IFRS 9, accounting discretion and provisioning behaviour around credit events

Published as part of the Financial Stability Review, May 2023.

The aim of International Financial Reporting Standard 9 (IFRS 9) is to improve the recognition of banks’ credit losses, but its implementation has triggered discussions about potential side effects.[1] IFRS 9 was adopted in 2018 to introduce a more forward-looking estimation of credit losses and a loan-staging approach that more accurately captures the level of risk. The general goal was to increase transparency and to tackle the “too little, too late” problem of previous accounting principles that were criticised after the global financial crisis.[2] However, there have been concerns that an undue interpretation of the approach may imply significant increases in provisioning at the onset of a shock (“cliff effects”), where the corresponding erosion of capital may prompt banks to cut lending at the worst moment for the economy (procyclicality). There have also been fears that less well-capitalised banks could exploit the discretion associated with reliance on internal provisioning models to provision less and avoid further reductions in capital, which would conflict with the objective of transparency.

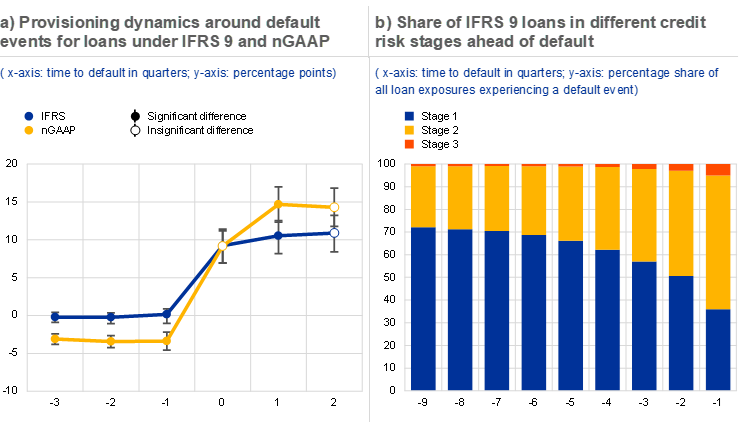

Chart A

Provisioning dynamics around credit events for IFRS 9 loans remain similar to those of nGAAP loans, as many IFRS 9 loans are still in Stage 1 shortly before or even at the time of default

Sources: ECB and ECB calculations.

Notes: Panel a: provisioning rates at the bank-firm level are defined as impairments over carrying amount plus impairments. The sample includes all bank-firm pairs reporting a default and without missing values in the interval of [-3; +2] quarters around default. Dots refer to regression coefficients for interaction terms between dummy variables indicating the time to default (in quarters) and the accounting approach (IFRS 9 or nGAAP). Coefficient estimates indicate the difference in provisioning rate relative to the comparison group, comprising all observations outside the indicated timeframe (i.e. observation more than three quarters before or more than two quarters after the default event for the respective bank-firm pair). The regression also includes a broad set of control variables at the bank and loan level (including for support measures implemented during the pandemic) as well as firm-quarter fixed effects that systemically control for any differences in borrower riskiness. Solid (light) dots indicate whether the Wald test for difference of the coefficients is (in)significant at the 10% level. Negative coefficient estimates mean that provisions in the corresponding quarter are on average lower than in the reference group, comprising observations before and after the default but outside the interval shown of [-3; +2] quarters around default. Panel b: The sample is an unbalanced panel with 53,088 bank-firm observations nine quarters before default and 207,201 observations one quarter before default.

This box uses loan-level data from the European credit register (AnaCredit) to analyse provisioning patterns for different types of loan.[3] Specifically, it compares provisioning dynamics for IFRS 9 loans with those of comparable loans under pre-existing national generally accepted accounting principles (nGAAP) and examines whether IFRS 9 loans from well-capitalised and less well-capitalised banks exhibit divergent dynamics.[4] It relies on information on loans from 1,721 distinct banks for the period running from the second quarter of 2018 to the second quarter of 2022 and examines provisioning patterms around credit events and the energy price shock in 2022.

Average provisions for a performing IFRS 9 loan are higher than those for a comparable nGAAP loan, while the dynamics of provisioning ratios around credit events are similar under both approaches. While IFRS 9 loans start off with higher ex ante provisions, the bulk of provisioning for the average loan still occurs at or after default, as is the case with nGAAP loans (Chart A, panel a). By contrast, a pronounced cliff effect when IFRS 9 loans are first moved to Stage 2 is not detectable in these aggregate patterns. One reason for this is that the timing of the move to Stage 2 (and the associated increase in provisions) differs across loans and tends to occur late or not at all: around 50% of IFRS 9 loans are still in Stage 1 two quarters ahead of the default and around 35% one quarter ahead (Chart A, panel b). Moreover, loans that are already in Stage 2 still exhibit a sizeable jump in provisioning at default, albeit one that is smaller than for the loans that are still in Stage 1. Overall, this suggests that IFRS 9 has not fundamentally changed provisioning patterns.[5]

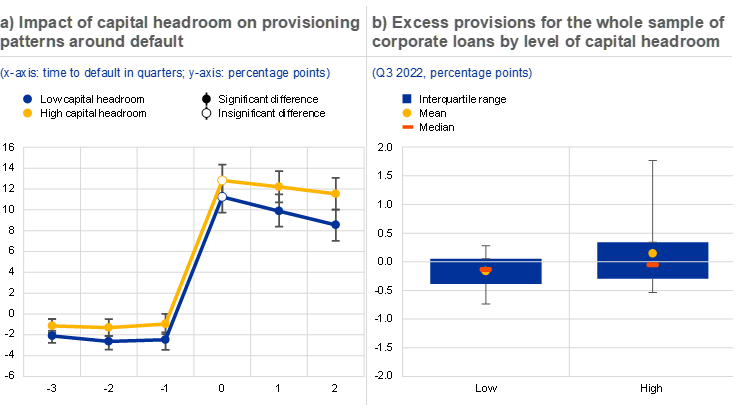

Chart B

Banks with less capital headroom tend to provision substantially less than other banks, both around default events and for the whole sample of loans

Sources: ECB and ECB calculations.

