mitigate spillovers from higher interest rates in developed economies and has kept vulnerabilities contained.[4] However, a further – or disorderly – tightening of financial conditions could leave some emerging market economies vulnerable to capital outflows and might challenge their ability to service foreign currency debt.

Against the background of high uncertainty, the risks to financial stability stemming from materialising vulnerabilities remain elevated. The drop in energy prices has relieved some pressure on inflation and has contributed to an improvement in the growth outlook. However, inflation remains high and the outlook for economic growth remains weak, with risks skewed to the downside. Moreover, after an episode of high macro volatility, global economies face renewed uncertainty from the potential financial feedback to credit availability resulting from the recent stress events in the banking sectors of some mature economies.

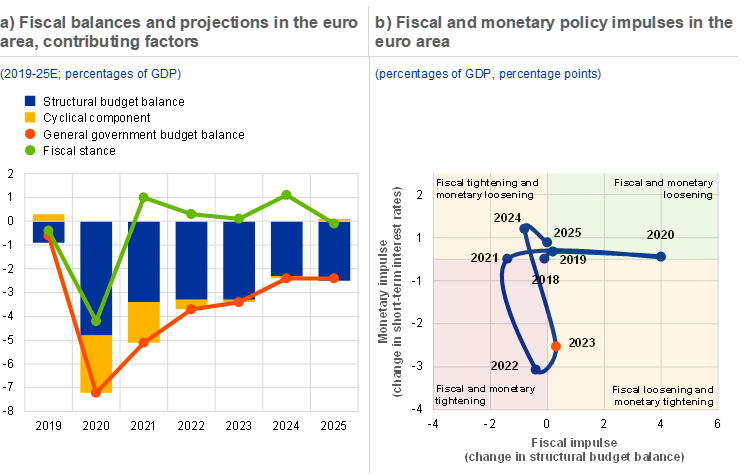

1.2 Fiscal positions benefit from lower energy prices, while unaddressed challenges lie ahead

The euro area fiscal deficit is expected to decline, as lower energy prices help the fiscal outlook. The projected euro area budget deficit is expected to decline somewhat in 2023 (to 3.4% of GDP) and more significantly in 2024 (to 2.4% of GDP), before remaining unchanged in 2025 (Chart 1.3, panel a). The forecast for the euro area fiscal position is driven by the expected improvement in the cyclically adjusted primary balance, followed by an improvement in the cyclical component, while interest payments are expected to gradually increase as maturing public debt is rolled over at higher interest rates. There are significant downside risks to this outlook, however, as fiscal positions ultimately depend on inflation developments and economic uncertainty going forward. Consequently, the improvement in fiscal positions since the previous version of the Financial Stability Review will be susceptible to substantial downward revisions if risks materialise in the form of higher energy prices (Chapter 2), Next Generation EU (NGEU) absorption rates are lower than expected or the inflation outlook deteriorates significantly.

Fiscal support measures to cushion the energy price shock remain largely untargeted. Since the end of 2022, favourable energy price and inflation developments have contributed to a slight downward rescaling of fiscal support measures to about 1.8% of GDP from over 1.9% of GDP at the end of 2022.[5] At the same time, fiscal support has been revised up for some euro area countries since the previous issue of the Financial Stability Review, following the extension of measures into 2023 or updated estimates based on final budget laws. While these support measures are helping to cushion the impact of high inflation in the short term, the effect is expected to reverse in the years after 2023. Additionally, most fiscal support measures remain untargeted and are at odds with the monetary policy response to fight inflation (Chart 1.3, panel b).[6] Broad-based fiscal stimulus to aggregate demand is unwarranted and economically inefficient; this should preferably be replaced by policies that target only vulnerable cohorts of corporates and households.

Chart 1.3

Fiscal balance improves on the back of lower energy prices, but support measures might stoke inflation

Sources: ECB, ECB calculations and Bloomberg Finance L.P.

Notes: Panel a: the data refer to the aggregate general government sector of euro area countries. The fiscal stance is adjusted for the impact of NGEU grants on the revenue side. The cyclical component refers to the impact of the economic cycle and that of temporary measures implemented by governments; it includes one-off revenues and one-off capital transfers. Panel b: monetary impulse reflects the expected change in short-term interest rates as implied by the OIS (€STR) forward curve at the end of each calendar year. The impulse does not include the impact of unconventional monetary policy measures.

A favourable snowball effect, amid high inflation, has initially helped to push government debt-to-GDP ratios onto a declining trajectory. In a baseline scenario, the euro area debt-to-GDP ratio is projected to decline from 89.4% of GDP in 2023 to slightly below 87% in 2025. Nevertheless, the ratio is projected to remain above pre-pandemic levels (84%) through 2025. The expected decline is driven mainly by a favourable interest rate-growth differential (the snowball effect) stemming from high nominal GDP growth, which should more than offset foreseen refinancing needs arising from persisting, albeit decreasing, primary deficits.[7] Additionally, sovereign debt ratios have benefited from a declining real debt burden owing to first-round effects (a favourable denominator effect).[8]

In the longer term, euro area public finances would likely be negatively affected by persistently high inflation. High inflation would have an adverse impact on fiscal positions through rising interest rates that would gradually propagate to interest payments. Additionally, the detrimental impact of the energy price shock on real economic activity will have a negative effect on fiscal positions. The size of this negative effect can primarily be explained by the nature and size of the inflation shock in the euro area – mainly a large, external shock that negatively affects household balance sheets, corporate profitability and growth, and puts high pressure on nominal public spending.[9]

