- THE ECB BLOG

One year since Russia’s invasion of Ukraine – the effects on euro area inflation

24 February 2023

Russia’s unjustified war against Ukraine and its people is first and foremost a human tragedy. It is also having an economic impact on Ukraine and beyond. This ECB Blog post – the first in a series about the economic effects of the war – focuses on inflation in the euro area.

One year ago Russia started its unjustified invasion of Ukraine. This was a watershed moment for Europe. The ECB stands with the people of Ukraine who are suffering great loss of life and material destruction caused by Russia’s attacks on cities and infrastructure. As the first post in a series, this entry focuses on the war’s economic effects outside Ukraine.

The war triggered a massive shock to the global economy, especially to energy and food markets, squeezing supply and pushing up prices to unprecedented levels. Compared with other economic regions, the euro area has been particularly vulnerable to the economic consequences of Russia’s invasion of Ukraine.[2] This is mainly because the euro area depends very strongly on energy imports, which accounted for more than half of the euro area’s energy use in 2020. Furthermore, Russia was a key energy supplier to the euro area before the war.[3] Russia and Ukraine also played a large role in euro area imports of food and fertilisers before the start of Russia’s invasion.[4] More generally, the euro area is a highly open economy, which makes it vulnerable to disruptions in global markets and value chains.

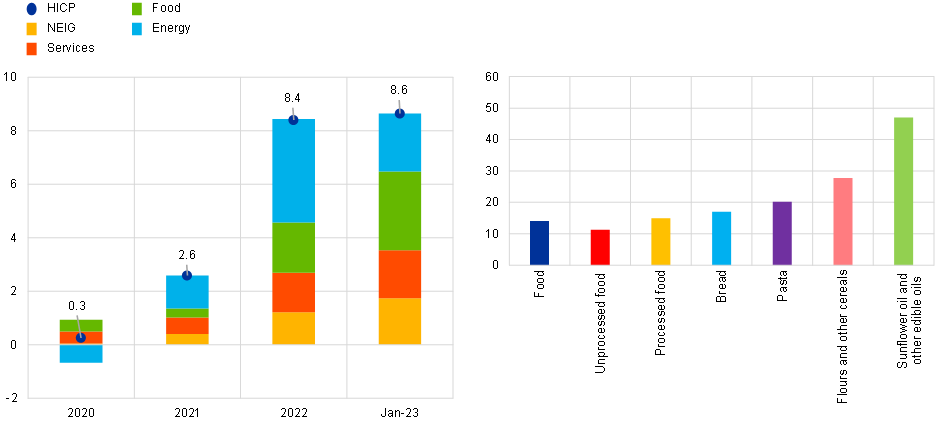

The war added heavily to the inflationary pressures building up in the euro area during the post-pandemic recovery and pushed up consumer prices, especially for energy (Chart 2a) and food.[5] Headline inflation increased from 0.3% in 2020 to 2.6% in 2021 and then to 8.4% in 2022 (Chart 1a). Energy and food inflation accounted for more than two-thirds of this record-high inflation in 2022.

Chart 1

Euro area HICP inflation and HICP food inflation with sub-components

(panel a: annual percentage changes and pp contributions; panel b: annual percentage changes)

Sources: Eurostat and ECB staff calculations. Latest observation: January 2023.

While in 2022 energy inflation was by far the most significant driver of inflation, most recently the largest contribution has come from food inflation (Chart 1). Food prices increased by 14.1% in January 2023 compared with one year previously. As food production is quite energy intensive, the high rates of food inflation reflect in part the indirect and lagged effects of high energy prices, for which the war has played a key contributing role. Zooming in on the inflation rates of different components more starkly reveals the impact of the war (Chart 1b). Prices for food products such as wheat (as an ingredient of flour, bread and pasta) or oilseeds, for which imports from Ukraine and Russia had played an important role before the war, recorded inflation rates far above average food inflation. For example, sunflower oil and other edible oils were over 47% more expensive for euro area consumers in January 2023 than one year previously.

High inflation, of which energy and food account for a large proportion, continues to have a significant negative impact on all areas of our economy and on people’s everyday lives. This is particularly the case for low-income households in which food and energy constitute a sizeable share of the consumption.[6] Based on the high energy import dependence of the euro area, the surge in prices for energy imports leads to a large and unavoidable loss of real income owing to the deterioration in our terms of trade.[7] In such a situation, firms have an incentive to try to minimise their share of the burden by adjusting their pricing in order to fully recoup the increases in their input costs. Furthermore, workers have an incentive to try to minimise their share of the burden by adjusting their wage claims in order to fully recoup the real wage losses associated with higher inflation. The mutually reinforcing feedback between higher profit margins, nominal wages and prices leads to risks of second-round effects that can cause too-high inflation to become entrenched.[8] This is why the ECB Governing Council started a process of policy normalisation in December 2021 and committed to bringing inflation back to the 2% medium-term target in a timely manner, in line with the ECB’s mandate.

