- STATISTICAL RELEASE

Euro area insurance corporation statistics: first quarter of 2021

2 June 2021

- Total assets of euro area insurance corporations amounted to €9,040 billion in first quarter of 2021, €14 billion higher than in fourth quarter of 2020

- Total insurance technical reserves of euro area insurance corporations dropped to €6,797 billion in first quarter of 2021, down €39 billion from fourth quarter of 2020

Total assets of euro area insurance corporations increased to €9,040 billion in the first quarter of 2021, from €9,026 billion in the fourth quarter of 2020. Debt securities accounted for 39.6% of the sector's total assets in the first quarter of 2021. The second largest category of holdings was investment fund shares (28.1%), followed by equity (11.1%) and loans (7.3%).

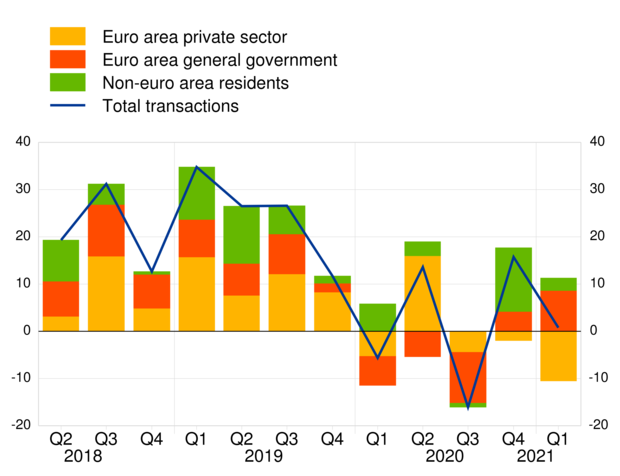

Holdings of debt securities decreased to €3,578 billion at the end of the first quarter of 2021 from €3,653 billion at the end of the previous quarter. Net purchases of debt securities amounted to €1 billion in the first quarter of 2021; price and other changes amounted to -€76 billion (see Chart 1). The year-on-year growth rate of debt securities held was 0.4%.

Looking at holdings by issuing sector, the annual growth rate of debt securities issued by euro area general government was -0.2% in the first quarter of 2021, with net purchases in the quarter amounting to €9 billion. As regards debt securities issued by the private sector, the annual growth rate was -0.1%, and quarterly net sales amounted to €11 billion. For debt securities issued by non-euro area residents, the annual growth rate was 2.7%, with quarterly net purchases of €3 billion.

Chart 1

Insurance corporations' holdings of debt securities by issuing sector

(quarterly transactions in EUR billions; not seasonally adjusted)

Turning to insurance corporations' holdings of investment fund shares, these increased to €2,536 billion in the first quarter of 2021, from €2,472 billion in the previous quarter, with net purchases of €38 billion and price and other changes of €26 billion (see Chart 2). The year-on-year growth rate in the first quarter of 2021 was 4.8%.

The annual growth rate of euro area money market fund shares held by insurance corporations was ‑7.5% in the first quarter of 2021, with net sales in the quarter amounting to €1 billion. As regards holdings of euro area non-money market fund shares, the annual growth rate was 5.6%, with quarterly net purchases amounting to €36 billion. For investment fund shares issued by non-euro area residents, the annual growth rate was 5.7%, with quarterly net purchases of €2 billion.

Chart 2

Insurance corporations' holdings of investment fund shares by issuing sector

(quarterly transactions in EUR billions; not seasonally adjusted)

In terms of main liabilities, total insurance technical reserves of insurance corporations amounted to €6,797 billion in the first quarter of 2021, down from €6,837 billion in the fourth quarter of 2020 (see Annex, Table 1). Life insurance technical reserves accounted for 90.5% of total insurance technical reserves in the first quarter of 2021. Unit-linked products amounted to €1,428 billion, accounting for 23.2% of total life insurance technical reserves.

Euro area insurance corporations' total written premiums declined to €1,095 billion in 2020 (corresponding to 16.6% of total insurance technical reserves at end-2019), down from €1,125 billion in 2019 (18.8%). In the same period, claims increased from €824 billion (13.8%) to €835 billion (12.7%) and acquisition expenses rose marginally from €117 billion (2.0%) to €119 billion (1.8%).

For queries, please use the statistical information request form.

Notes:

- "Other assets" includes currency and deposits, insurance technical reserves and related claims, financial derivatives, non-financial assets and remaining assets.

- "Private sector" refers to euro area excluding general government.

- "Investment funds" includes money market funds and non-money market funds.

- Hyperlinks in the main body of the statistical release and in the annex table lead to data that may change with subsequent releases as a result of revisions. Figures shown in the annex table are a snapshot of the data as at the time of the current release.

- 2 June 2021