- ECB OP-ED

Climate change and monetary policy

Contribution by Isabel Schnabel, Member of the Executive Board of the ECB, to the International Monetary Fund’s magazine Finance and Development

Frankfurt am Main, 31 August 2021

Central banks must do their part in fighting global warming

The devastating effects of climate change are becoming increasingly evident.[1] Temperature records are being shattered again this year—in Canada, the United States, arctic Russia and central Asia. Globally, the past six years have been the hottest six on record, and temperatures in 2020 exceeded the 1850-1900 average by 1.25°C (2.25°F).

Exactly how climate change will affect the economy and the financial system is uncertain. The European Central Bank (ECB) is currently trying to quantify the consequences of climate change on companies and banks through an economy-wide stress test. The exercise, the results of which will be published soon, draws on a range of climate scenarios developed by the Network for Greening the Financial System (NGFS), a global association of central banks and supervisory authorities advocating a more sustainable financial system. These scenarios are used to assess the potential impact of climate change on roughly four million companies worldwide and nearly 2,000 banks in the euro area.

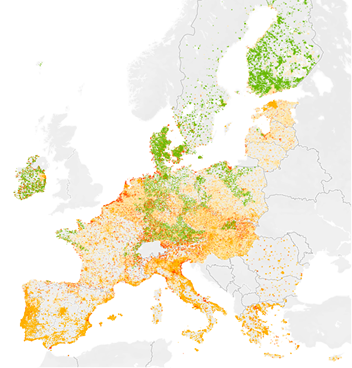

Preliminary results show that without further mitigation policies physical risks from climate change—heat waves, windstorms, floods, droughts, and the like—will probably increase substantially (Alogoskoufis and others, 2021). The average default probability of the credit portfolios of the 10 percent of euro area banks most vulnerable to climate risks could rise substantially—up 30 percent by 2050. Firms across Europe are exposed to physical risks from climate change, although risks are distributed unevenly (see Chart 1).

Chart 1

Corporate exposures to physical risks within Europe

(Maximum risk level of each firm)

Source: Alogoskoufis and others, (2021).

Note: Green represents no significant exposure. Color shifts as exposure increases to red, which represents high present / projected exposure. Gray indicates no information is available.

Compared with these risks, the costs of transitioning to a carbon-neutral economy appear relatively contained (de Guindos, 2021). There are clear benefits to acting early. The transition may be costly in the short run, but upfront investment will likely be more than offset over the long run as firms avoid the aggravation of physical risks and reap the economic rewards of mitigation. Based on a range of different models, recent IMF research echoes these findings (Barrett and others, 2020). The resulting message is simple: now is the time to undertake ambitious and broad-based action to ensure an orderly transition and mitigate the effects of climate change.

The existential threat posed by climate change implies that all policymakers must contemplate how to contribute to the fight against global warming. While governments are the primary actors, a consensus is building that central banks cannot stand on the sidelines. The NGFS, established with eight members in 2017, now has 95 members and 15 observers, including all major central banks. In 2019, the IMF joined as an observer.

The main reason that central banks should increase their attention to climate change is the likelihood it will affect their ability to achieve their mandates. The ECB’s primary mandate is price stability, an objective shared by most central banks. Evidence suggests that climate change has crucial implications for price stability and also affects other areas of central bank competence, such as financial stability and banking supervision.

Climate change affects price stability through at least three channels.

First, the consequences of climate change might impair the transmission of central banks’ monetary policy measures to the financing conditions faced by households and firms, and hence to consumption and investment. Losses from materializing physical risks or stranded assets (such as oil reserves that will not be tapped as the world moves away from fossil fuels) could weigh on financial institutions’ balance sheets, reducing the flow of credit to the real economy. In addition, the longer climate change is insufficiently addressed, the greater the risks to policy transmission from a sharp and abrupt rise in credit risk premiums. Central banks themselves are exposed to potential losses—from securities acquired in asset purchase programs and on the collateral provided by counterparties in monetary policy operations.

Second, climate change could further diminish the space for conventional monetary policy by lowering the equilibrium real rate of interest, which balances savings and investment. For example, higher temperatures might impair labor productivity or increase rates of morbidity and mortality. Productive resources might be reallocated to support adaptation measures, while climate-related uncertainty may increase precautionary savings and reduce incentives to invest. Collectively, these factors can reduce the real equilibrium interest rate and therefore increase the likelihood that a central bank’s policy rate will be constrained. But this is far from certain; equilibrium rates might instead rise because of green innovation and investment and chart a path out of the current low-inflation, low-interest-rate environment.