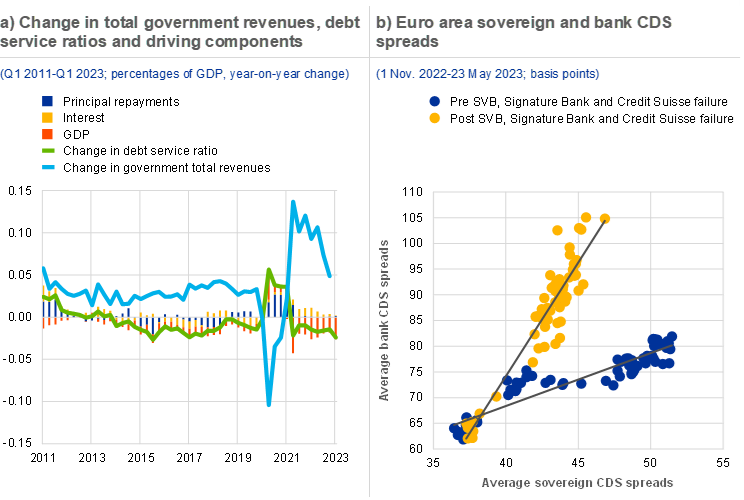

Although sovereign debt service risks have been kept in check by benign debt service conditions, they might become more challenging in the future. At present, several factors are helping debt serviceability in the short term. First, the lengthening maturity of the outstanding debt stock means that principal repayment needs are about 15% lower than they would have been for running the same amount of debt against the maturity profile in 2010. Second, although yields have been increasing, the average interest paid on outstanding government debt is still hovering around record lows for most euro area sovereigns (1.7% in March 2023), and sovereigns have continued issuing longer-term debt – despite the steep increase in funding costs. Third, higher interest payments and debt issuance have not offset nominal GDP growth, a situation which has contributed to declining debt service ratios (Chart 1.4, panel a). However, debt service ratios in some euro area countries remain high, at around 40% of GDP, and rollover risks have increased as interest rate uncertainty has added to high price volatility in sovereign bond markets (Chapter 2). A further tightening of financial conditions could spark an increase in borrowing costs for more-indebted sovereigns. This means that funding conditions could become more challenging, particularly when sovereigns need to issue high volumes of debt in volatile and shallow government bond markets.

As central bank balance sheets are reduced around the world, fiscal issuance will be increasingly absorbed by the private sector. The envisaged balance sheet run-off will reduce the market footprint of the Eurosystem, thus fostering the efficient transmission of monetary policy.[10] At the same time, the higher expected net issuance of sovereign debt this year on top of the higher free float resulting from the balance sheet run-off will need to be absorbed by the private sector.[11] This could include foreign investors, which might have a stabilising impact (Box 3), and non-banks, but also encompasses domestic banking sectors. Against this background, stress in the euro area banking sector might renew concerns over the sovereign-bank nexus. So far, the co-movement in sovereign and bank credit risk has been much more contained than in previous joint stress periods (Chart 1.4, panel b).

Chart 1.4

Debt service risk are contained, but banking stress might spark concerns over the sovereign-bank nexus

Sources: ECB, Eurostat and Bloomberg Finance L.P.

Notes: Panel a: the debt service ratio is calculated as principal and interest expenditure during the debt service period (two years) as a share of GDP. Panel b: the chart displays the average five-year CDS spreads across euro area banks and sovereigns in basis points. Pre/post failure reflects the period before/after the failures of Silicon Valley Bank, Signature Bank and Credit Suisse as of 10 March 2023.

Short-term fiscal pressures remain contained, but medium-term challenges are adding to financial stability risks. Medium and longer-term challenges are adding to sovereign vulnerabilities. Climate change is a significant source of sovereign risk (Special Feature C), and an ageing population aggravates challenges around pensions and longer-term economic growth prospects. At the current juncture, the recent stress episode in the banking sectors of some mature economies remains contained, but credit risk spillovers between sovereign and banks could lead to a reassessment of sovereign risk by market participants. The outlook for sovereigns may deteriorate if financial conditions tighten, geopolitical tensions contribute to higher commodity prices, market liquidity is low, refinancing needs are high and additional fiscal support is needed.

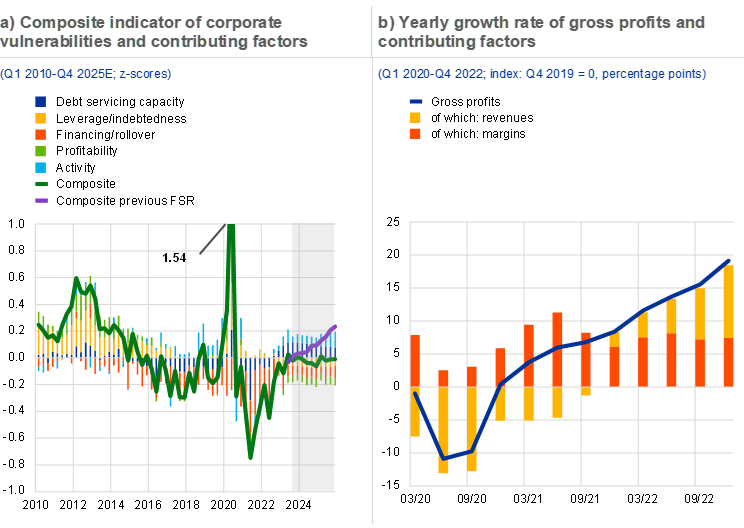

1.3 Corporates bank on high margins, but vulnerabilities might increase as financial conditions tighten

Euro area firms have benefited from a sharp post-pandemic recovery and strong profits, but business prospects are surrounded by high uncertainty. Aggregate corporate vulnerabilities remained below their long-run average for much of last year, with nominal gross profits surprisingly strong (19% above pre-pandemic levels in the fourth quarter of 2022). Despite the overall tightening of financial conditions, lower indebtedness and a high interest coverage ratio kept corporate vulnerabilities below their long-term average (Chart 1.5, panel a). Furthermore, both higher revenues and stronger profit margins contributed significantly to the corporate recovery in the second half of 2022 (Chart 1.5, panel b). These high profit margins are closely linked to high inflation prints in the euro area, as around half of the gross value-added deflator is explained by higher profit margins.[12]

Chart 1.5

Corporates benefit from burgeoning profits

Sources: ECB, Eurostat, S&P Dow Jones Indices LLC and/or its affiliates and ECB calculations.

