Key linkages between banks and the non-bank financial sector

Published as part of the Financial Stability Review, May 2023.

Banks are connected to non-bank financial intermediation (NBFI) sector entities via loans, securities and derivatives exposures, as well as funding dependencies. Linkages with the NBFI sector expose banks to liquidity, market and credit risks. Funding from NBFI entities would appear to be the most likely and strongest spillover channel, given that NBFI entities maintain their liquidity buffers primarily as deposits and very short-term repo transactions with banks. At the same time, direct credit exposures are smaller and are often related to NBFI entities associated with banking groups. Links with NBFI entities are highly concentrated in a small group of systemically important banks, whose sizeable capital and liquidity buffers are essential to mitigate spillover risks.

The elevated vulnerabilities in the NBFI sector, which have been flagged repeatedly in previous issues of the FSR, raise questions about the risk of spillovers to the euro area banking sector. Since the global financial crisis, growth in the euro area NBFI sector has far outstripped growth in its banking sector.[1] This trend has been beneficial in that it has led to a diversification of sources of finance in the economy, although the NBFI sector is marked by material liquidity and leverage risks. Banks have maintained their central role in financial markets as the main market-makers, clearing counterparties and gateways for NBFI entities. Recent episodes such as the failure of Archegos Capital Management have been idiosyncratic and largely contained, but they show that spillovers from such entities to banks may be material. This special feature examines the linkages which enable financial stress to be transmitted from the NBFI sector to banks, starting with asset-side exposures and funding dependencies, and followed by linkages in the derivatives markets and indirect linkages through overlapping securities portfolios.[2] The special feature identifies exposure concentrations and ranks the spillover channels in terms of their systemic relevance.

1 Euro area banks’ asset exposures to the NBFI sector

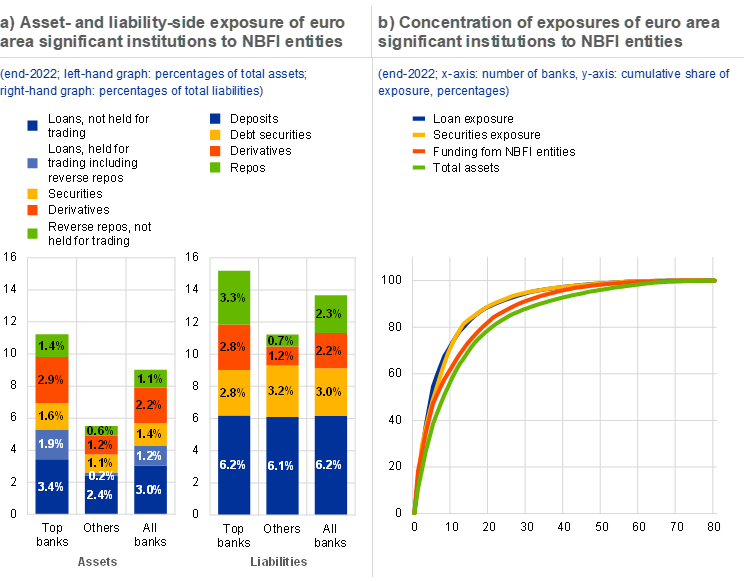

Banks’ asset exposures to NBFI entities are considerable and, on average, account for about 9% of significant institutions’ total assets. These asset-side exposures consist primarily of loans, with securities playing a more limited role (Chart B.1, panel a). The credit risk associated with these exposures tends to be low, thanks to the large share of collateralised lending in the loan exposure and investment grade-rated instruments in the securities holdings. Over the past three years, banks’ loans to NBFI entities and holdings of securities issued by NBFI entities have increased materially, even if at a slower pace than total assets. Large banks are more strongly linked to NBFI entities, as 80% of funding and about 90% of asset exposures are concentrated in fewer than 20 banks (Chart B.1, panel b).

Chart B.1

Liability-side exposure to NBFI entities is larger than asset-side exposure, and both are concentrated in large, complex banks

Sources: ECB and ECB calculations.

