Analytical indicators on carbon emissions

Our carbon emissions indicators provide information on the carbon intensity of the securities and loan portfolios of financial institutions, and on the financial sector’s exposure to counterparties with carbon-intensive business models. The carbon emissions indicators help users to assess the role of the financial sector in financing carbon-related activities, and thus to evaluate the associated transition risks with regard to sectors with carbon-intensive operations.

You will find on this page:

Indicators on financed emissions and weighted average carbon intensityIn focus: breakdown of annual changes in weighted average carbon intensityData accessTwo different data sources and methodologies are used to compile the indicators. Emissions indicators related to securities (both listed shares and debt) are derived from the Securities Holdings Statistics dataset and are calculated at corporate group level for the issuing non-financial corporations (NFCs). Indicators for emissions financed through loans to euro area counterparties are calculated at single entity and corporate group level and are based on the analytical credit dataset (AnaCredit).

Since their introduction in January 2023, the indicators have undergone various improvements. For example, their coverage has been significantly increased using additional imputation approaches. The indicator for loans at single entity level now covers 85% of outstanding debts held by euro area financial institutions. The methods currently applied for imputation are relatively simple, and some missing data are filled in using medians at various breakdowns.

In addition, a new data balancing approach has been implemented, again improving the indicator’s overall coverage. This is achieved by excluding NFCs from the sample if part of the required source data is unavailable, but retaining those NFCs for which the absence of data is likely to be due to divestment or investment activities.

Despite these improvements, there are still gaps in carbon emissions and – to a lesser extent – financial data for certain issuers and debtors. Coverage varies over time and across instruments and countries. Consequently, direct comparisons between carbon emissions indicators on securities and loans and across countries should be treated with caution. More sophisticated methods will be introduced in the future.

In view of these caveats, our carbon emissions indicators on securities and loans are published as analytical indicators for the time being. Therefore, they should be analysed with care and with due consideration of the data’s characteristics. Please consult the statistical paper for further details on the methodology, data sources, key results and limitations.

Indicators on financed emissions and weighted average carbon intensity

Carbon emissions by NFCs can be linked to the financing provided to them through both the equity and debt securities they issue and the loans they receive. In turn, holders of securities and creditors of loans in the financial sector finance these emissions via the respective funding channels.

The financed emissions (FE) indicator provides information on the financing of high-emitting economic activities. It tracks the amount of total carbon emissions from NFCs that can be linked to funding from financial institutions, based on a set of identifiable securities and loan portfolios.

Weighted average carbon intensity (WACI) is calculated as the greenhouse gas emissions of a debtor/issuer divided by the debtor’s/issuer’s total revenue and weighted by the value of the creditor’s/holder’s investment as a share of its total investment portfolio. Notably, as opposed to the FE indicator, the WACI indicator uses the total investment portfolio value of the creditor/security holder as a standardisation variable and thus takes an investor perspective. It therefore serves as a proxy for the exposure of a creditor/holder to climate transition risks and can be aggregated at country or euro area level.

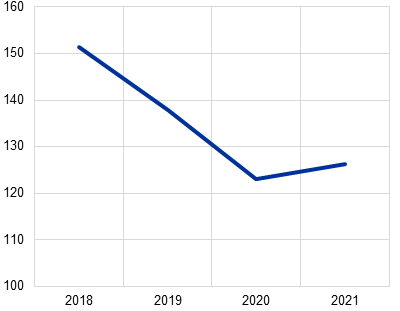

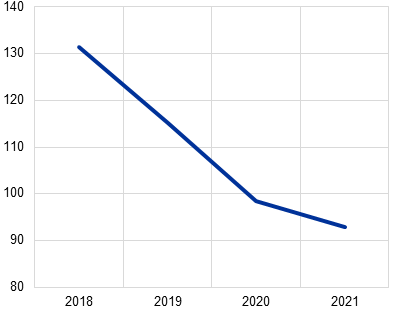

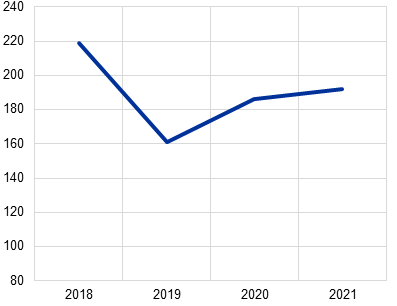

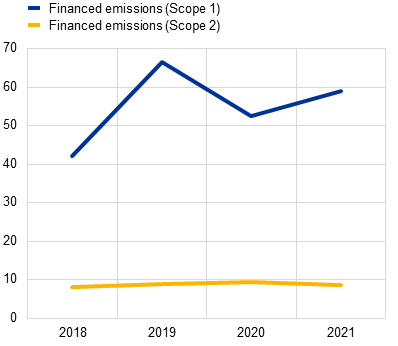

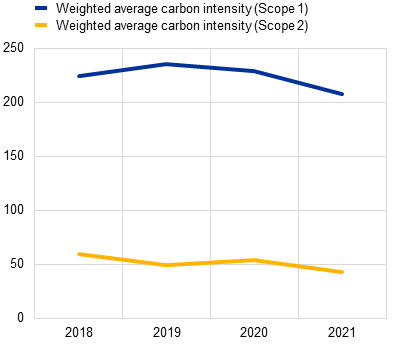

At single entity level, the FE indicator suggests that local, direct emissions financed through loans issued by euro area financial institutions have declined over the period for which data are available, albeit with a slight rebound after the pandemic (Chart 1, panel a). The trend is less clear for loan-related emissions calculated at corporate group level (Chart 2, panel a). Looking at securities holdings at corporate group level, the indicator shows that direct (Scope 1) emissions are increasing, despite a dip in 2020, and indirect (Scope 2) emissions are stable (Chart 3, panel a).