Notes: Panel a: grey shaded area refers to the forecast. Positive values indicate higher vulnerability while negative values indicate lower vulnerability.* Panel b: profit margins are proxied by net operating surplus divided by value added. Gross nominal profits are proxied by the respective growth rate of quarterly gross operating surplus. Data are displayed as two-period moving averages.

*) For more detail on the indicator components, see the box entitled “Assessing corporate vulnerabilities in the euro area”, Financial Stability Review, ECB, November 2020.

Aggregate corporate vulnerabilities are expected to increase by less than previously anticipated, but a disorderly tightening of credit conditions is a key risk. Revisions in the forecast of the corporate vulnerability indicator since the previous edition of the Financial Stability Review mainly reflect the baseline scenario of an improving economic environment and moderating debt accumulation. At the same time, high downside risks to the economic outlook are also translating into uncertain prospects for corporates, and not all corporates have benefited equally from the economic recovery. Moreover, a disorderly tightening of financial conditions resulting from the recent stress episode in the global banking sector remains a key risk for business prospects.

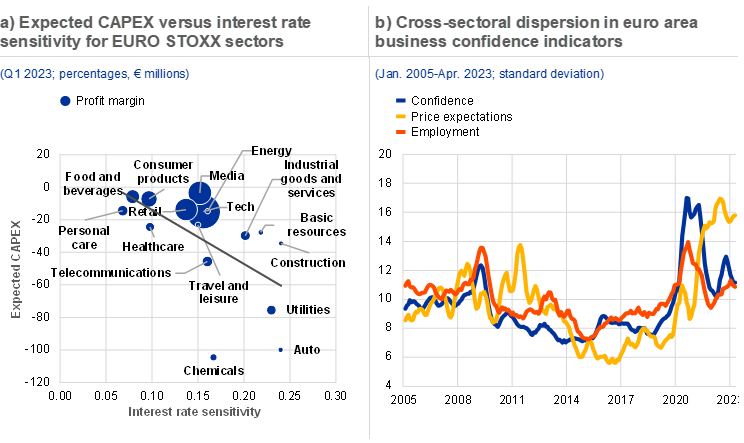

Despite the overall resilience of the corporate sector, corporate fragilities vary greatly across sectors and firm sizes. Valuations of firms with higher capital expenditure needs are more sensitive to changes in interest rates (Chart 1.6, panel a). Some of these firms might also be more vulnerable to rising borrowing costs and generally have lower interest coverage ratios (Box 1). Additionally, survey-based confidence measures indicate a large dispersion across different sectors in the euro area (Chart 1.6, panel b). In general, lower business confidence has been observed in energy-intensive sectors, while sectors that have benefited more from the post-pandemic reopening demonstrate greater confidence. Moreover, soft data from the survey on the access to finance of enterprises (SAFE) indicate that SMEs have benefited less from the rebound in economic activity.

Chart 1.6

Corporate capital expenditure is expected to drop, as economic sectors face differing prospects

Sources: ECB, Bloomberg Finance L.P., European Commission and ECB calculations.

Notes: Panel a: interest rate sensitivity is calculated as the market beta of the sector EURO STOXX sub-index to the German five-year government bond over the period from January 2015 to May 2023. Expected CAPEX reflects Bloomberg’s estimate of the amount of money a company spends to buy capital assets or upgrade its existing capital assets. A negative value reflects higher expenditure. Panel b: standard deviation across 56 NACE Rev. 2 sectors in the euro area.

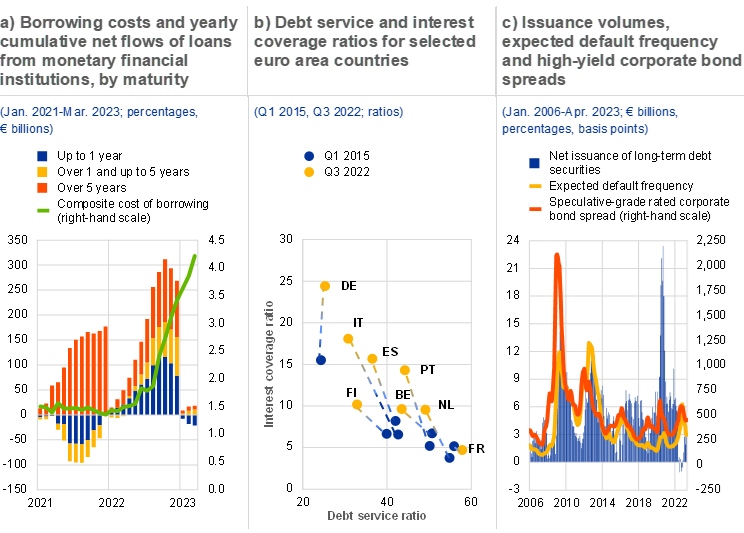

Tighter financing conditions have started to have an impact on firms’ debt service costs and issuance behaviour. As financial conditions have tightened, both markets and banks have reassessed the risks surrounding corporate activity. Consequently, the cost of debt has increased sharply since mid-2022 (Chart 1.7, panel a).[13] Net lending flows fell back strongly in the first months of 2023 as it became more expensive to roll over debt, indicating deleveraging in some countries and sectors. In 2022 higher interest rates and higher working capital needs on account of high production costs also contributed to a shift from long-term lending to loans with a shorter maturity. The results of the ECB’s Q1 2023 bank lending survey indicate that the rise in the general level of interest rates, together with a decline in fixed investments, served to dampen demand for new lending. Furthermore, the impact of tighter credit standards might build up over time, with a delayed pass-through to the real activity of firms. In some euro area countries, high debt service needs are accompanied by lower interest coverage ratios, and corporates might be impacted more by the rising rate environment.