Notes: The analysis is based on samples of 98 banks (panel a) and 80 banks (panel b) for Q4 2022. Top banks include the 13 euro area banks that are among the ten banks most exposed to NBFI entities in terms of either loan or securities exposure, as shown in panel b. The value of derivatives is reported using carrying amounts. Loans and reverse repos classified as “held for trading” are presented together due to the scope limitations of supervisory reporting. More granular data indicate that reverse repos account for a large share of this item.

Banks have less economic exposure to NBFI entities than the headline data would imply, as many NBFI entities are part of banking groups. The top hundred NBFI entities account for about 46% of total bank exposure to this sector. 64 of these entities are connected to euro area banking groups, reflecting ownership linkages and sponsorship of special-purpose vehicles. Based on AnaCredit data and supervisory large exposure reporting, a sizeable part of lending to NBFI entities is extended to securities firms owned by banks, which often benefit from implicit support from the parent bank. Some of the large exposures also arise from holdings of securitisations as well as repo and liquidity lines made available to securitisation vehicles.[3] Similarly, banks often hold securities issued by financial conduits. Although these are classified as NBFI entities for statistical purposes, they are, in economic terms, equivalent to exposures to the bank sponsoring the conduit. Some of these linkages remain within the same consolidated banking group.

2 Euro area banks’ reliance on funding from NBFI entities

The NBFI sector is an important source of funding for euro area banks. The total share of funding from NBFI entities in bank liabilities amounts to about 14%, substantially higher than the total share of exposures to such entities in bank assets. Unsecured deposits account for the largest part of funding, followed by debt securities funding and repo funding (Chart B.1, panel a). The share of funding from NBFI entities is higher and more diversified for larger banks than for smaller banks.

Chart B.2

Banks’ repo funding is highly concentrated in a small number of institutions and is subject to high rollover risk

Sources: ECB and ECB calculations.

Notes: The analysis is based on a sample of 120 euro area banks with 1,529 counterparties. Top borrowing banks are 13 euro area large banks, including all global systemically important banks (G-SIBs) based in the euro area. On the lender side, “Top 10% lenders” are the largest bank funding providers within a given NBFI sector. Data represent median of daily values over the first quarter of 2023. Transactions include the stock of repurchase agreements and buy/sell-backs. OFIs stands for other financial institutions; IFs stands for investment funds; FAs stands for financial auxiliaries; ICPFs stands for insurance companies and pension funds; MMFs stands for money market funds; ON stands for overnight.

Although small relative to retail and corporate deposits, deposit funding from NBFI entities can be particularly vulnerable to changes in market conditions. About half of all deposits from NBFI entities are held with banks for non-operational purposes: these deposits are not related to clearing, custody or cash management and can be withdrawn freely.[4] They often reflect the liquidity buffers of the NBFI entities and would typically be the first line of defence for meeting redemptions and other cash needs. They would be the main vehicle for transmitting liquidity shocks from the NBFI sector to the banking sector.

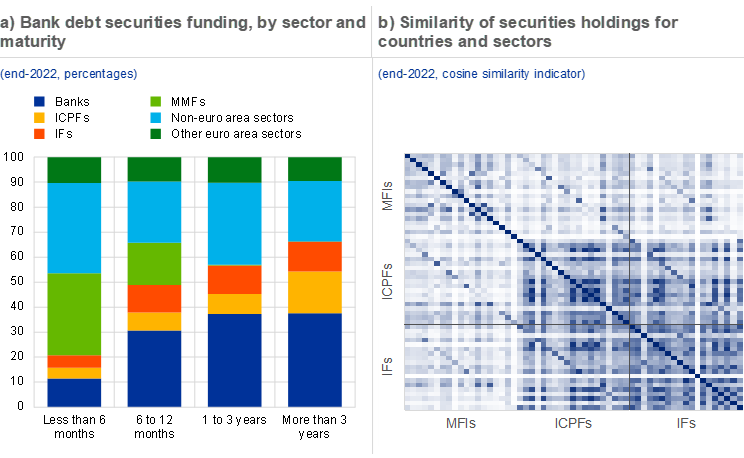

NBFI entities also play a major role as providers of repo funding to banks. In the last quarter of 2022, almost half of all repo funding to banks came from these entities. The share of euro area bank repo funding from non-banks has fluctuated between 41% and 54% since 2015. Investment funds and other financial institutions are the largest group of NBFI entities providing repo funding to banks (Chart B.2, panel a), with French, German and Dutch banks being the main recipients.