The WACI indicator is trending downwards at both single entity and corporate group level, with a more pronounced decline observed for the loan portfolio than for the securities portfolio (Charts 1, 2 and 3; panel b).

Chart 1

Carbon emissions indicators on loans from euro area banks, single entity level

a) Financed emissions (FE) | b) Weighted average carbon intensity (WACI) |

|---|---|

(million tonnes of Scope 1 CO2 emissions) | (tonnes of Scope 1 CO2 emissions per million EUR of revenue) |

|  |

Sources: European System of Central Banks (ESCB) calculations based on data from AnaCredit, Register of Institutions and Affiliates Database (RIAD), EU Emissions Trading System and Eurostat air emissions accounts.

Note: WACI is adjusted for inflation and exchange rate effects.

Chart 2

Carbon emissions indicators on loans from euro area banks, corporate group level

a) Financed emissions (FE) | b) Weighted average carbon intensity (WACI) |

|---|---|

(million tonnes of Scope 1 CO2 emissions) | (tonnes of Scope 1 CO2 emissions per million EUR of revenue) |

|  |

Sources: ESCB calculations based on data from AnaCredit, RIAD and Institutional Shareholder Services (ISS).

Note: WACI is adjusted for inflation and exchange rate effects.

Chart 3

Carbon emissions indicators on securities portfolios of euro area deposit-taking corporations, corporate group level

a) Financed emissions (FE) | b) Weighted average carbon intensity (WACI) |

|---|---|

(million tonnes of CO2) | (tonnes of CO2 emissions per million EUR of revenue) |

|  |

Sources: ESCB calculations based on data from RIAD, Centralised Securities Database (CSDB), Securities Holding Statistics (SHSS) and ISS.

Notes: Securities include listed shares and debt securities. “Deposit-taking corporations” does not include central banks. WACI is adjusted for inflation and exchange rate effects.

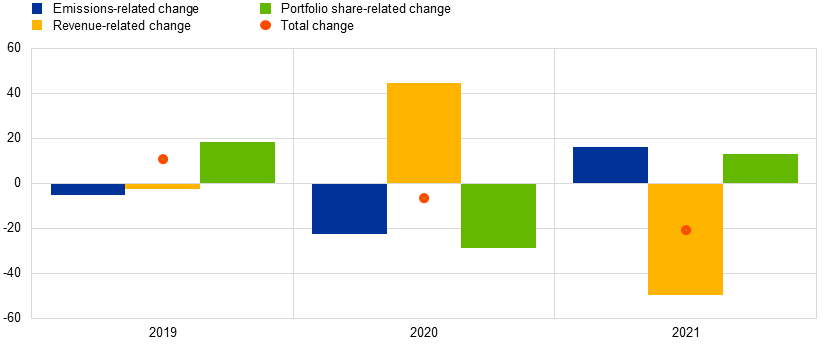

In focus: breakdown of annual changes in weighted average carbon intensity

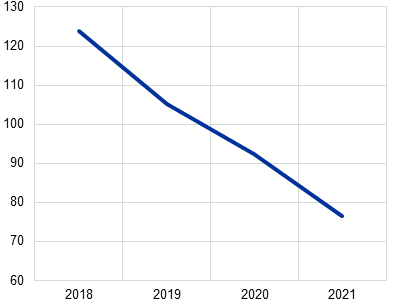

The latest data release includes a breakdown of annual changes in the WACI indicator. This allows users to identify the key drivers of changes, including the emissions of underlying assets, as well as firms’ financial characteristics (such as revenue) and investment decisions. Notably, a reduction in revenue from one year to the next corresponds to a positive revenue component in the WACI breakdown and vice versa. In other words, when revenue decreases, carbon intensity increases.

Chart 4 shows that emissions and revenue both decreased from 2019 to 2020, possibly owing to disruptions in the economy as a result of pandemic-related restrictions. Both emissions and revenues increased from 2020 to 2021, which may have been due to the economic recovery after the restrictions were lifted. The breakdown of the WACI of securities portfolios also reveals that revenue has been the largest driver of changes over the years studied.

Time series breakdowns are also available for other carbon emissions indicators, i.e. the financed emissions and carbon footprint indicators. The breakdown findings are sensitive to data outliers and the imputation approaches applied. Further improvements are foreseen and may lead to revisions in the future.

Chart 4

Breakdown of annual changes in weighted average carbon intensity of securities portfolios of euro area deposit-taking corporations, corporate group level

(change in tonnes of Scope 1 CO2 emissions per million EUR of revenue compared with the previous year)

Sources: ESCB calculations based on data from RIAD, CSDB, SHSS, and ISS.

Notes: Securities include listed shares and debt securities. “Deposit-taking corporations” does not include central banks. WACI is adjusted for inflation and exchange rate effects.

Data access

The underlying data for the analytical indicators on carbon emissions are available as compressed csv files below.

To receive updates on methodology and data quality, subscribe to our climate data information service.

Data for the analytical indicators on carbon emissions