At the same time, corporate balance sheets in most euro area countries are currently healthier than they were during previous rate-hiking cycles. A long period of low interest rates and a strong post-pandemic recovery have helped the average corporate to build resilience in the face of a new downturn and rapidly rising financing costs. Gross interest coverage ratios have improved, particularly for countries which started with lower levels of interest coverage in the non-financial corporate sector (Chart 1.7, panel b). Moreover, non-financial corporate debt levels declined to 144% of gross value added in the fourth quarter of 2022, compared with 148% before the pandemic.

Chart 1.7

Corporates have built resilience, but borrowing costs are increasing strongly and bankruptcies have picked up in some euro area countries

Sources: ECB, Eurostat, Bank for International Settlements. Moody’s Analytics, Refinitiv and ECB calculations.

Notes: Panel b: the debt service ratio is defined as the ratio of interest payments plus amortisations to income. As such, it provides a flow-to-flow comparison – the flow of debt service payments divided by the flow of income.* The interest coverage ratio is defined as the ratio of gross operating surplus to gross interest payments before the calculation of financial intermediation services indirectly measured.

*) See “How much income is used for debt payments? A new database for debt service ratios”, BIS Quarterly Review, Bank for International Settlements, September 2015.

Bankruptcies in some euro area countries have started to increase from a very low base, although they remain below pre-pandemic levels. Bankruptcies in most large euro area economies remain below pre-pandemic averages, although they have now started to normalise from the low levels reached during the pandemic.[14] Moreover, forward-looking measures for default risk signal elevated risk (Chart 1.7, panel c), driven by those sectors directly impacted by the energy crisis such as transport and industry.

Corporate vulnerabilities might be higher than the aggregate suggests, as not every corporate benefited equally from the post-pandemic recovery. The uneven impact of two succeeding, and distinctly different, crises has introduced considerable diversity over the cross-section of firms and might imply that an economic recession could have more severe consequences for financial stability than this aggregate picture suggests. Furthermore, the predominance of variable-rate lending in some countries, together with high corporate debt levels by historical and international standards, renders some corporates vulnerable to a further or disorderly tightening of financial conditions. Moreover, debt instruments that are more sensitive to rate increases, such as leveraged loans, might be particularly exposed should financial conditions tighten further. As such, there could be more defaults going forward, with potential knock-on effects on bank balance sheets and household employment prospects.

Box 1

Corporate vulnerabilities and the risks of lower growth and higher rates

Following a strong post-pandemic recovery in profits, euro area non-financial corporations are now facing the risk of stagnating economic activity combined with tightening financial conditions. As monetary policy normalises, interest rates on corporate bonds and loans are increasing at their fastest pace in decades, leading to declining corporate lending and investment. Against this backdrop, this box uses firm-level balance sheet data to identify vulnerable non-financial corporations (NFCs) based on the Altman Z-score, a measure of insolvency risk.[15]

More1.4 A resilient household sector is facing tightening financial conditions

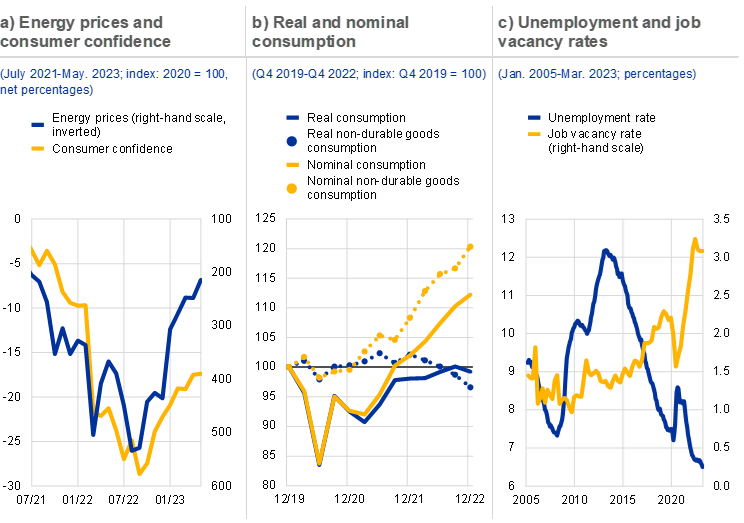

Euro area households have benefited from the improvement in economic conditions, despite elevated uncertainty and the impact of persistent inflation. While households remain worried about their future economic situation, consumer sentiment improved somewhat as energy prices started to decline at the end of 2022. This helped to ease upward pressure on headline inflation and make it more likely that a recession would be avoided in 2023 (Chart 1.8, panel a). Nevertheless, stubbornly high inflation continues to weigh on households’ real disposable incomes. This led to a decline in real household consumption in the fourth quarter of 2022 (Chart 1.8, panel b).

Strong labour markets have provided constant support to household resilience. The unemployment rate in the euro area remained at historic lows of around 6.6% throughout the end of 2022 and start of 2023, while the job vacancy rate reached an all-time high of over 3% (Chart 1.8, panel c). This situation benefits household incomes and suggests that a significant reduction in labour demand would be needed to cause a large increase in unemployment.

Chart 1.8

Real household consumption in the euro area is being squeezed by inflation, but households are benefiting from strong labour markets

Sources: European Commission, Hamburg Institute of International Economics (HWWI), Eurostat and ECB calculations.

Notes: Panel b: non-durable goods consumption is aggregated across those euro area countries for which the breakdown of consumption across different classes of goods and services is available. They account for roughly 80% of total euro area private consumption. Non-durable goods consumption refers to the consumption of goods that can be used only once or that have a lifetime of considerably less than one year (including energy and food). Panel c: the latest data for the job vacancy rate refer to Q4 2022.