The bulk of the NBFI sector’s repo funding to banks has a very short maturity. Around half the repo funding provided by NBFI entities consists of overnight transactions, while almost 80% of volumes have a maturity of one month or less (Chart B.2, panel a). This suggests that banks may face significant rollover risk. As is the case for unsecured deposits, repo transactions often serve as a liquidity buffer for NBFI entities, in particular for investment funds and other financial institutions, including broker-dealers (Chart B.2, panel b). Banks might therefore need to replace the funding obtained in the repo market very rapidly if the NBFI sector were to be hit by large, abrupt outflows.

Chart B.3

NBFI entities are a key investor class in bank debt securities, while their portfolios do not overlap significantly with those of euro area banks

Sources: ECB and ECB calculations.

Notes: ICPFs stands for insurance companies and pension funds; IFs stands for investment funds; MFIs stands for monetary financial institutions, excluding central banks; MMFs stands for money market funds. Panel b: based on the cosine similarity indicator, which measures the level of commonality between pairs of portfolios. The indicator equals zero (white) if the portfolio allocations of two country-sectors are uncorrelated and equals one (dark blue) if they are the same. Shades within this range quantify the degree of similarity. Assets belong to the same group if they are issued in the same country/region and by the same sector. The chart is symmetric.

Euro area NBFI entities are also significant investors in bank debt securities. They hold 28% of outstanding bank debt securities, a share that has remained broadly stable over the past few years. Their role is larger in the short-term bank debt market, including commercial paper where money market funds are a key investor group (Chart B.3, panel a) and a possible source of funding tensions, as the March 2020 “dash for cash” episode showed.[5] Investment funds and insurers are slightly more exposed to longer-term bank debt and are a key source of funding for banks needing to meet MREL requirements.[6]

3 Indirect linkages through common securities portfolios

Common exposures between NBFI entities and banks appear to be limited. Indirect links between banks and non-banks, such as those related to common exposures, can also be a source of risk. Banks tend to display a greater home bias in their securities portfolios compared with NBFI entities, which limits the extent of common exposures (Chart B.3, panel b). The countries with the greatest similarity between bank and NBFI securities holdings are financial centres like Ireland, Luxembourg and Malta which attract banks and NBFI entities operating mainly on a cross-border basis. Portfolio similarities may also amplify funding tensions in the repo and derivatives markets, reducing the amounts that NBFI entities and banks can borrow from each other and pledge as collateral in the event of asset price shocks triggering outflows from the NBFI sector. Measures of portfolio similarity may not fully capture exposure to correlated assets, which can give rise to spillovers even when there is no similarity between the asset holdings of banks and NBFI entities.

4 Banks’ exposure to NBFI entities as counterparties and clearers of derivatives

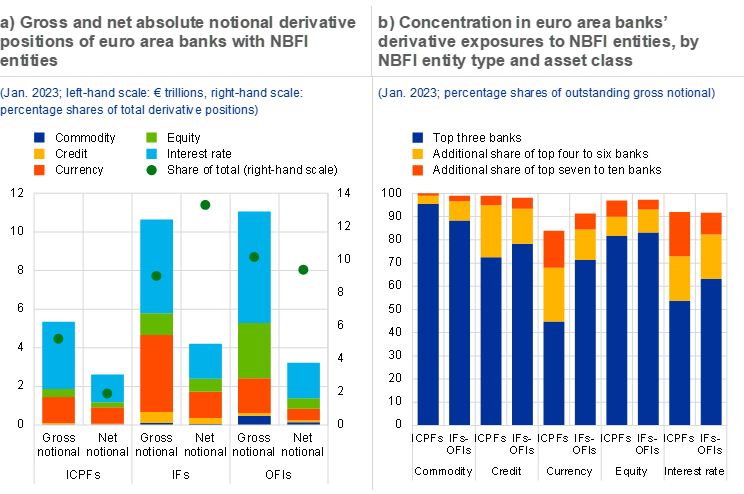

Banks are also exposed to NBFI entities through direct trading in derivatives or because they provide access to central clearing counterparties (CCPs). Usually, NBFI entities do not act as clearing members in the derivatives market and use banks to access CCPs. In markets not subject to central clearing, banks often intermediate customer trades, taking offsetting positions with NBFI counterparties.

