Non-banks’ liquidity preparedness and leverage: insights and policy implications from recent stress events

Published as part of the Financial Stability Review, May 2023.

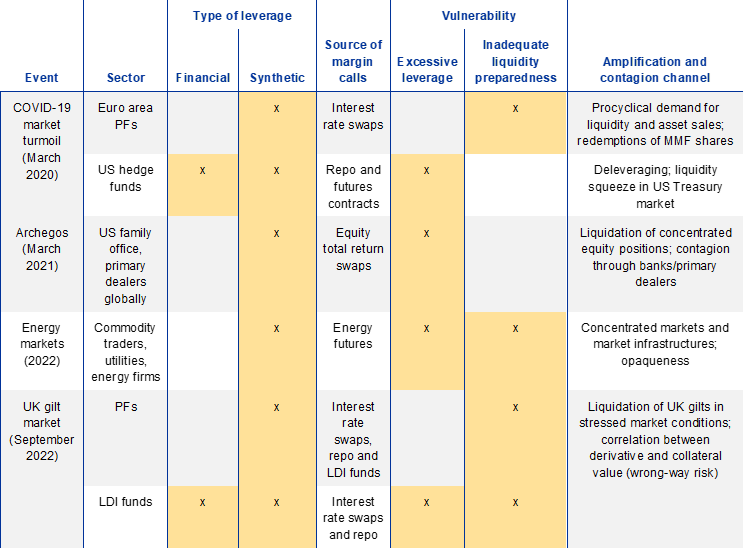

Recent stress episodes have shown how non-bank financial institutions can amplify stress in the wider financial system when faced with sudden increases in margin and collateral calls (Table A). The March 2020 market turmoil, tensions in commodity markets in 2022 and, most recently, stress in the UK government bond (gilt) market in September 2022 revealed non-bank financial intermediation (NBFI) vulnerabilities associated with rapid surges in margin and collateral calls. The resulting spikes in the demand for liquidity and/or deleveraging pushed some NBFI entities towards disorderly asset sales or large cash withdrawals, from money market funds for instance, with spillovers to other financial institutions or markets. In several cases, extraordinary policy responses by public authorities and central banks helped to stabilise markets and limit contagion. This box examines two of the key vulnerabilities – excessive leverage and inadequate liquidity preparedness to meet margin calls – and discusses policy implications for enhancing the resilience of the NBFI sector.

Excessive leverage in NBFI entities and inadequate liquidity preparedness can interact, amplifying margin call dynamics, especially in stressed markets. Irrespective of whether derivatives are used for speculative or hedging purposes, their use exposes derivative counterparties to margin calls.[1] For example, as at end-March 2023, euro area insurance corporations and pension funds held 33% of the receive-fixed interest rate swap net notional,[2] making them vulnerable to margin calls in an environment of rising interest rates. Although margin calls offer protection against counterparty risk in derivative transactions, they may amplify liquidity stress in two ways (Table A). First, excessive leverage can create solvency issues, forcing entities to deleverage and abruptly unwind their positions if significant margin calls are accompanied by large mark-to-market losses. Such dynamics affected US hedge funds in March 2020 and UK liability-driven investment (LDI) funds in September 2022.[3] Second, inadequate liquidity preparedness can force entities to sell assets in a disorderly manner in order to raise liquidity to meet margin calls, even if they do not face immediate solvency issues. This was the case for EU pension funds in March 2020 and UK pension funds in September 2022.[4] Both types of vulnerability give rise to adverse feedback dynamics. Forced selling in periods of market stress may depress asset prices further and, in turn, accelerate margin calls and the need to deleverage.[5]

The episode in the UK gilt market brought the interplay between these vulnerabilities into sharp focus as some institutions struggled to raise funds at short notice. The announcement of the UK Government’s mini-budget in September 2022 triggered a strong initial sell-off in UK gilts. The sudden increase in yields led to large margin calls for UK pension funds on their interest rate derivative positions, which largely needed to be met with cash collateral. However, the main source of stress was related to the outsourcing of their underlying liability-driven investment (LDI) strategies.[6] This related in particular to the use of “pooled” LDI funds by smaller pension funds. These funds had relied heavily on obtaining leverage via the repo market[7] and were subject to large collateral calls when the value of gilts fell. This led to the need for significant deleveraging, which was further amplified by delays in raising capital from their pension fund trustees.[8] This combination of factors related to leverage and liquidity preparedness among pension funds and LDI funds contributed to large asset sales, which amplified gilt market movements and liquidity stress, leading to further margin calls and threatening the viability of LDI funds.[9] In response to these significant one-sided selling pressures and rising tensions in the gilt market, the Bank of England was prompted to intervene on financial stability grounds by making temporary purchases of long-dated UK government bonds.[10]

The stress episode in UK gilt markets is yet another example illustrating the significant challenges authorities face in anticipating where and through which channels NBFI sector stress can materialise. The event underlines the challenges in identifying leverage – and liquidity-related vulnerabilities – including, for instance, that leverage can be “hidden” in third-party entities, such as LDI funds, which may be subject to less regulatory and supervisory scrutiny. This can be compounded by the cross-border dimension to NBFI sector risks – the LDI funds which experienced stress were typically domiciled outside the UK. In addition, given the interplay between leverage and liquidity preparedness, the episode highlights the importance of considering these dimensions together when designing a policy response to tackle systemic risks related to margin calls.

