- 19 DECEMBER 2023 · RESEARCH BULLETIN NO. 114

Hawkish or dovish central bankers: do different flocks matter for fiscal shocks?

This column presents evidence on the role that US monetary policy plays in how fiscal spending affects the economy. A dovish Federal Open Market Committee (FOMC) delays policy rate increases, while a hawkish FOMC tightens monetary policy more promptly, following increased fiscal spending. We show that the dovish response supports fiscal expansions. In contrast, the hawkish response results in a GDP decline but effectively controls inflation expectations.

Tracking historical fluctuations in systematic monetary policy

Central banks make monetary policy decisions in response to economic conditions. These responses are called systematic monetary policy or the “policy rule”. In theory, systematic monetary policy shapes the transmission of macroeconomic shocks, such as fluctuations in oil prices, technological changes or shifts in fiscal policy. Yet, gauging these causal effects in the data without imposing strong assumptions is challenging. In the words of Bernanke, Gertler and Watson (1997), “using time-series evidence to uncover the effects of monetary policy rules on the economy is a daunting task.”

In Hack, Istrefi and Meier (2023), we tackle this challenge. Our measure of systematic monetary policy reflects the historical composition of hawks and doves in the Federal Reserve's FOMC since 1960. The classification of FOMC members as hawks or doves is based on narratives from news archives, portraying them as either more concerned about inflation (hawks) or more concerned about supporting employment and growth (doves), as in Istrefi (2019).[2] To address concerns that economic conditions or political developments may influence the balance of hawks and doves in the FOMC, we exploit the rotation of voting rights in the FOMC.[3] Specifically, we exploit the fact that four out of 12 voting rights in the FOMC are mechanically rotated each year among 11 Presidents of the Federal Reserve Banks.[4] This introduces exogenous variation in the FOMC’s hawk-dove balance, enabling us to identify the causal effects of systematic monetary policy in the United States. The idea is that when FOMC members rotate in and out, the mix of hawks and doves in the FOMC is affected for reasons unrelated to the macroeconomy.

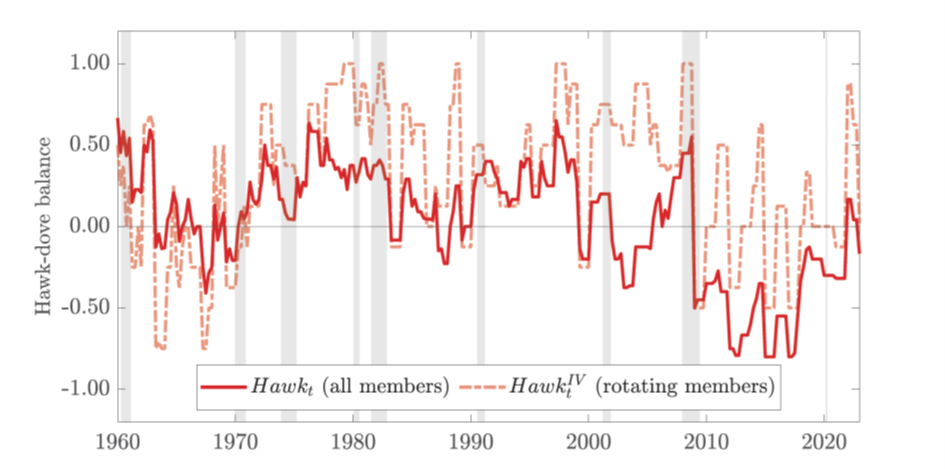

As shown in Chart 1, both the overall hawk-dove balance () and the FOMC rotation instrument () display large fluctuations over time, mainly reflecting the turnover of members and the rotation of voting rights. While the Federal Reserve's response to macroeconomic shocks is highly sophisticated and depends on various economic factors, we argue that our hawk-dove balance corresponds well to narratives of monetary policy in the United States (Istrefi, 2019; Hack, Istrefi and Meier, 2023).

Chart 1

Historical variation in the Federal Reserve’s systematic monetary policy represented by the FOMC hawk-dove balance

Source: Hack, Istrefi, and Meier (2023).