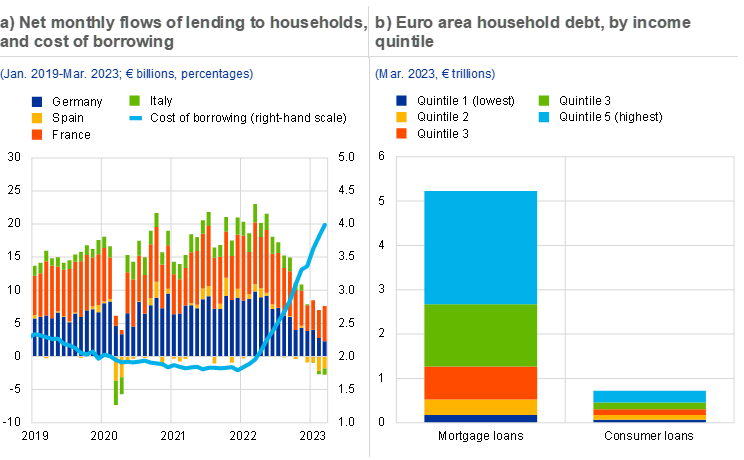

Tightening financial conditions have led to a turn in household borrowing, particularly for interest rate-sensitive items. Interest rates on household loans increased to 4% in March 2023, up by 2 percentage points year on year and marking the fastest increase since the euro was introduced. This resulted in a marked deceleration to 2.8% in the annual growth of lending to households, down by over 1.5 percentage points over the same period, driven predominantly by a contraction in demand for new mortgage loans (Section 1.5). While the annual growth in loan volumes has remained positive, net loan flows have turned negative in some euro area countries since the end of 2022, meaning that more loans were repaid than new loans were issued (Chart 1.9, panel a). As interest rates rise and banks signal their intention to continue tightening credit standards, lending volumes are likely to decline further – possibly resulting in a deleveraging of the household sector.

The debt servicing capacity of some households may be challenged by tightening financial conditions. Households in many countries continue to be shielded from immediate increases in the interest burden on their outstanding debt as a high share of loans have been issued with longer interest rate fixation periods over the last decade. This trend has reversed somewhat since the second half of 2022, particularly in countries where the relative pricing of variable-rate and fixed-rate loans has changed. Households in these countries are therefore more exposed to a repricing of outstanding debt over the short term. Some households may fall into distress as the purchasing power of their incomes continues to decline and credit standards are, as expected, tightened further. At the current juncture, households at the lower end of the income distribution are the most vulnerable as they are disproportionally affected by high inflation. Wider risks to financial stability appear contained, however, as households in some countries have experienced a significant deleveraging since the global financial crisis across the income distribution and, in particular, in the lowest income cohorts. Moreover, these households account for only a small share of overall household borrowing (Chart 1.9, panel b).[16]

Chart 1.9

New household borrowing is declining, but vulnerable households hold only a low share of overall household debt

Sources: ECB and ECB calculations.

Notes: Panel a: financial transactions (flows), monetary financial institutions excluding ESCB reporting sector. Data are working-day and seasonally adjusted. Panel b: shares of loans held by income quintiles are forward-extrapolated from the ECB’s 2017 Household Finance and Consumption Survey and are multiplied by outstanding loans.

While vulnerabilities among households have increased further, risks still appear moderate. Although net wealth growth has moderated significantly, aggregate household balance sheets remain resilient and may benefit from deleveraging going forward. Households’ real incomes and consumption, while under pressure from persistently elevated inflation, are supported by the continued strength of labour markets and fiscal measures. Nonetheless, some vulnerable households may face difficulties servicing their debt, as reflected in an increase in consumer loans classified by banks as suffering a significant deterioration in credit quality (Chapter 3). Such vulnerabilities could worsen, in particular if labour market conditions deteriorate or energy prices rise again significantly. Moreover, housing markets have started to cool in most euro area countries, and price developments could weigh on consumer sentiment going forward (Section 1.5). In the medium term, vulnerabilities could be exposed and debt servicing capacity could deteriorate, especially in countries where residential properties remain overvalued, debt levels are elevated and household debt is mainly at variable rates. That said, such an adverse scenario currently remains a tail risk.

1.5 Vulnerable real estate markets are turning

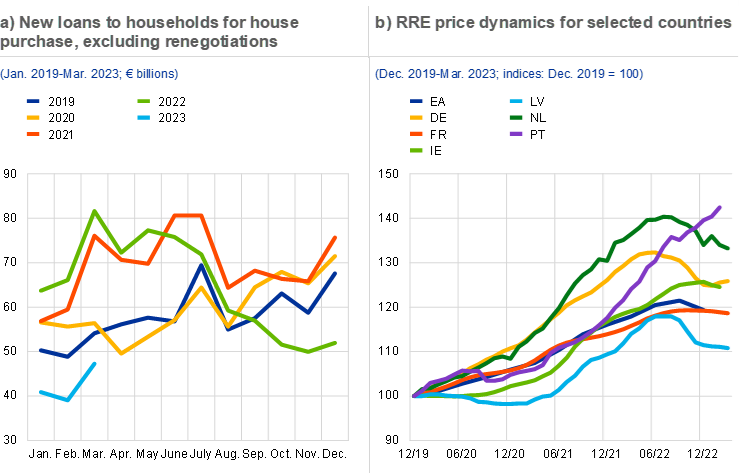

Both mortgage loan origination and house prices have slowed significantly amid higher interest rates. The average interest rate on loans for house purchase in the euro area stood at 3.4% in March 2023, almost 2 percentage points higher than it had been a year earlier. This steep rise in borrowing costs has led to a significant decline in loan origination. While the volume of new lending was higher during the first half of 2022 than in previous years, it declined markedly in the second half of the year and fell again sharply at the beginning of 2023 (Chart 1.10, panel a). Residential real estate (RRE) prices in some euro area countries or market segments also started declining in the second half of 2022. This fall could become more pronounced as higher interest rates reduce mortgage affordability (Chart 1.10, panel b). In the ECB’s latest bank lending survey, banks reported a further substantial net tightening of credit standards for housing loans and a strong net decline in loan demand in the first quarter of 2023. They expect credit standards for mortgages to tighten further, and net loan demand to decline further, in the second quarter of the year as well, although to a lesser extent than during the first quarter. In other words, the trends observed in new lending and house prices at the end of 2022 are expected to continue in 2023.