Banks trade more than 20% of their gross notional derivative exposures with NBFI entities, which are mainly investment funds and other financial institutions. The breakdown by asset class of euro area banks’ derivative exposures to NBFI entities reflects the market landscape for derivatives, where interest rate contracts make up more than half of total positions (Chart B.4, panel a). Investment funds and other financial institutions also actively trade currency and equity derivatives with banks. Commodity and credit derivatives are marginal in comparison, and are traded mostly by the financial arms of energy firms seeking to hedge their commodity business and by bond funds seeking to hedge sovereign and corporate bond exposures. Net notional exposures, which measure the open positions taken by NBFI entities with banks in the underlying asset, are significantly smaller than gross positions. For some asset classes, such as equity derivatives, banks operate matched books by netting opposite exposures across different counterparties. For other asset classes, such as interest rate derivatives, banks transfer some financial risks to the NBFI sector and may be restricted in their ability to manage these risks should major NBFI entities become distressed.

Chart B.4

Banks provide access to clearing services for NBFI entities and make the market for derivatives traded over the counter

Sources: ECB, EMIR and ECB calculations.

Notes: The analysis is based on a sample of 95 euro area banks, directly supervised by the ECB and active in the euro area derivatives market, which have outstanding derivative positions with NBFI entities. ICPFs stands for insurance companies and pension funds; IFs stands for investment funds and money market mutual funds; OFIs stands for other financial institutions. Net notional is calculated at counterparty, asset class, contract type and clearing level, and absolute values are aggregated at NBFI sector and asset class levels. EMIR sector classification based on Lenoci, F.D. and Letizia, E., “Classifying Counterparty Sector in EMIR Data”, in Consoli, S., Reforgiato Recupero, D. and Saisana, M. (eds.), Data Science for Economics and Finance, Springer, Cham, 2021.

Banks’ derivative exposures to NBFI entities create counterparty and liquidity risks. When acting as market-makers, banks generally take limited directional positions in their trading books. However, their NBFI counterparties may take on exposures to the underlying assets, which exposes banks to counterparty credit risk. This risk is mitigated through margining practices, which expose banks to step-in liquidity risk if counterparties are unable to meet initial or variation margin calls after abrupt market movements. On average, the magnitude of such margin calls is limited in comparison with the size of the banking sector and its liquidity buffers. However, such calls may pose a challenge to NBFI entities and may also trigger funding outflows and further spillovers to banks via credit impairments to their asset-side exposure.

5 Concentration of spillover risks among large, systemically important banks

Any turmoil in the NBFI sector is likely to disproportionately affect large, complex, systemically important banks, as asset exposures, funding linkages and derivative exposures are concentrated in this group. The concentration of banks’ exposure to NBFI entities on the lender side is much higher than the concentration of euro area banking assets (Chart B.1, panel b). The top five banks account for about 50% of total loan and securities exposure and the top 13 banks for over 80%. This group of banks includes the eight euro area G-SIBs, as well as several other large universal banks.

Banks’ funding from NBFI entities is also highly concentrated, on both the borrower and the lender side. 13 large banks account for about 80% of euro area banks’ total repo borrowing from NBFI entities (Chart B.2, panel b). These banks play a central role in the market, as they are virtually the only recipient of repo liquidity from investment funds, insurers, pension funds and money market funds. Most of the repo volume is also concentrated in a small number of lenders. The top 10% of lenders by size provide 88% of total funding. These figures suggest that concentration risk is elevated, as there is a small number of banks which heavily rely on repo funding, which is provided by a small number of NBFI entities.