Notes: The solid red line shows the quarterly time series of the aggregate hawk-dove balance () of the FOMC from Q1 1960 until Q1 2023. The balance is an aggregate of the individual policy preferences of FOMC members in period t, where +1 means all FOMC members are hawks and -1 means all FOMC members are doves. The dashed red line shows the aggregate hawk-dove balance of the sub-group of rotating Presidents of Federal Reserve Banks (HawkIV) with voting rights in period t. Grey bars indicate recessions as identified by the National Bureau of Economic Research (NBER).

Fiscal spending shocks and the response of different monetary policy flocks

How monetary policy reacts to fiscal policy is considered crucial for the effects of fiscal policy, not only in policy debates (e.g. Blinder, 2022) but also in economic theory (e.g. Woodford, 2011; Farhi and Werning, 2016). Recent expansions in government spending during the COVID-19 pandemic (Baldwin and Weder di Mauro, 2020), the war in Ukraine (Trebesch et al., 2023; Chebanova, Faryna and Sheremirov, 2023) or the recent inflation surge (Dao et al., 2023) make this question highly relevant for current policymaking. Despite the importance of the debate, we lack direct causal evidence on how systematic monetary policy shapes the effects of government spending shocks.

We assess the effects of US government spending shocks on the economy accounting for the hawkishness of the FOMC. In our regression model, macroeconomic variables such as real GDP, government spending, the Federal Funds Rate or inflation expectations may respond to the spending shock and the interaction between the spending shock and the hawk-dove balance in the FOMC. To identify the causal effects of the hawk-dove balance, we use our FOMC rotation instrument. Our spending shocks are discretionary changes in military spending due to unforeseen military build-ups (or “build downs”) between 1960 and 2014, taken from Ramey (2011) and Ramey and Zubairy (2018).

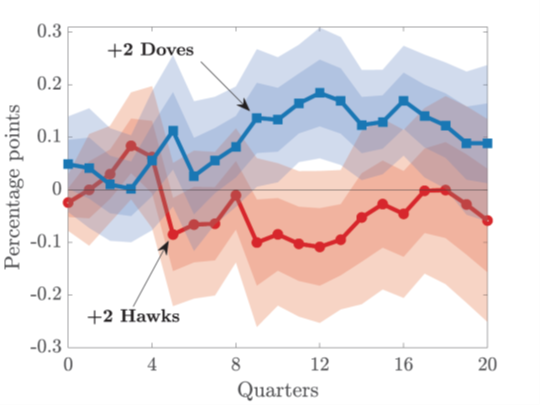

Chart 2 compares the estimated effects of an expansionary government spending shock under a hawkish and a dovish FOMC. The impact of this shock on real GDP is highly dependent on the hawkishness of the FOMC.[5] When the FOMC is more dovish (+2 doves relative to the average FOMC), higher government spending leads to a significant GDP expansion. Conversely, when the FOMC is more hawkish (+2 hawks), increased spending does not lead to a GDP expansion but rather a decline in GDP.

Chart 2

Comparing the effects of an expansionary government spending shock under a hawkish and a dovish FOMC

Real GDP

Federal Funds Rate

Inflation expectations

Source: Hack, Istrefi and Meier (2023).

Notes: The chart shows the responses of real GDP, the Federal Funds Rate and inflation expectations to an expansionary military spending shock, corresponding to 1% of GDP, conditional on systematic monetary policy. The line in red (blue) captures the state-dependent responses when the hawk-dove balance exceeds the sample average by two hawks (doves). The shaded areas indicate the 68% and 95% confidence bands.

The striking differences in the GDP response align with the reaction of the policy rate. Under a hawkish FOMC, the Federal Funds Rate increases in response to the spending shock, effectively preventing a rise in inflation expectations. Conversely, with a more dovish FOMC, the Federal Funds Rate initially falls, accompanied by a rise in inflation expectations. A dovish FOMC thus delays policy tightening in response to fiscal expansion.

Finally, in assessing the effectiveness of fiscal spending, a standard measure is the fiscal multiplier, indicating the dollar increase in GDP per additional dollar of government spending. With a hawkish FOMC, the multiplier is insignificant, with estimates at or below 0. In contrast, under a dovish FOMC, the multiplier is highly statistically significant, ranging between 2 and 3.