A combination of stretched valuations, high debt and interest rate sensitivity in some euro area countries could amplify system-wide losses should an adverse scenario materialise. The rapid growth in RRE prices over the last few years has led to stretched valuations in some euro area countries, as house price dynamics have exceeded their fundamentals. In some euro area countries, the estimates of house price overvaluation in the fourth quarter of 2022 exceed 10%, increasing the risk of a price correction. At the same time, household indebtedness has remained high, increasing the risk of defaults or lower consumption in the event of adverse shocks, such as a significant increase in unemployment. However, these vulnerabilities vary across euro area countries (Chart 1.11, panel a). In countries where fixed-rate mortgages predominate, rising interest rates will mainly have a negative impact on the demand for new loans in the short term, while they will also push up household debt burdens in countries with a large share of variable-rate mortgages.

Chart 1.10

The housing cycle is turning, as new lending volumes and housing prices decline

Sources: ECB, Europace (Germany), Statistics Netherlands, Central Statistics Office (Ireland), Confidencial Imobiliário (sourced from BIS, Portugal), Arco Real Estate (Latvia), meilleursagents.com (France), Eurostat (euro area) and ECB calculations.

Notes: Panel b: data show developments in house price levels for euro area countries for which higher frequency data are available. For Germany, France, Latvia and Portugal, these data are not obtained from national statistical offices and might only reflect price developments for some segments of the RRE market. The data for Portugal show much stronger growth than the official data, the latter covering the universe of housing transactions. Similarly, the data included in the chart for Latvia reflect only changes in prices for standard apartments in the secondary market. The euro area index, which covers the universe of housing transactions in all euro area countries, is included in the chart as a reference despite being available only until end-December 2022.

Default rates on household mortgages are likely to rise in the event of an economic downturn, although a severe increase remains a tail risk. Simulations using loan-level data from securitised mortgage loans show that rising mortgage rates alone are unlikely to trigger a significant increase in defaults on mortgages. Estimated probabilities of default (PDs) for mortgages exhibit a moderate increase (around 0.2 percentage points) when considering only the impact of higher interest rates. By contrast, estimated PDs increase much more (by up to 5 percentage points) when considering different scenarios combining higher interest rates with higher unemployment, lower house prices and lower disposable incomes (Chart 1.11, panel b). The more severe scenarios remain a tail risk, as households have generally benefited from favourable labour market conditions and borrower-based macroprudential policy measures, and the increasing share of fixed-rate mortgages has made borrowers more resilient in many countries over recent years.

Chart 1.11

Accumulated RRE vulnerabilities are elevated in some euro area countries and could amplify losses in an adverse scenario

Sources: ECB, European DataWarehouse GmbH and ECB calculations.

Notes: Panel a: the latest data point available is used for countries for which Q4 2022 data are not available. The average valuation estimate is the simple average of the price-to-income ratio and an estimated Bayesian vector autoregression model. For details of the methodology, see the boxes entitled “Tools for detecting a possible misalignment of residential property prices from fundamentals”, Financial Stability Review, ECB, June 2011, and “A model-based valuation metric for residential property markets”, Financial Stability Review, ECB, November 2015. The measures of overvaluation used in the chart can be found in the ECB’s Statistical Data Warehouse. Overall, estimates from the valuation models are subject to considerable uncertainty and should be interpreted with caution. Alternative valuation measures can point to lower/higher estimates of overvaluation. Panel b: the estimations are based on securitised loan data available for Belgium, Spain, France, Ireland, Italy, the Netherlands and Portugal. As the chart uses information on securitised mortgage loans alone (potentially resulting in selection bias), it might not be an accurate reflection of national mortgage markets. PDs are estimated using data on the stock of loans reported in the database with reference date end-2020. The scenarios considered are as follows: Scenario 1: interest rates rising by 200 basis points from March 2023 level (baseline PD uses end-2021 interest rates); Scenario 2: interest rates rising by 150 basis points, RRE prices falling by 10%, real incomes falling by 10% and unemployment rates rising by 4 percentage points; Scenario 3: interest rates rising by 200 basis points, RRE prices falling by 15%, real incomes falling by 15% and unemployment rates rising by 6 percentage points.