Notes: Panel a: variables, sample composition and estimation approach are the same as in Chart A. Dots refer to regression coefficients for interaction terms between dummy variables indicating the time to default (in quarters) and a dummy variable that indicates whether the bank’s capital headroom is above or below the sample median. Solid (light) dots indicate whether the Wald test for difference of the coefficients is (in)significant at the 10% level. Panel b: to calculate excess provisions, bank-firm provisioning rates are first demeaned at the firm level. The demeaned ratios are then averaged at the bank level, weighted by the sum of carrying amount and impairment amount. Values are winsorised at 2.5% and 97.5%. Diamonds report the mean across banks in a given bucket.

Provisioning patterns for IFRS 9 loans around default events depend on banks’ capital headroom, which is consistent with accounting discretion having a strong impact. Better-capitalised banks posted considerably higher provisions than less well-capitalised banks for loans to the same firm in the same period under IFRS 9, particularly after a default event (Chart B, panel a). This is consistent with capital management considerations which see banks “provision as much as they can afford”, possibly facilitated by a reliance on banks’ internal models for provisioning under IFRS 9.[6] Estimates suggest that this behaviour could have a material impact on provisioning rates at the bank level, with less well-capitalised banks showing, on average, significantly lower provisioning rates (Chart B, panel b).

Provisioning dynamics around the energy price shock in 2022 were a function of accounting standards, but also of capital headroom.[7] While the dynamics around the shock are similar for the average loan under different standards, provisions for IFRS 9 loans were more risk sensitive, rising faster for firms that were more exposed to the energy price shock, in line with the intended functioning of the new framework. However, while banks with more capital headroom increased their provisioning across the board, those with less excess capital followed a more targeted approach, focusing on firms that were more exposed to the shock. Thus, accounting discretion and capital management considerations affected not only the overall level of provisioning, but also its distribution across borrowers.

Overall, this box suggests that IFRS 9 has only partly delivered on its objective of fostering transparency and speedier provisioning. Provisions have been higher ahead of credit events and increased more risk-sensitively around the energy price shock. However, the bulk of the adjustment still occurs at default, and IFRS 9 and nGAAP show similar provisioning dynamics around credit events. As such, the objective of encouraging speedier provisioning has not been fully achieved, while concerns about possible cliff effects at the onset of a shock may be overstated. The consequences of IFRS 9 in terms of procyclicality may not be much different from nGAAP.[8] While it is difficult to arrive at firm conclusions on the overall adequacy of current provisions, banks with less capital headroom may be at greater risk of being under-provisioned, possibly also due to the discretion offered by IFRS 9. This may conflict with the transparency objective of IFRS 9 and warrants close supervisory scrutiny.

See, for example, “Financial stability implications of IFRS 9”, European Systemic Risk Board, July 2017, or “The procyclicality of loan loss provisions: a literature review”, Working Paper Series, No 39, Basel Committee on Banking Supervision, Bank for International Settlements, 2021.

Loans are sorted into stages, where Stage 1 comprises performing loans, Stage 2 underperforming loans that have seen a significant increase in credit risk and Stage 3 credit-impaired loans (see, for example, “Snapshot: Financial Instruments: Expected Credit Losses”, IASB, 2013).

For further details on the regression analysis, see Behn, M. and Couaillier, C., “Same same but different – credit risk provisioning under IFRS 9”, Working Paper Series, ECB, forthcoming.

In the EU, application of IFRS 9 is mandatory for the consolidated financial statements of public companies listed in any Member State. Other companies (e.g. unconsolidated or non-listed entities) may, in several Member States, also resort to nGAAP. Of the 1,721 banks in the sample, 1,318 (including 47 significant institutions) report under nGAAP for at least some of their loans. While nGAAP exposures are particularly prevalent in Austria and Germany, they are also observed in other countries.

These results are confirmed by robustness analyses which control for the possibility that banks using IFRS 9 or nGAAP differ in any other characteristics that drive their provisioning behaviours via: (i) constructing a set of comparable IFRS 9 and nGAAP banks using propensity score matching and (ii) restricting the sample to banks that have at least 20% of their loans in each accounting framework (which is possible if some unconsolidated entities of the bank use IFRS 9 and others nGAAP).

Capital headroom also affects provisioning rates for nGAAP loans, indicating that there is accounting discretion under both approaches, although the effects tend to be stronger under IFRS 9.

We use this shock rather than the coronavirus (COVID-19) pandemic shock as it allows for an interaction with the firm’s risk exposure to the shock (in this case the jump in energy prices), measured as the share of energy in the input used by the NACE-2 sector to which the firm belongs.

Concerns about potential procyclicality could still arise if a lot of exposures are moved simultaneously to Stage 2 soon after a shock occurs. The change in aggregate provisioning ratios does not support such concerns for the sample period Q2 2018-Q2 2022.