Don’t reckon without the hawks and doves

Our findings highlight the power of monetary policy to steer the macroeconomy. Consequently, the effects of fiscal policy cannot be gauged reliably without accounting for the response of monetary policy. Applied to recent years, our findings suggest that the combination of fiscal expansions in 2020 and a dovish FOMC may have played a role in the robust recovery in US GDP.

References

Abrams, B. (2006): “How Richard Nixon Pressured Arthur Burns: Evidence from the Nixon Tapes,” Journal of Economic Perspectives, Vol. 20, pp. 177–188.

Baldwin, R. and Weder di Mauro, B. (eds.) (2020), “Mitigating the COVID economic crisis: Act fast and do whatever it takes”, VoxEU.org eBook, CEPR.

Bernanke, B. S. Gertler, M., and Watson, M. (1997), “Systematic Monetary Policy and the Effects of Oil Price Shocks,” Brookings Papers on Economic Activity, Vol. 28, No 1, pp. 91-157.

Blinder, A. S. (2022), A Monetary and Fiscal History of the United States, 1961-2021, Princeton University Press.

Chebanova, M., Faryna, O. and Sheremirov, V. (2023), “The Economic Effects of Military Support for Ukraine: Evidence from Fiscal Multipliers in Donor Countries”, VoxEU column, VoxEU.org, 20 June.

Dao, M., Dizioli, A., Jackson. C., Gourinchas, P. and Leigh, D. (2023), “Unconventional Fiscal Policy in Times of High Inflation,” IMF Working Paper Series, No 178.

Hack, L., Istrefi, K. and Meier, M. (2023), ”Identification of Systematic Monetary Policy”, Working Paper Series, No 2851, ECB, October and CEPR Discussion Papers No 17999, CEPR Press, Paris & London.

Istrefi, K. (2019), “In Fed Watchers’ Eyes: Hawks, Doves and Monetary Policy,” Working Papers, No 725, Banque de France.

Farhi, E., and Werning, I. (2016), “Fiscal Multipliers: Liquidity Traps and Currency Unions,” Handbook of Macroeconomics, Elsevier, Vol. 2, pp. 2417-2492.

Ramey, V. A. (2011), “Identifying Government Spending Shocks: It’s all in the Timing,” Quarterly Journal of Economics, Vol. 126, pp. 1-50.

Ramey, V. A. and Zubairy, S. (2018), “Government Spending Multipliers in Good Times and in Bad: Evidence from U.S. Historical Data,” Journal of Political Economy, Vol. 126, pp. 850-901.

Trebesch, C., Antezza, A., Bushnell, K., Frank, A. and Frank, P., Franz, L., Kharitonov, I., Kumar, B., Rebinskaya, E. and Schramm, S. (2023), "The Ukraine Support Tracker: Which countries help Ukraine and how?," Kiel Working Papers, No 2218, Kiel Institute for the World Economy (IfW Kiel).

Woodford, M. (2011), “Simple Analytics of the Government Expenditure Multiplier,” American Economic Journal: Macroeconomics, Vol. 3, pp. 1-35.

This article was written by Lukas Hack (University of Mannheim), Klodiana Istrefi (Senior Economist, Directorate General Research, European Central Bank and CEPR) and Mathias Meier (University of Mannheim). The authors gratefully acknowledge the comments of Gareth Budden, Michael Ehrmann, Alex Popov and Zoë Sprokel. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank or the Eurosystem.

The Federal Reserve System has a dual mandate – pursuing the economic goals of maximum employment and price stability.

For example, Abrams (2006) documents the influence of the Nixon administration on the FOMC in the period before the 1972 election.

The seven members of the Board of Governors and the president of the Federal Reserve Bank of New York are permanent voters in the FOMC. While non-voting Federal Reserve Bank (FRB) presidents attend the FOMC meetings and participate in the discussions, we focus on the voting FOMC, the decision-making body, in line with the literature that studies central bank decision-making by committees.

The responses correspond to a shock raising expected military spending over the next five years by 1% of potential GDP.