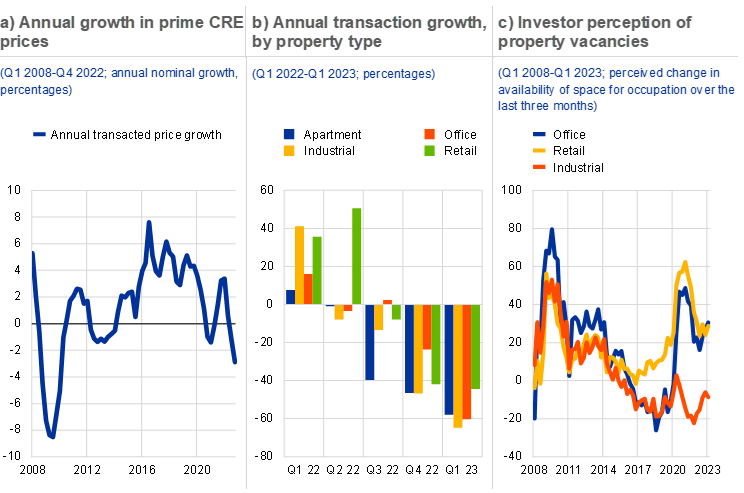

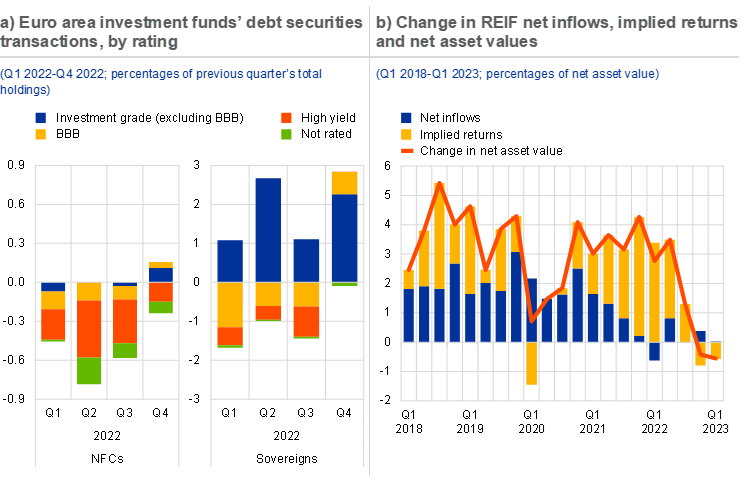

Commercial real estate (CRE) markets are suffering a clear downturn, with declining prices, falling investor demand and residual vulnerabilities persisting from the pandemic. Price growth in CRE markets fell sharply into negative territory at the end of 2022 (Chart 1.12, panel a). This was accompanied by a sharp drop in market activity, with 39% fewer transactions in euro area CRE markets in the fourth quarter of 2022 compared with a year earlier. This pace of decline is similar to that observed during the global financial crisis.[17] Unlike during the pandemic, this contraction in investor demand applies across all types of CRE assets, as investors in every segment are facing rising financing costs and macro-financial uncertainty (Chart 1.12, panel b). In addition, the impact of the current market environment may be amplified by vulnerabilities arising from structural changes in CRE markets. While market intelligence indicates that vacancy rates in euro area CRE markets are substantially lower than in the United States, tenant demand in the retail and office segments has not fully recovered from the pandemic, with vacancy rate indicators remaining substantially above pre-pandemic levels (Chart 1.12, panel c). Market intelligence indicates that these structural vulnerabilities are clustered in markets for lower quality CRE assets, as hybrid working and ESG concerns are concentrating investor and tenant demand in prime markets. More widely, flows to real estate funds have been slowing steadily, raising the risk of liquidity events among euro area real estate funds, especially in those countries where open-ended real estate funds dominate (Section 4.2).[18]

Chart 1.12

Prices and investor demand are falling across CRE markets, while structural vulnerabilities arising from the pandemic remain

Sources: ECB, RCA, RICS and ECB calculations.

Note: Panel b: data show the annual growth in euro area market transaction numbers. Note that the “Apartment” segment reflects purchases of large residential assets as shown in the RCA database. This will not include purchases of residential buildings by households, for example.

The speed and depth of the turn in euro area real estate markets will determine the potential for stress on the financial system, notably so if the correction turns disorderly. Affordability and demand in housing markets have decreased as financial conditions have tightened – thus far in an orderly manner for real estate markets which had seen considerable growth in previous years. Risks remain tilted to the downside, especially in those countries where debt levels are elevated and properties might be overvalued. The commercial segment has seen a steeper downturn, as the changing macro-financial environment compounds structural vulnerabilities that arose from the pandemic. A pronounced correction in real estate markets could have an adverse effect on the wider financial system and the real economy. Stress among institutional investors, who have seen marked increases in exposures to real estate, could amplify any correction in real estate markets (Box 2), while the construction sector could suffer in the event of a pronounced decline in demand for new houses.[19] At the same time, as banks have tightened financial conditions mainly in the light of their higher risk perceptions – with funding costs or balance sheet constraints playing a smaller role – macroprudential policy measures might still allow resilience to be enhanced in the banking sector without having procyclical effects (Chapter 5).

Box 2

Institutional investors and house price growth

The presence of institutional investors, particularly investment funds, in euro area residential real estate (RRE) markets has increased markedly in recent years. This growth may be attributed to a range of factors, including persistent flows into riskier asset classes such as real estate over the prolonged period of low interest rates (Chart A, panel a).[20] Yet the implications for housing markets, as well as for financial stability more broadly, remain largely unstudied. This issue is becoming more pressing as the real estate cycle turns and as rising interest rates reverse the dynamics of flows into real estate funds. It also raises concerns that vulnerabilities in the investment fund sector may amplify any real estate market correction.[21] This box provides an initial empirical examination of the role of institutional investors in euro area RRE markets and the possible implications for financial stability.