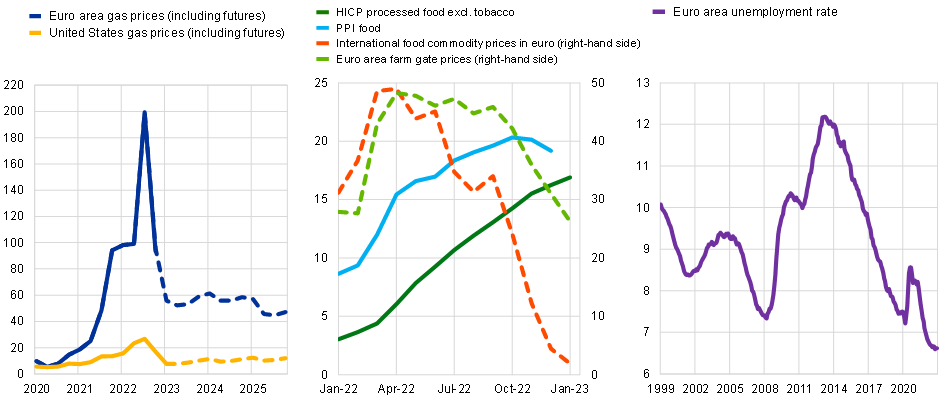

Looking ahead, there are signs that the effects of the war on euro area inflation via developments in international energy and food markets could moderate. One key factor in this respect is the price of energy. In 2022 natural gas consumption in the EU decreased by almost 20%, which helped the EU to cope with the reduction in gas imports from Russia owing in part to EU sanctions. National measures and the REPowerEU initiative are helping to accelerate the transition to green energy and increase the EU’s energy independence. Efforts to save energy and diversify energy supplies have contributed to the sharp fall in natural gas prices over recent months from their record highs of autumn 2022.[9] Furthermore, prices on futures markets currently signal a further moderation of gas prices, and this should feed through to consumers’ energy costs (Chart 2a).

Chart 2

Gas price developments, leading indicators for food inflation and unemployment rate

(panel a: EUR/MWh; panel b: annual percentage changes; panel c: percentage)

Sources: Refinitiv, Eurostat, HWWI and ECB calculations.

Notes: For euro area gas futures, the cut-off date for the latest futures was 22 February 2023 (based on futures averaged over the ten working days preceding the cut-off date). For United States gas prices, the series reflects futures as of 22 February 2023. Latest observations are from December 2022 for PPI (Producer Price Index), and the unemployment rate, and from January 2023 for HICP processed food excluding tobacco, international food commodity prices and euro area farm gate prices.

Consumer food inflation is currently the largest component in euro area inflation and leading indicators such as euro area farm gate prices or food commodity prices on international markets have shown strong decreases since mid-2022. This supports the expectation that food inflation will moderate again over the next months (Chart 2b). Despite these positive signals it is important to remember that the war continues to pose significant downside risks to the economy and could again push up the costs especially of energy and food. The ECB will continue to closely monitor these developments and the ECB’s monetary policy will over time reduce inflation and ensure a timely return of inflation to its 2% medium-term target.

Overall the euro area has defied expectations and shown remarkable economic resilience to the effects of the war. While the Eurosystem and most analysts expected a contraction in the euro area economy at the turn of last year, real GDP in fact grew 0.1% quarter-on-quarter in the fourth quarter of 2022. Estimates point towards weak but positive growth in the near term, supported by lower energy costs and fiscal measures aimed at mitigating the impact of high inflation in real incomes. Robust labour markets in the euro area also remain a bright spot.[10] In line with the remarkable resilience of the overall economy to the effects of the war, the unemployment rate declined to its lowest level since the start of the Economic and Monetary Union, reaching 6.6% in December 2022. This strong labour market performance supports the euro area economy going forward and could also help to increase employment opportunities in euro area labour markets for a large number of Ukrainian refugees. The ECB Blog will take a closer look at this aspect in an upcoming post.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

We would like to thank Eduardo Gonçalves and Sara Romaniega Sancho for their support in preparing this blog post.

See Arce, O., Koester, G. and Pierluigi, B. (2022), “Challenges for global monetary policy in an environment of high inflation: the case of the euro area”, ICE: Revista De Economía, No 929, pp. 115-130.

See Adolfsen, J.F., Kuik, F., Lis, E. and Schuler, T. (2022), “The impact of the war in Ukraine on euro area energy markets”, Economic Bulletin, Box 1, Issue 4, ECB. Around 42% of energy came from domestic production (including from nuclear power and renewable sources) in 2020 – see the Eurostat webpage on EU energy mix and import dependency.

See Bodnár, K. and Schuler, T. (2022), “The surge in euro area food inflation and the impact of the Russia-Ukraine war”, Economic Bulletin, Box 6, Issue 4, ECB; Emter, L., Fidora, M., Pastoris, F. and Schmitz, M. (2022), “Euro area linkages with Russia: latest insights from the balance of payments”, Economic Bulletin, Box 8, Issue 7, ECB; and Attinasi, M.G., Doleschel, J., Gerinovics, R., Gunnella, V. and Mancini, M. (2022), “Trade flows with Russia since the start of its invasion of Ukraine”, Economic Bulletin, Box 1, Issue 5, ECB.

Lane, P.R. (2022), “Inflation diagnostics”, ECB Blog, 25 November.

See Charalampakis, E., Fagandini, B., Henkel, L. and Osbat, C. (2022), “The impact of the recent rise in inflation on low-income households”, Economic Bulletin, Box 4, Issue 7, ECB.

See Gunnella, V. and Schuler, T. (2022), “Implications of the terms-of-trade deterioration for real income and the current account”, Economic Bulletin, Box 1, Issue 3 and also Lane, P.R. (2022), “Inflation diagnostics”, ECB Blog, 25 November.

See Lagarde, C. (2022), “Monetary policy in a high inflation environment: commitment and clarity”, speech organised by Eesti Pank, Tallinn, November.

See also Adolfsen, J.F., Lappe, M.-S. and Manu, A.-S. (2023), “Global risks to the EU natural gas market”, Economic Bulletin, Box 1, Issue 1, ECB.

Labour markets in the euro area were supported by the widespread use of short-time work schemes during the pandemic. See Dias da Silva, A., Dossche, M., Dreher, F., Foroni, C. and Koester, G. (2020), “Short-time work schemes and their effects on wages and disposable income”, Economic Bulletin, Box 6, Issue 4, ECB.