Third, both climate change and policies to mitigate its effects can have a direct impact on inflation dynamics. Recent history confirms that a greater incidence of physical risk can cause short-term fluctuations in output and inflation that amplify longer-term macroeconomic volatility. Unless mitigation policies are more forceful, the risk of even larger climate shock grows, with more persistent consequences for prices and wages. In addition, even mitigation policies, such as carbon pricing programs, can affect price stability, potentially precipitating large and long-lasting trends in relative prices and driving a wedge between headline and core measures of inflation.

As a result of these factors, central banks are starting to integrate climate-related risks into their monetary policy operations.

Toward carbon neutrality

Climate change considerations formed an integral part of the ECB’s monetary policy strategy review that concluded in July 2021. We published an ambitious action plan and a detailed roadmap confirming our strong commitment to further incorporating climate change considerations into our monetary policy framework. Our comprehensive strategy review demonstrated that there are many areas in which central banks can contribute to the fight against global warming, and further areas may open up in the future.

By thoroughly analyzing potential actions and developing ways to make them operational, for example regarding the classification of more or less “green” activities, the ECB and other central banks can act as catalysts for promoting a more sustainable financial system. Moreover, by pre-announcing changes to our operational framework, we can encourage market participants to speed up the transition to carbon neutrality.

As part of its action plan, the ECB will embed climate change considerations into its monitoring of the economy—for example by bolstering analytical capacity in climate-related macroeconomic modelling and forecasting.

As part of its statistical function, the ECB will develop new climate-related statistical indicators, for example regarding the classification of green instruments, the carbon footprint of financial institutions’ portfolios and their exposures to climate-related physical risks.

In addition, the ECB is advocating climate disclosures that are internationally consistent and auditable. The ECB will introduce disclosure requirements for private sector assets, either as a new eligibility criterion or as basis for differentiated treatment for collateral purposes and asset purchases, which could help to speed up disclosure in the corporate sector. The ECB will start disclosing climate-related information on its non-monetary policy portfolios, and its corporate sector purchase program (CSPP) by the first quarter of 2023.

Starting in 2022, the ECB will conduct climate stress tests of the Eurosystem balance sheet, using the methodology of its ongoing economy-wide climate stress test. The ECB will further perform a review to gauge the extent to which credit ratings and asset valuations under our collateral framework reflect climate-related risk exposures.

The ECB will also incorporate climate-related criteria into its corporate bond purchases. In the past, allocations of private sector bonds have generally been guided by the principle of market neutrality—in which purchases reflect the composition of the overall market— to avoid relative price distortions.

However, emission-intensive sectors tend to have large fixed long-term capital investment needs and generally issue bonds more frequently. As a result, CSPP-eligible debt and the ECB’s portfolio exhibit high emission intensity (Papoutsi and others, 2021). In other words, adherence to the market neutrality principle is likely to perpetuate pre-existing market failures or even exacerbate market inefficiencies that give rise to a suboptimal allocation of resources.

It seems appropriate, then, to replace the market neutrality principle with one of market efficiency that more fully incorporates the risks and societal costs associated with climate change (Schnabel, 2021), taking into account the alignment of issuers with EU legislation implementing the Paris Agreement.

With its new strategy and action plan, the ECB acknowledges that climate change is a global challenge that requires an urgent policy response, including from central banks. Within our mandate, we are determined to contribute to accelerating the transition to a carbon-neutral economy.

References:

Alogoskoufis, S. et al. (2021), “Climate-related risks to financial stability”, Financial Stability Review, ECB, May.

Barrett, P. et al. (2020), “Mitigating climate change – growth- and distribution-friendly strategies”, World Economic Outlook, Chapter 3, International Monetary Fund, October.

de Guindos, L. (2021), “Shining a light on climate risks: the ECB’s economy-wide climate stress test”, The ECB Blog, March.

Papoutsi, M., Piazzesi, M. and Schneider, M. (2021) “How unconventional is green monetary policy?”, JEEA-FBBVA Lecture at ASSA (January 2021), Working paper.

Schnabel, I. (2021), “From market neutrality to market efficiency”, Welcome address at the ECB DG-Research Symposium “Climate change, financial markets and green growth”, Frankfurt am Main, 14 June.

- I would like to thank Miles Parker for his assistance in preparing this article.