More2 Financial markets

2.1 Inflation persistence might trigger renewed market corrections

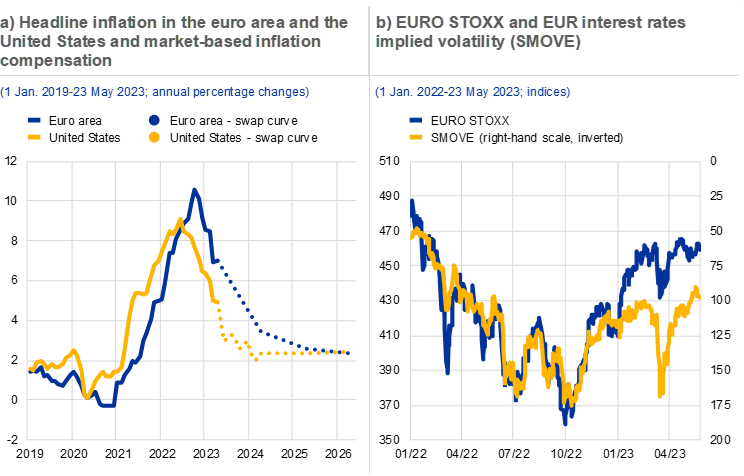

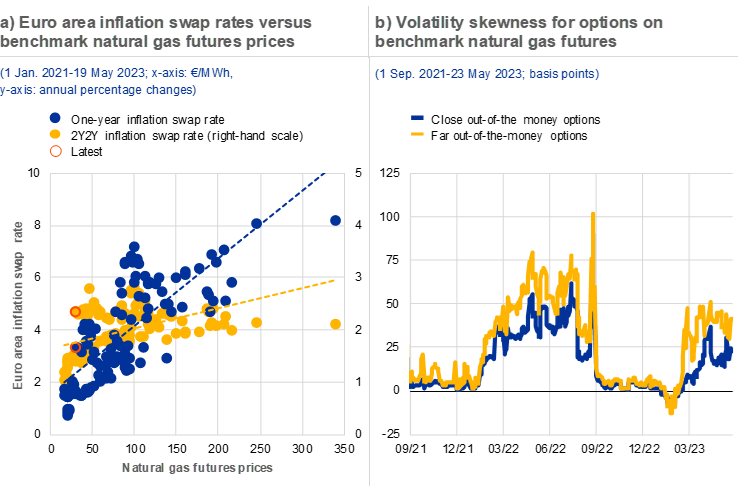

Elevated volatility in interest rate markets continues to weigh on wider financial market dynamics and may reveal both cyclical and structural vulnerabilities in the financial system. Rising inflation and market participants’ concerns that the major central banks could tighten monetary policy significantly in response were among the main drivers of the market correction seen in 2022. More recently, however, falling energy prices and the easing of supply chain bottlenecks have led to market expectations of a relatively rapid decline in inflation (Chart 2.1, panel a). This contributed to a decrease in implied rate volatility and, together with a stronger outlook for growth (Chapter 1), supported a substantial rebound of risky-asset valuations until early March (Chart 2.1, panel b). In contrast to 2022, the subsequent jump in volatility was related to banking sector stress in some mature economies combined with renewed recession fears. Looking forward, continued large swings in policy rate expectations may lead to a further deterioration of market liquidity conditions (Special Feature A) and may also challenge the liquidity preparedness of non-bank financial intermediaries with significant interest-rate derivative exposures (Chapter 4, Chapter 5 and Box 7).

Chart 2.1

Inflation expectations and interest rates volatility remain important drivers of market dynamics

Sources: Bloomberg Finance L.P. and ECB calculations.

Notes: Panel a: market-based inflation compensation based on euro area one-year, two-year and three-year HICP inflation swap rates and 1M-11M, one-year, two-year and three-year US CPI inflation swap rates. Panel b: SMOVE is the Merrill Lynch 1M EUR Swaption Volatility Estimate Index.

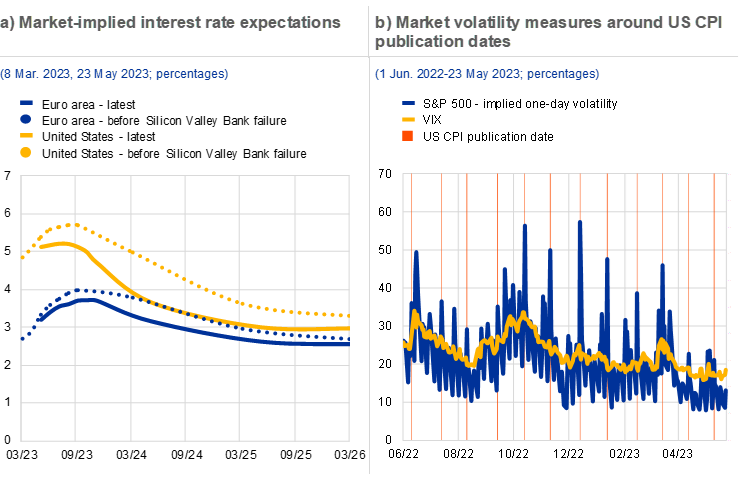

Inflation persistence could put pressure on risky-asset valuations. The stress in the banking sectors of some mature economies following the failure of Silicon Valley Bank has resulted in a substantial decline in market-based interest rate expectations, especially in the United States (Chart 2.2, panel a). Growing risk aversion has led some market participants to rebalance their portfolios towards safer assets, thereby pushing risk-free rates lower. In addition, investors have concluded that the stress might result in banks further tightening credit conditions (Chapter 3), which could have a disinflationary impact and might, therefore, also be relevant for monetary policy. However, if inflation remains at elevated levels, market expectations for future interest rates might be revised upwards once again. A combination of a tighter policy environment and renewed recession fears could put pressure on risky-asset valuations. Therefore, markets remain sensitive to inflation data, albeit to a lesser extent recently, as evidenced by short-term implied volatility which increases around CPI publication dates (Chart 2.2, panel b).

Chart 2.2

Inflation persistence might lead to a substantial jump in market volatility

Sources: Bloomberg Finance L.P. and ECB calculations.

Notes: Panel a: market expectations are based on the €STR OIS and the USD SOFR OIS implied forward one-month rates, which might also include a term premium component. Data before the failure of Silicon Valley Bank refer to 8 March 2023. Panel b: VIX refers to the Cboe Volatility Index. Implied one-day volatility is calculated as the average annualised one-day volatility implied from the last close prices of put and call options on the S&P 500, with a delta parameter of around 50% and one day to expiry.