A similar group of large banks is also central to the functioning of the derivatives market. On top of taking limited directional positions and acting as natural counterparties for some derivatives transactions, banks provide market access to NBFI entities, acting as clearing members and market-makers.[7] Only large and systemically important banks, which have the necessary size and balance sheet capacity to keep a matched book and which can manage the associated market and liquidity risks, are able to run a derivatives desk (Chart B.4, panel b). 80% of the outstanding notional for derivatives traded by NBFIs in the euro area is intermediated by ten banks, mainly domiciled in France or Germany or subsidiaries of non-euro area banks. The degree of concentration is even higher in commodity and credit derivatives trading, where the three largest banks account for over 75% of all trades with NBFI entities.

6 Conclusions

Linkages with the NBFI sector expose banks to liquidity, market and credit risks, with liquidity risk seeming to be the main concern at present. The materialisation of liquidity and credit risks in the NBFI sector would lead to an outflow of the funding provided by this sector, which primarily holds its liquid assets in the form of bank deposits and short-term securities. This funding may be highly sensitive to the credit quality of the recipient banks and can amplify the funding pressures faced by banks if the soundness of their fundamentals has been called into question. Liquidity pressures on NBFI entities may also lead to heightened drawing from credit facilities provided by banks. Should liquidity stress force NBFI entities to sell assets, the resulting impact on asset prices could trigger a revaluation of assets held by banks, in particular in the cases where the portfolios of banks and NBFI entities overlap or asset prices are correlated. This could affect bank capital as well as liquidity, assuming these assets are used to support secured funding or margins on derivatives portfolios. Based on the magnitude of the linkages discussed in this special feature, funding spillovers are likely to be more significant from a systemic risk perspective, while direct credit exposures are likely to be less significant.

A small group of systemically important banks is key to ensuring the smooth operation of parts of the NBFI sector. If one or a group of such institutions were to become distressed, there would probably be substantial ramifications in terms of the ability of significant parts of the NBFI sector to manage liquidity and market risks. At the same time, distress in the NBFI sector would probably affect these key banks more significantly than smaller banks. The limited substitutability of these key banks has already been recognised in the global and European framework governing the identification of systemically important banks and is one reason why such banks are subject to more stringent capital and disclosure requirements. Greater resilience of these key nodes in the financial system is a precondition for containing spillovers between the NBFI sector and the banking sector and for insulating the provision of bank credit to the real economy from shocks stemming from NBFI entities. The sizeable capital and liquidity buffers held by these banks help to mitigate potential spillovers. That said, improving liquidity risk management practices and tackling synthetic leverage in the NBFI sector (Section 5.2) would indirectly support the resilience of banks, by mitigating the risk of such spillovers occurring.

The term “NBFI entities” is used throughout this special feature to refer to a wide range of institutions including investment funds, insurance companies, pension funds and other financial institutions. The last category includes institutions such as securitisation vehicles, broker-dealers, captive financial institutions and family offices; see di Filippo, G. and Pierret, F., “A typology of captive financial institutions and money lenders (sector S127) in Luxembourg”, Working Papers, No 146, Banque Centrale du Luxembourg, July 2020. For an assessment of developments in the NBFI sector, see “Financial integration and structure in the euro area”, ECB, April 2022.

For an extensive discussion of mechanisms of contagion between investment funds, as an example of an NBFI sector, and banks, see Sydow, M. et al., “Shock amplification in an interconnected financial system of banks and investment funds”, Working Paper Series, No 2581, ECB, August 2021. This special feature does not cover ownership linkages which can lead to reputational and step-in risk; see the box entitled “The role of bank and non-bank interconnections in amplifying recent financial contagion”, Financial Stability Review, ECB, May 2020.

These holdings often consist of senior tranches retained by the sponsor.

Based on supervisory data. Non-operational deposits are defined in line with Article 27 of Commission Delegated Regulation (EU) 2015/61 to supplement Regulation (EU) 575/2013 of the European Parliament and the Council with regard to liquidity coverage requirement for credit institutions.

See the box entitled “Recent stress in money market funds has exposed potential risks for the wider financial system”, Financial Stability Review, ECB, May 2020.

See “Interim Report on MREL: Report on implementation and design of the MREL framework”, EBA-Op-2016-12, European Banking Authority, 19 July 2016.

See the box entitled “Euro area interest rate swaps market and risk-sharing across sectors”, Financial Stability Review, ECB, November 2022.