Table A

Excessive leverage and inadequate liquidity preparedness in the NBFI sector have led to several recent episodes where margin calls have threatened to amplify stress in the wider financial system

Overview of stress events

Source: ECB.

Notes: See also the box entitled “Lessons learned from initial margin calls during the March 2020 market turmoil”, Financial Stability Review, ECB, November 2021, and the special feature entitled “Financial stability risks from energy derivatives markets”, Financial Stability Review, ECB, November 2022. MMF stands for money market funds; LDI stands for liability-driven investment.

The lessons from recent episodes underline the need to strengthen NBFI sector resilience for a wide range of entities and activities, especially in relation to liquidity preparedness and leverage. First, it is critical to enhance margining practices and NBFI sector liquidity preparedness to meet margin calls from a system-wide perspective.[11] For example, NBFI entities often rely on the same sources of liquidity and may not internalise the extent to which their actions aimed at raising liquidity could contribute to systemic stress.[12] Second, due to the interplay between leverage and liquidity preparedness in derivatives markets, addressing vulnerabilities related to one aspect would help mitigate the risks associated with the other. For instance, entity-based measures such as leverage limits for highly leveraged funds could reduce the size of their margin calls and need for deleveraging. On the other hand, enhanced liquidity risk management would mitigate the need for forced asset sales to meet large margin calls. In both cases, entities would be better able to withstand market-wide shocks, thereby lowering the risk of spillovers to broader market liquidity. Finally, the cross-border dimension of activities in the NBFI sector underlines the need for close international cooperation and coordination in the regulation and monitoring of the sector.

Financial leverage implies an on-balance-sheet exposure from the borrowing of funds. Synthetic leverage is usually obtained via derivative exposures and requires daily mark-to-market margining as a result, which exposes entities to liquidity risk in the event of significant adverse price movements.

The share reflects the notional outstanding for receive-fixed interest rate swaps with a residual maturity of more than ten years. Exposures are netted for each institution at different maturity buckets. Central counterparties and intragroup transactions are excluded. Snapshot from the EMIR database as at 31 March 2023.

For US hedge funds, see Schrimpf, A., Shin, H.S. and Sushko, V., “Leverage and margin spirals in fixed income markets during the Covid-19 crisis”, BIS Bulletin, No 2, Bank for International Settlements, April 2020. For LDI funds, see “Letter from the Bank of England to the Chair of the Treasury Committee”, Bank of England, 5 October 2022.

See the box entitled “Interconnectedness of derivatives markets and money market funds through insurance corporations and pension funds”, Financial Stability Review, ECB, November 2020.

Liquidity risk can turn into solvency risk if the losses from depressed asset prices are sufficiently large. Independently, margin calls may also reflect the losses on (leveraged) derivative positions. This was the case with Archegos Capital Management in March 2021, which defaulted on its margin calls. While the collapse of Archegos had only a limited impact on the broader financial system, the event highlighted the amplifying effect of leverage and possible contagion channels to banks/primary dealers.

LDI strategies aim to reduce interest rate risk on pension funds’ balance sheets. Such strategies typically involve leverage, which can be obtained through interest rate swaps, repo market activity or indirectly by investing in leveraged third-party entities.

In the United Kingdom, many smaller pension funds outsourced their LDI strategies to investment funds operating as separate legal entities (i.e. LDI funds).

Raising funds from pension fund trustees can be a difficult process for pooled LDI funds, in part due to the large number of trustees involved across different pension funds. Pooled LDI funds were reported to have been more heavily involved in forced selling. See also “Risks from leverage: how did a small corner of the pensions industry threaten financial stability?”, speech by Sarah Breeden given at ISDA & AIMA, Bank of England, 7 November 2022.

The risks of a similar amplification occurring in the euro area would appear less pronounced for several reasons. Compared with UK pension funds, for example, Dutch pension funds rely less on leverage, hedge less of their interest rate risk, are more diversified in terms of assets and rely significantly less on the use of LDI funds. See also “Leverage and liquidity backstops: cues from pension funds and gilt market disruptions”, BIS Quarterly Review, Bank for International Settlements, December 2022.

See “Bank of England announces gilt market operation”, news release, Bank of England, 28 September 2022.

See BCBS, CPMI, IOSCO, “Review of margining practices”, Bank for International Settlements, September 2022.

The reliance on money market funds to raise large amounts of cash during times of stress is a case in point. See also the box entitled “Interconnectedness of derivatives markets and money market funds through insurance corporations and pension funds”, Financial Stability Review, ECB, November 2020.